Bitcoin started 2024 on a high with explosive gains, driven by optimism surrounding the launch of Spot Bitcoin ETFs in the United States. In the first two months following the launch of the ETFs, Bitcoin price shot to an all-time high of $73,800.

Then the decline started and the bulls lost control of the Bitcoin price. What is going on and what can we expect for the rest of 2024?

Receive a Free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,500 people went before you!

Each Monday in Thursday receive everything you need to know about the financial markets directly in your mailbox.

Nvidia steals the show

One major development that is currently hindering Bitcoin (in my opinion) is the rise of artificial intelligence and the associated hype surrounding companies like Nvidia.

Year-to-date, Nvidia is up 156%, while Bitcoin is up 44% (which isn’t bad at all).

In my opinion, companies like Nvidia are putting pressure on the Bitcoin price, because investors who are open to investing in Bitcoin are also people who like to invest in emerging technology such as artificial intelligence.

Of course, they can only invest their money once and for that reason Bitcoin may have a bit more difficulty than in a “normal” cycle. On the other hand, we should not forget that Bitcoin made a new all-time high for the first time in history before the halving.

In that respect, we can’t say that things are really going badly, on the contrary. It is also remarkable that people now apparently experience a Bitcoin price of 60,000 dollars as negative and are worried. After all, in November 2022, Bitcoin was still at 15,500 dollars.

Macroeconomic pressure on the Bitcoin price

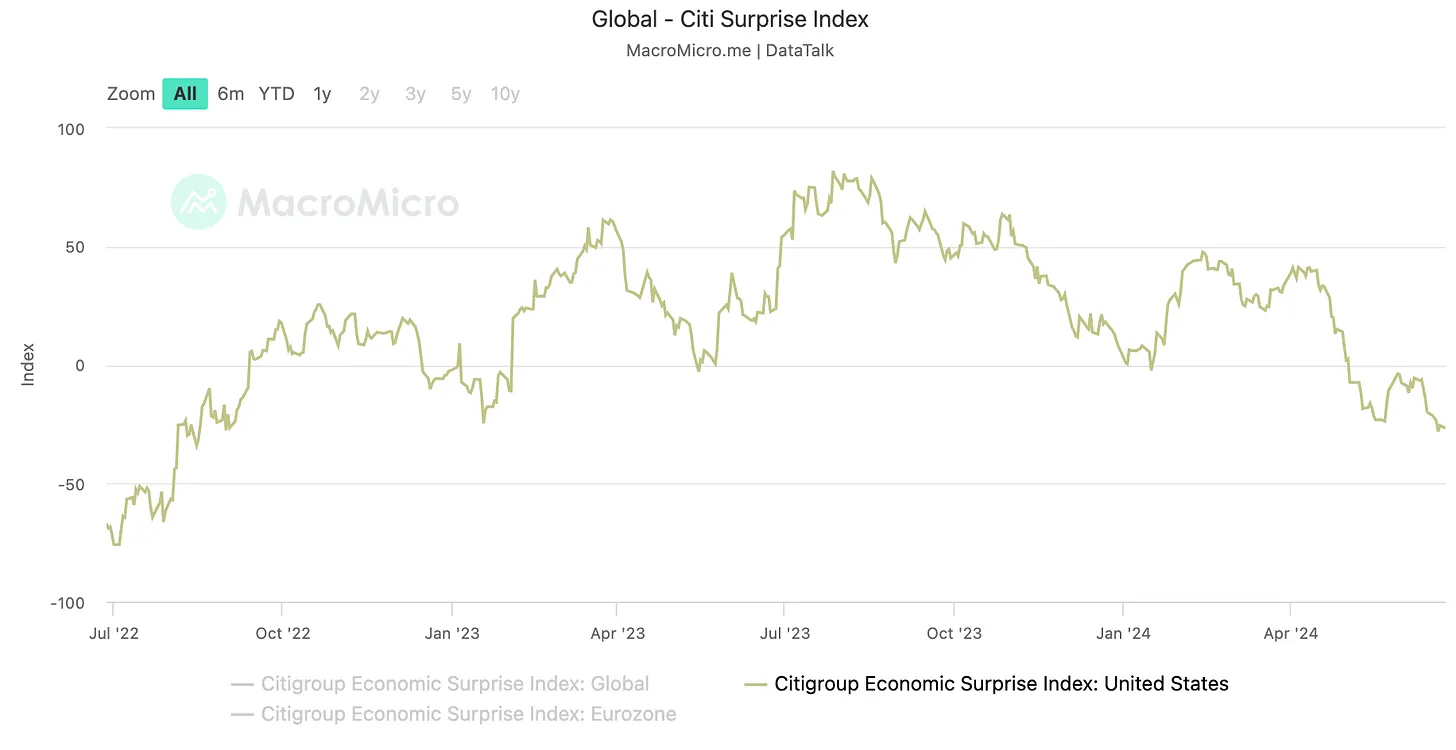

As a second and final “reason” for the disappointing performance of the Bitcoin price, I would like to mention the macroeconomic circumstances. The year 2024 started with a huge optimism about the number of interest rate cuts that the American central bank (Federal Reserve) would implement.

The market was betting on 6 rate cuts for 2024. Now, six months later, the first rate cut has yet to come. During Q1 2024, inflation in the United States unexpectedly rose, making the market more pessimistic about the Federal Reserve’s interest rate policy.

At this point, only 1-2 more rate cuts are expected before 2024. The “postponement” of the rate cuts currently appears to be the main reason for the subdued performance of the Bitcoin price.

In recent weeks, however, we have seen inflation fall back somewhat and the US economy (seemingly) begins to weaken. This offers hope for the second half of the year. Personally, I am still betting on the continuation of the bull market in Q3/Q4 2024.

Receive a Free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,500 people went before you!

Each Monday in Thursday receive everything you need to know about the financial markets directly in your mailbox.

Trade €10,000 for free and get €10 bonus

Want to enter the crypto world and perhaps buy Solana or another crypto? Then grab your chance now with this exclusive offer! Thanks to a special deal between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers get an exclusive offer.

Create an account at Bitvavo using the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you also pay no trading fees on your first 10,000 euros in transactions. Sign up now!

Source: https://newsbit.nl/waarom-verliezen-de-bulls-hun-controle-over-de-bitcoin-koers/