New fronts to reduce the gender gap after retirement. The Government’s proposal to close the pension reform, agreed on Thursday by the coalition partners, provides for more favorable measures for women, whether they are specific, such as covering their contribution gaps, or that have a greater impact on them, such as the improvement of the lowest pensions. The result, explain sources of the negotiation, is expected to reduce the great distance between the benefits that men and women receive, which exceeds 30%.

The CEOE employers reject the government’s pension reform and threaten to raise wages less

Further

The average pension for men, taking into account the entire contributory system (retirement, disability, widowhood…), reaches 1,439 euros per month, while that of women stands at 966 euros per month. In other words, on average the benefits of men are 33% higher than those of women. In addition, they are more among welfare pensions, non-contributory, for people who have not contributed the minimum amount.

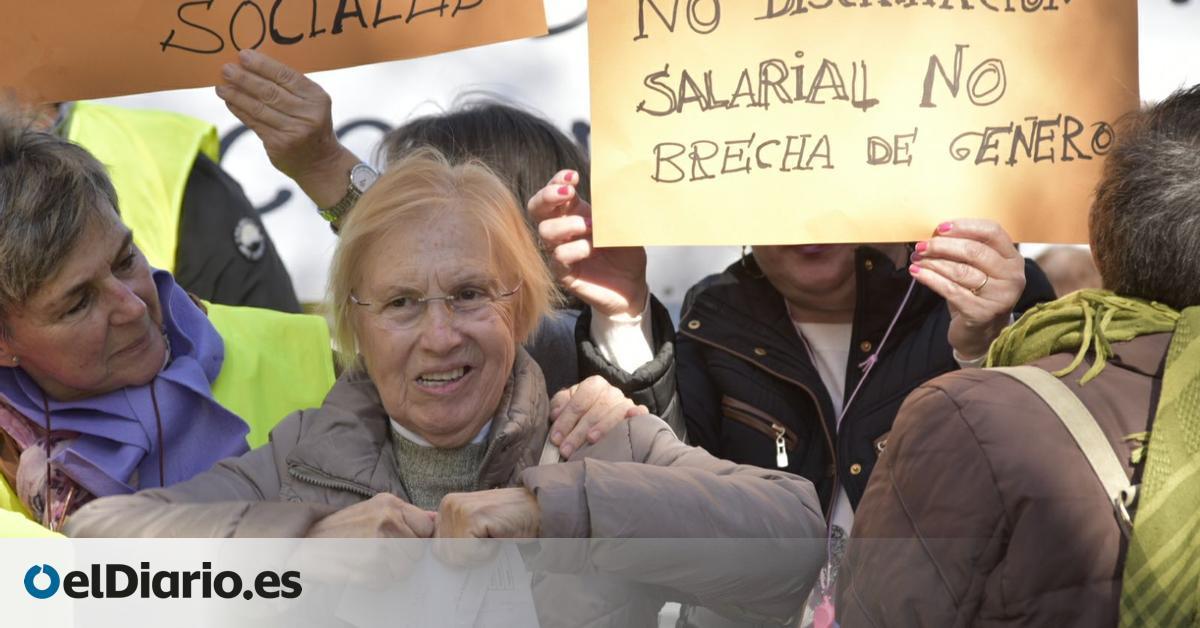

The gender gap in pensions is the last step in a long list of inequalities throughout the working lives of men and women. It affects the wage gap, the fact that women earn less than men, but also their lesser integration in the labor market, the higher incidence of unemployment, part-time shifts and interruptions in their careers to take on care tasks. relatives, among others.

Thus, to resolve the great gap between men’s and women’s pensions, it is essential to act on the causes of all these gaps, but measures can also be taken to cushion it from the benefit system itself, as demanded by the unions and partners of the Government. The former is fundamental, but its effects require time, while the latter seeks to compensate for the inequalities already experienced and that leave women with more adjusted pensions at the end of their lives.

Better coverage of the “gaps” of the contribution

Women assume more tasks of caring for children and the elderly and therefore see their careers more interrupted. Given this situation, there are measures to lessen the impact of these “gaps” or “gaps” through coverage by the Social Security system.

This “gap coverage” is extended to women in the Government’s proposal, the negotiation of which has been led by Minister José Luis Escrivá. 100% of the minimum base will continue to be covered for the first 48 months (which add up to four years) and 50% from month 49 onwards. But in the case of employed women, the Government plans to cover 100% of the minimum base between the empty month 49 and 60 (ie, up to the fifth year) and 80% of the minimum base from the 61st month to the 84th (seven years).

The majority unions have celebrated that measures against the gender gap are addressed in this last phase of the reform, as they requested, but have warned that they will propose some changes. For example, the CCOO and the UGT will propose “improving the formula for integrating gaps so that it includes all workers”, not only women employees, “knowing that it will mainly benefit women in two out of three cases, but not excluding men with equally precarious careers.”

Complement against the gender gap

Another of the specific measures against the inequality of men’s and women’s pensions involves the supplement against the gender gap, previously the maternity supplement of pensions invalidated by the courts. This recognizes a bonus to workers for having had children and, as it declines in the parent with the highest incidence of maternity/paternity in their jobs, it is usually received mainly by women.

Last month almost 432,000 pensioners received it, “of which 92% are women (397,721),” according to Social Security figures. The average amount of this supplement in the pension is 66 euros per month, which the unions demanded to increase.

The agreement between PSOE and Unidas Podemos in pensions includes an increase of “10%, in addition to the annual revaluation” in the next two years, 2024 and 2025, but the CCOO and UGT have explained that they will also request an improvement on this point.

Increase in minimum and non-contributory pensions

Lastly, there is another key measure designed for the most precarious people, but which is especially indexed in women. This is the increase promised in the reform for minimum contributory pensions and non-contributory pensions, the lowest in the system, for the coming years.

The second vice president, Yolanda Díaz, has highlighted the gender impact of this measure, although it is directed at men and women, as is the case with increases in the minimum wage, since they are the majority among the lowest wages and pensions. Investiture partners of the Government, such as ERC and EH Bildu, have placed great emphasis on this increase.

The Executive’s approach is to design a path of increases in the coming years, as was done with the minimum wage. The minimum contributory pensions will reach “60% of the median income” corresponding to a household with two adults in 2027 with progressive increases from next year, 2024.

For non-contributory pensions, aimed at people without the minimum contribution for a pension, the goal is to reach “75% of the poverty threshold calculated for a single-person household”, also in 2027. These pensions are relevant in another scope, the minimum vital income, since its increase is the reference for the annual increase in the state minimum income. The majority unions and some investiture partners have affirmed this Friday that they will also try to broaden these horizons.

Source: www.eldiario.es