Is the Bitcoin bull market over again? That is currently the most important issue within the crypto industry. After reaching the all-time high of $73,800 on March 14, Bitcoin fell to a local bottom of $56,800. From that moment on, a cautious new revival started, but the conviction is still lacking.

In this column we dive into the data together to determine whether the Bitcoin bull market will continue.

Receive a free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,000 people went before you!

Each Monday in Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

What does the blockchain say about the bull market?

Starting with the blockchain, where a lot of valuable data can be found. The image below shows Bitcoin’s HODL Waves. To predict the end of the bull market, it is important to look at the orange/red waves.

They represent “new investors” who are getting in and have only owned their Bitcoin for a very short time.

What you can clearly see from the graph above is that the orange/red waves peak when the Bitcoin price reaches its peak of the cycle. How is that possible? That is the moment when many new investors want to benefit from the peak of the bull market.

At the moment, the orange/red wave is nowhere near the level of the bull markets of the past. For that reason, based on the HODL Waves, we can conclude that Bitcoin is still mainly “controlled” by more experienced investors.

As long as the red-colored HODL Waves are still relatively low, it is difficult to argue that the bull market is already over.

This is also important for Bitcoin

However, we should not forget that Bitcoin has become quite a large financial asset at this point. For that reason, the macroeconomic environment is increasingly weighing more heavily on the Bitcoin price.

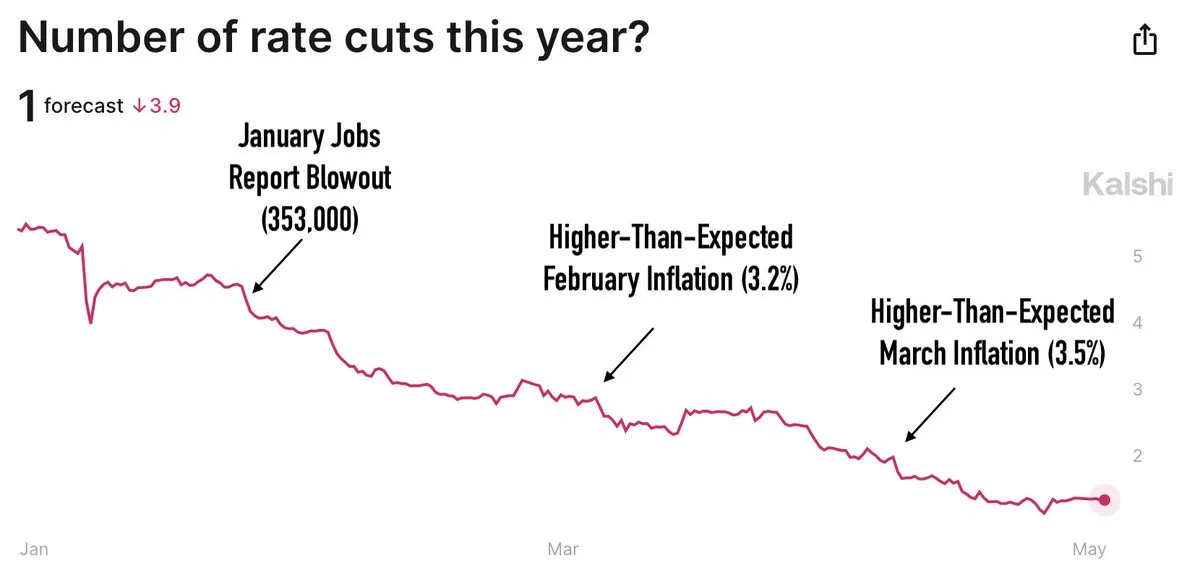

While the European Central Bank (ECB) appears to be implementing its first interest rate cut in June (good for Bitcoin), the US central bank will probably have to wait a long time. Therein lies the (temporary) problem for this bull market.

During the first quarter of 2024, US inflation consistently came in higher than expected and the economy/labor market also proved to be strong. That makes it difficult for the US central bank to lower interest rates.

In that regard, it becomes extremely important for Bitcoin to keep an eye on the US economy. For example, next week there will be another crucial inflation report on Friday, which could determine a lot for the Bitcoin price in the coming months.

Do you want to follow these types of developments closely? Then check out my newsletter that I send out twice a week for free on these types of topics.

Receive a free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,000 people went before you!

Each Monday in Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

Trade €10,000 for free and get a 10 euro bonus

Do you want to enter the crypto world and perhaps buy Ethereum or another crypto? Then grab your chance now with this exclusive offer! Thanks to a special deal between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers receive an exclusive offer.

Create an account with Bitvavo via the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you also don’t pay trading fees on your first 10,000 euros in transactions. Register now!

Source: https://newsbit.nl/de-bitcoin-bullmarkt-is-niet-voorbij-en-dit-is-waarom/