The Bitcoin price has been under pressure for months and people are slowly starting to lose confidence in the bull market. From Q1 2024, inflation suddenly started to rise again in America, forcing the central bank to postpone its interest rate cuts. This week we again ended with strong macroeconomic data for America and that looks bearish for Bitcoin.

Receive a free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,000 people went before you!

Each Monday in Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

US economy stronger than expected?

Bitcoin needs a weaker US economy. That weakness would, in theory, remove the upward pressure behind inflation, giving the Federal Reserve room to cut rates.

In that context, last Friday was a bad day for Bitcoin. On Friday it was announced that both the manufacturing and service sectors in the United States are stronger than expected.

I am talking about the so-called Purchasing Managers Index (PMIs), surveys in which purchasing managers of the largest American companies provide an insight into their business. Each one of these came in higher than expected.

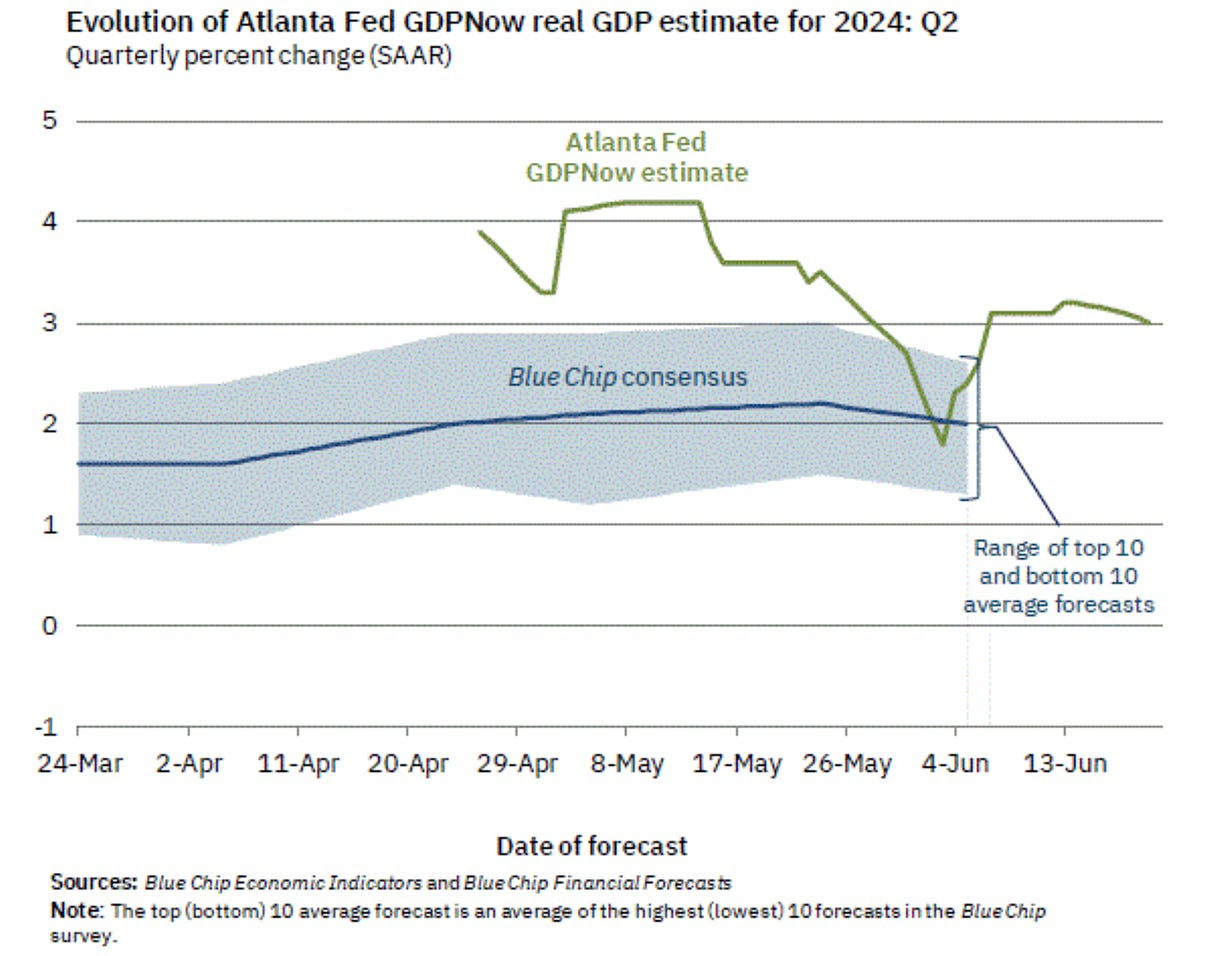

In addition, the Atlanta Federal Reserve estimates +3.0% for economic growth for Q2 2024. That would represent a considerable increase compared to the +1.3% of the first quarter of this year.

Although you often hear people speculate about a recession, most data still points to a strong American economy. This continues to put upward pressure on inflation, which is bearish for Bitcoin as it further postpones interest rate cuts.

That currently seems to be the “catalyst” that people are waiting for for the possible second part of the bull market.

Not all economic data is strong

However, it would be too simplistic to conclude from a few data points that the US economy is currently very strong. Although inflation in Q1 2024 was higher than hoped, both the CPI and PPI were lower than expected last week.

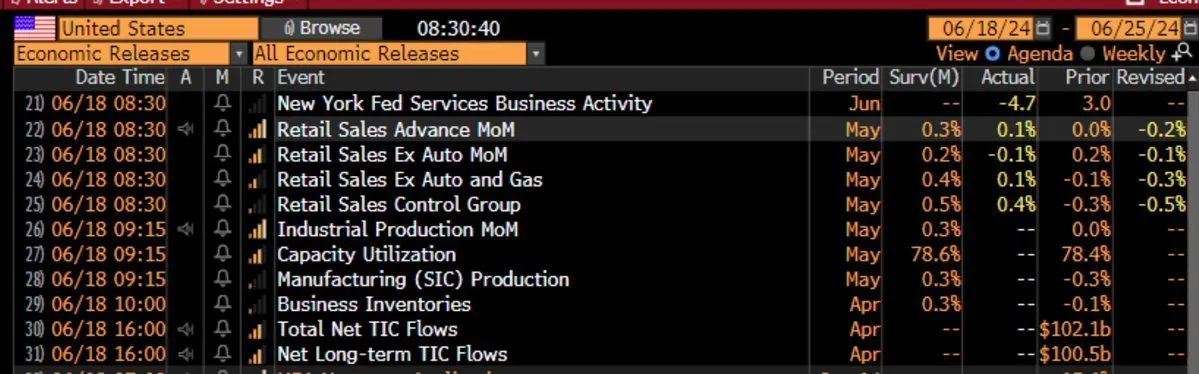

In addition, this week’s Retail Sales (sales figures from the American retail sector) were lower than expected.

So there are certainly data points that point to an economy that is slowing down somewhat, allowing inflation to fall to the desired 2.0%. In that sense, next Friday will be extremely important for the Bitcoin price.

On Friday we will receive the PCE Price Index, the US central bank’s favorite inflation gauge. Is that also lower than expected? Then we can probably prepare for Bitcoin price increases, as hopes for rapid interest rate cuts increase.

So we are at a bit of a crossroads and are facing a few extremely important weeks with Bitcoin.

Receive a free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,000 people went before you!

Each Monday in Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

Trade €10,000 for free and get a 10 euro bonus

Do you want to enter the crypto world and perhaps buy Bitcoin or another crypto? Then grab your chance now with this exclusive offer! Thanks to a special deal between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers receive an exclusive offer.

Create an account with Bitvavo via the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you also don’t pay trading fees on your first 10,000 euros in transactions. Register now!

Source: https://newsbit.nl/deze-economische-data-is-bearish-voor-de-bitcoin-koers/