The US central bank decided last Wednesday to leave interest rates unchanged. Not long after that decision, the Bitcoin price shot up by several thousand dollars. In my opinion, the US central bank is making a big mistake with its current policy, which could turn out to be very bullish for Bitcoin in the longer term.

High time to dive into the matter and take a closer look at the interest rate decision and the economic prospects for America.

Would you like to receive a free financial newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,000 people went before you!

Each Monday in Saturday you will receive everything you need to know about the financial markets directly in your mailbox.

US central bank at fault?

With an interest rate decision, the US central bank also shares its Dot Plot for the coming years. This sets out the central bank’s expectations regarding gross domestic product (GDP), unemployment, inflation and of course the interest rate they will charge.

Compared to December, it is particularly striking how positive the US central bank is about GDP: 1.4% versus 2.1% for 2024. It also expects GDP growth of 2.0% for 2025 and 2026, compared to previously 1.8% and 1.9% were.

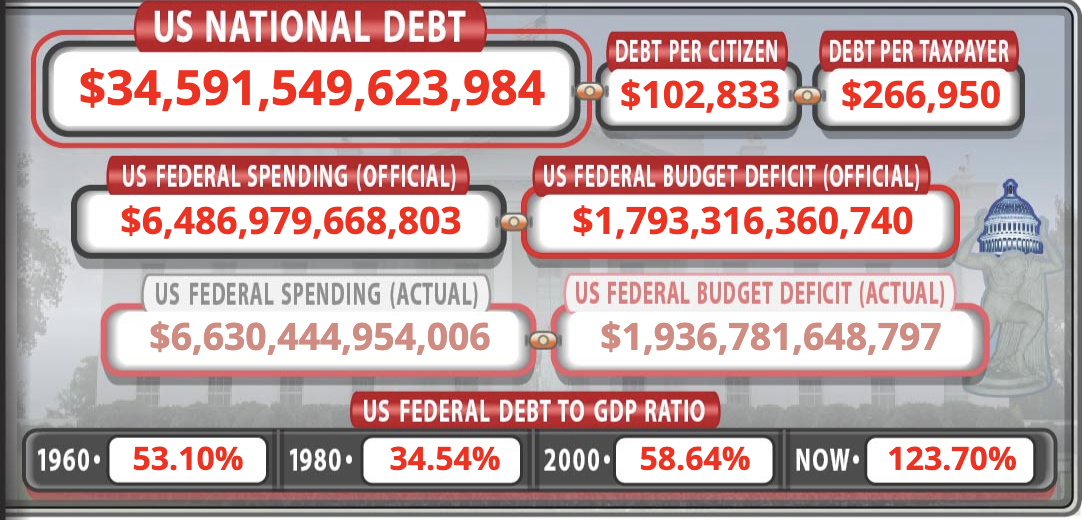

Where I think they go wrong is with the interest rate. For example, the US central bank expects interest rates to end 2024 at 4.6% and 2025 at 3.9%. That’s a problem because the US government is struggling with a debt of $34.5 trillion.

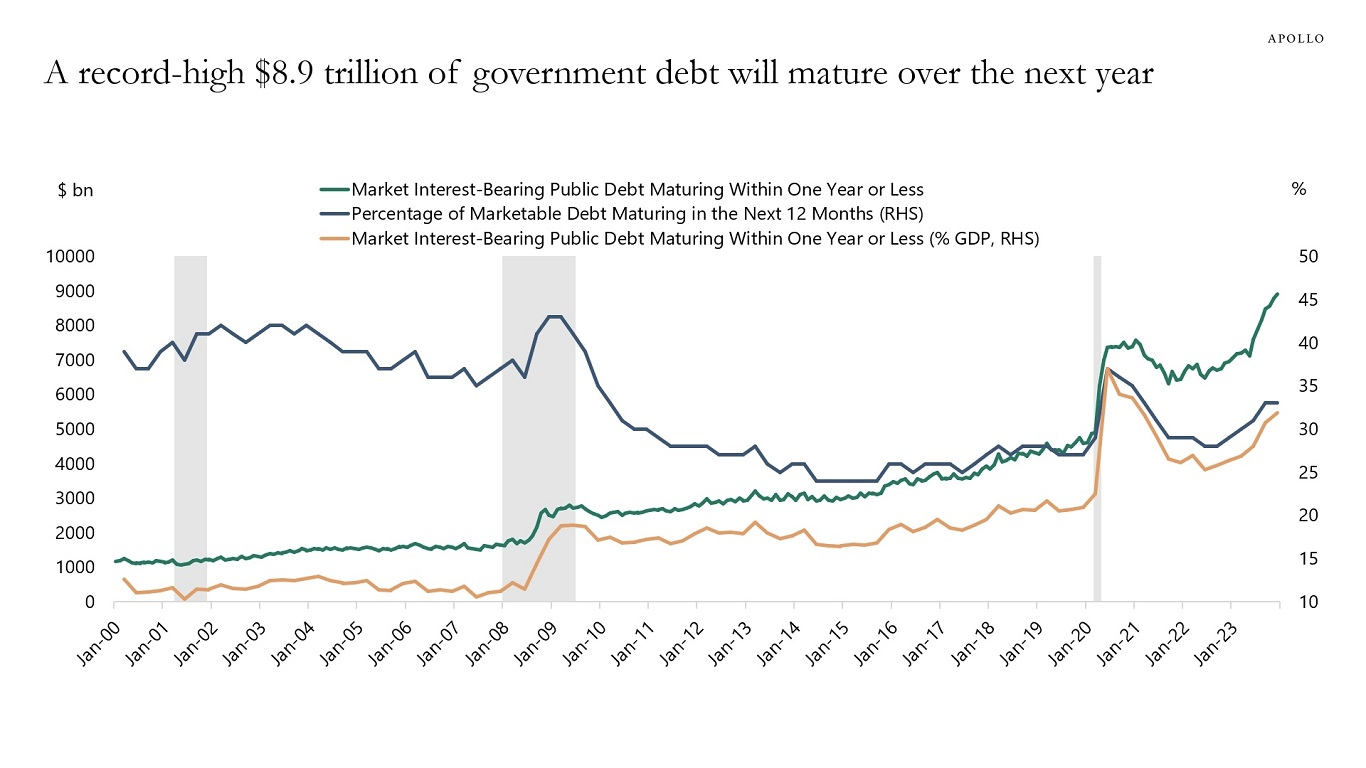

In the coming year, the US government must refinance $8.9 trillion in debt.

As long as interest rates remain at the level predicted by the US central bank, this will pose an incredible problem for the government. This means that interest costs will rise extremely quickly.

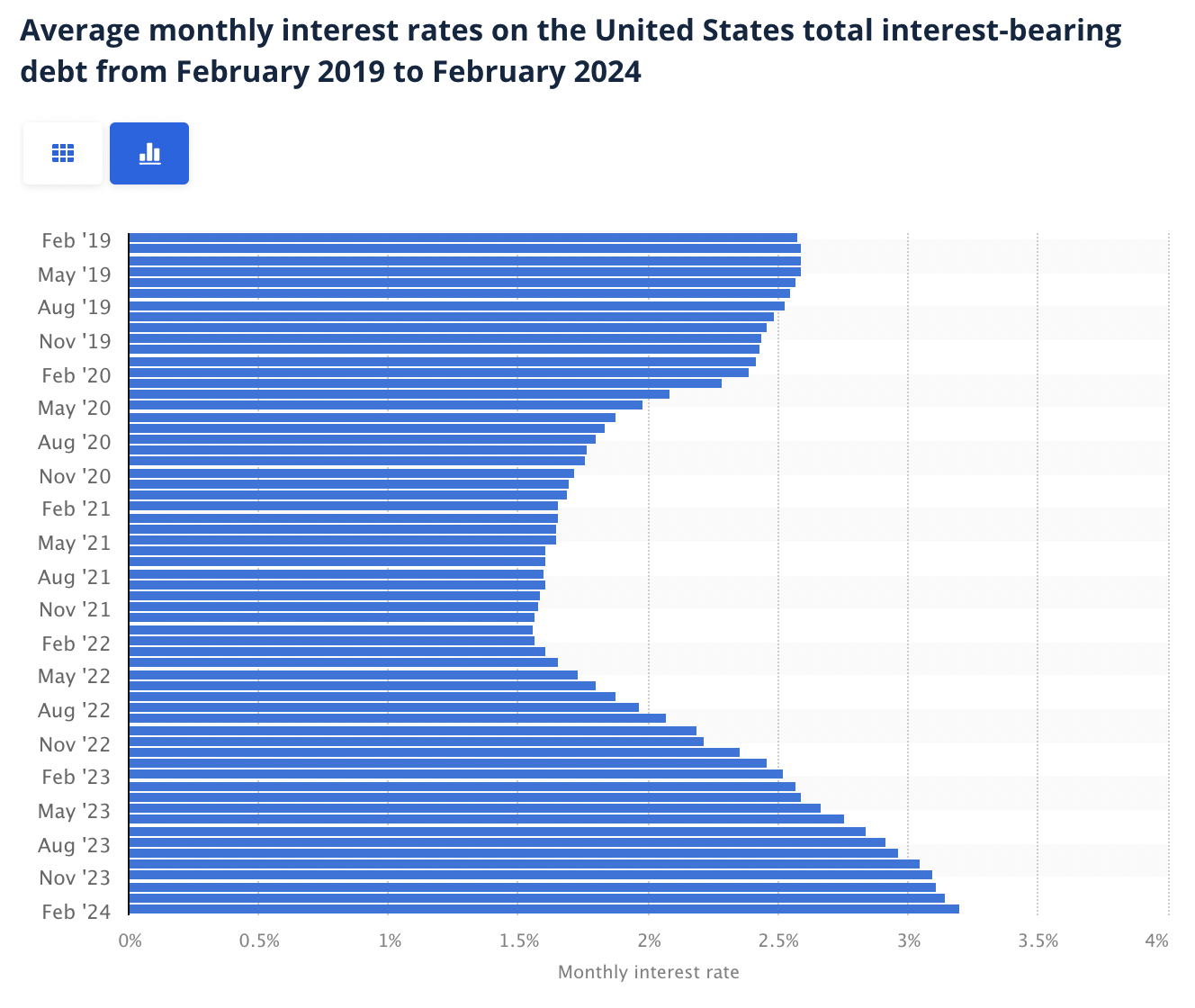

As you can see, the average interest rate on US debt is currently increasing rapidly. At the time of writing, that interest rate is 3.2%, which means that they spend ~1.1 trillion dollars annually in interest costs.

If that percentage rises to the 3.9% at which the US central bank wants to end the year 2025, it would amount to ~$1.34 trillion in interest costs.

By comparison, the entire US military costs approximately $800 billion annually.

Why is this bullish for Bitcoin?

Satoshi Nakamoto created Bitcoin to protect the world from inflation. The decentralized nature of Bitcoin, combined with the absolute scarcity of 21 million units, makes the digital currency, in theory, the ultimate protection against infinite money printing.

The longer interest rates remain at these elevated levels, the faster the U.S. government’s interest costs will rise, the more its budget deficits will rise, forcing them to take on even more debt to fill those gaps. These debts lead to higher interest costs and so the circle is complete.

It seems that America is in a negative debt spiral, while the US central bank cannot lower interest rates because inflation is rising again. That is a very scary situation, which could have major consequences for the US dollar.

Will investors switch en masse from the US dollar to assets such as Bitcoin, gold, shares, real estate and art in the coming months? That could just be possible.

Would you like to receive a free financial newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,000 people went before you!

Each Monday in Saturday you will receive everything you need to know about the financial markets directly in your mailbox.

Valid for 1 month: Grab your 20 Euro bonus now at Bitvavo

Are you about to discover the crypto world and are you considering buying Bitcoin or another crypto? Then grab your chance now with this exclusive offer! Thanks to a special deal between Newsbit and the Dutch crypto exchange Bitvavo, our readers receive an exclusive offer

Only Available for 30 Days: register with Bitvavo via the button below and receive a welcome gift of 20 euros completely free. And that’s not all – you also don’t pay trading fees on your first 10,000 euros in transactions. Register now!

Source: https://newsbit.nl/bullish-voor-bitcoin-amerikaanse-centrale-bank-maakt-enorme-fout/