The US central bank’s favorite inflation gauge arrived yesterday entirely in line with expectations. This concerns the Core Personal Consumption Expenditures index (Core PCE), which came in at 2.8 percent. That is a positive signal for the US central bank in their mission to reduce inflation to 2.0 percent.

Does this inflation score mean that we can expect the first interest rate cuts from the US central bank soon? And what does that mean for the Bitcoin price?

Uncertainty about US inflation

In recent weeks we have seen a rising consumer price index (CPI) and other key inflation gauges in the United States.

For that reason, there was fear that the Core PCE price index could also turn out to be higher than previously thought. If the US central bank can manage to reduce the Core PCE from the current 2.8 percent to 2.0 percent this year, that would be a huge victory.

Despite the positive inflation data, the market continues to raise its expectations about the US central bank’s first interest rate cut.

Now it seems as if they do not expect the first interest rate cut until after June 2024. We have also dropped from an expected number of 6-7 interest rate cuts before 2024, to only 3 pieces.

Should we take into account that interest rates will remain at this increased level for longer? Is this the new normal for the economy?

What does this mean for the Bitcoin price?

In principle, it is not a good development that the number of expected interest rate cuts for 2024 continues to decline. A lower interest rate means that the price of capital falls and that usually causes a greater inflow of money into the economy and the financial system.

The longer interest rates remain at this elevated level, the less money flows into the economy and that basically makes it more difficult for the Bitcoin price to rise.

On the other side is America’s government debt, which has already grown by $963 billion since the start of the 2024 fiscal year (about 150 days ago).

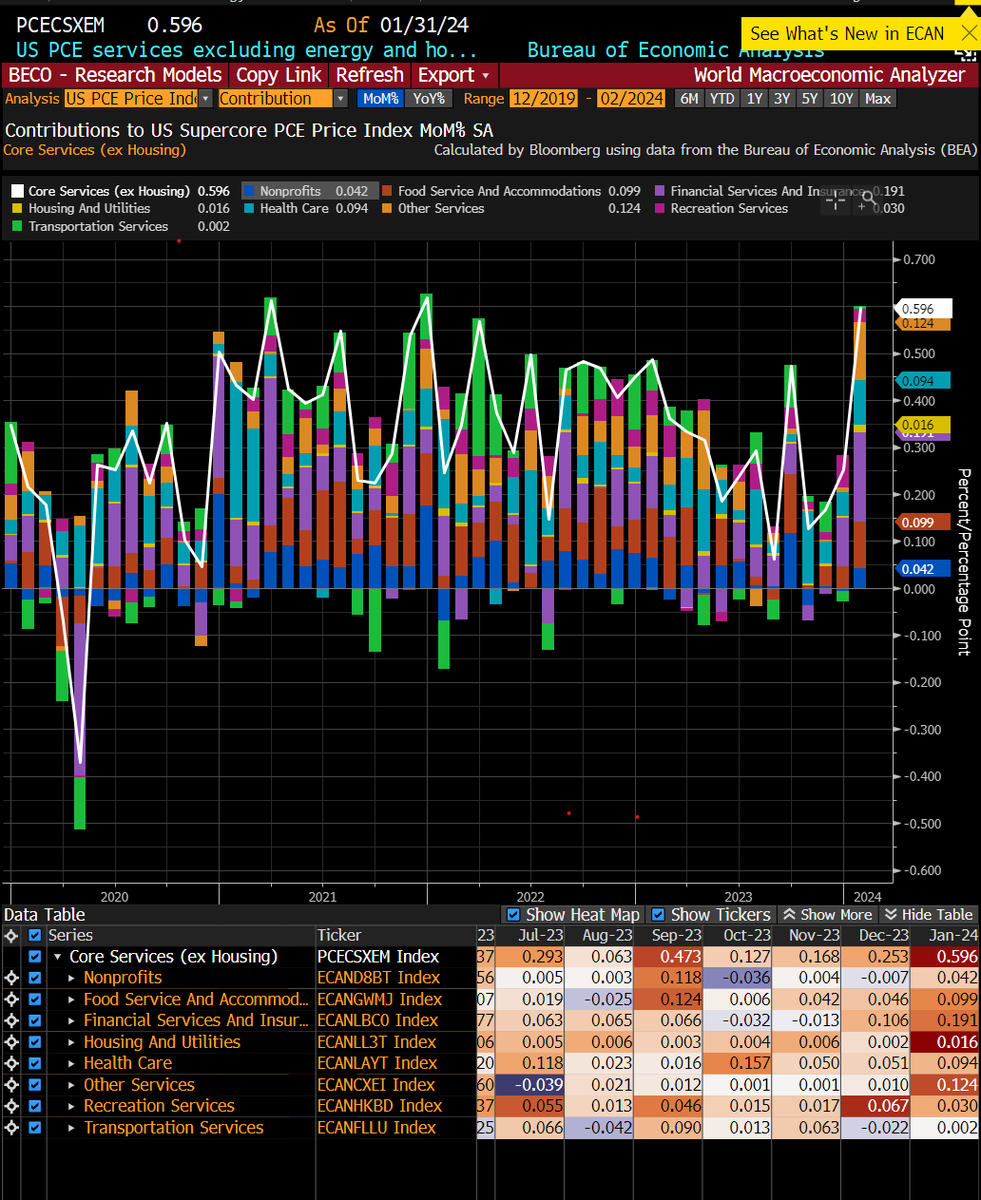

In addition, Super Core PCE inflation rose at almost the fastest pace ever in January. In that respect, the inflation battle does not appear to have been completely won by the US central bank.

The moral of the story? It will probably be a longer wait for interest rate cuts, which will put downward pressure on the Bitcoin price in the short term. In the long run, however, this will cause problems for the US government (due to its enormous debt).

They will see their annual interest payments increase, causing budget deficits to rise and them having to borrow even more to make ends meet. This ultimately results in a weaker dollar and that is positive for Bitcoin.

Valid for 1 month: Grab your 20 Euro bonus now at Bitvavo

Are you about to discover the crypto world and are you considering buying Bitcoin or another crypto? Then grab your chance now with this exclusive offer! Thanks to a special deal between Newsbit and the Dutch crypto exchange Bitvavo, our readers receive an exclusive offer

Only Available for 30 Days: register with Bitvavo via the button below and receive a welcome gift of 20 euros completely free. And that’s not all – you also don’t pay trading fees on your first 10,000 euros in transactions. Register now!

Source: https://newsbit.nl/bullish-voor-bitcoin-amerikaanse-inflatie-op-laagste-niveau-sinds-april-2021/