Solana (SOL) has been in a downtrend since May 21 and is currently forming a downtrend channel on the chart. At the time of writing, the altcoin is at $142.89, its lowest level in the past month.

If the price sticks near the bottom of the descending channel, SOL could fall further if the bulls fail to defend this support level.

Solana Bulls need to defend support level

Since Solana entered a downtrend on May 21, the coin has lost 18% of its value and is now forming a downtrend channel. The upper line of this channel acts as resistance, while the lower line provides support. Solana seems to find support around the price of $139.

If the bulls manage to hold this support level, Solana’s price could bounce back to the channel’s upper line. If they lose this support, this indicates a continuation of the bearish trend.

Sentiment around SOL has remained largely negative, making it unlikely that the bulls can successfully defend the support. Since June 1, SOL’s weighted sentiment has been negative. At the time of writing, this weighted sentiment is -0.28, according to Santiment data.

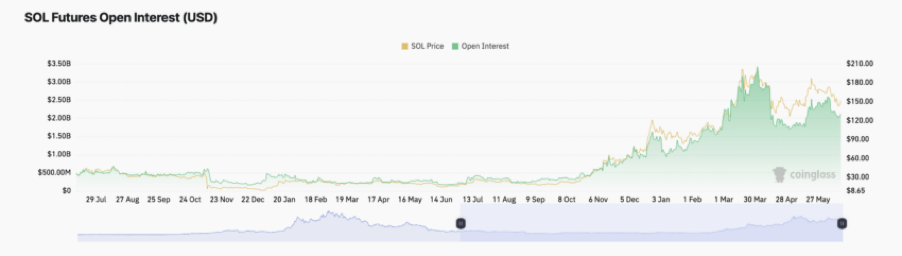

This metric measures the overall positive or negative sentiment towards an asset. Moreover, the declining open interest of SOL futures confirms the negative sentiment among market participants. At the time of writing, SOL futures open interest is $2.12 billion, showing an 18% decline over the past ten days.

The open interest of SOL futures represents the total number of outstanding futures contracts. When it drops, it means more traders are closing their positions without opening new ones. This is usually seen as a bearish signal for a financial asset.

SOL price prediction

SOL’s key momentum indicators point to an increase in selling pressure. The Relative Strength Index (RSI) stands at 41.07, while the Money Flow Index (MFI) also stands at 41.07. Overall, these are not positive scores for an asset.

These indicators measure an asset’s price momentum and identify potential buying and selling opportunities. At these values they signal that purchasing activity is low.

Furthermore, the Elder-Ray Index has been negative since June 7. This indicator measures the strength of bulls and bears in the market. When the value is negative, bear power dominates the market. At the time of writing, SOL’s Elder-Ray Index is -9.8.

If the bears continue to dominate the SOL market and selling pressure remains high, there is a chance that Solana will lose support at $139 and fall even further.

Trade €10,000 for free and get a 10 euro bonus

Do you want to enter the crypto world and perhaps buy Solana or another crypto? Then grab your chance now with this exclusive offer! Thanks to a special deal between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers receive an exclusive offer.

Create an account with Bitvavo via the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you also don’t pay trading fees on your first 10,000 euros in transactions. Register now!

Source: https://newsbit.nl/komt-er-een-gigantische-solana-koersval/