The future of the dollar, prices and salaries. The IMF: key actor. Economy column from El Círculo Rojo, a program from La Izquierda Diario on Radio Con Vos, 89.9. In text and video.

- What’s going to happen next week? Nobody can know. But some trends operating in the economy can be explored.

- The main question is what will happen to the dollar. Let us remember that the government found some relief on the exchange front due to several factors, among them the 70/30 system, which allowed exporters, particularly agricultural ones, to sell abroad at a dollar more expensive than the official one.

- This system expires this Friday 11/17. Therefore, until new rules are defined, a period of uncertainty may open with few dollar settlements from exporters and this situation will fuel the already existing exchange rate pressures.

- Only by April/May of next year are sales of the new crop expected to be deployed, which will be better than the current one, which suffered the impact of the drought. Until now, there remains a lot, a lot of time.

- The ruling party has a remainder of the “swap” (currency exchange) with China to try to manage the transition, but months of strong exchange rate pressure are coming.

- Based on what was agreed with the Fund, since this Wednesday the official dollar began to rise at a rate of 3% per month: this is what they call “crawling peg.”

- Although this is an increase that is far behind monthly inflation, the official dollar standing still, as in the last two months, is not the same as a dollar that begins to move.

- It must be remembered that the jump in the official price of the dollar in August brought inflation above 12% in that month and in September. In October it gave way a little, to 8.3% that was known this week, but in a context where many prices are influenced by state regulation.

- Among the frozen prices are those of transportation, fuel (although they increased after the general elections) and public services. We will have to wait and see what definition the government takes after the elections.

- Everything indicates that by November inflation will be above 10% again. And in the coming months it may accelerate as prices thaw.

- Inflation impacted the purchasing power of the salary: there is a moderate loss in the formal sector, both public and private, of one percentage point in September compared to December 2022. In the case of the informal sector, the loss is profound: of more than 8 percentage points.

- Obviously, the purchasing power of the salary never recovered in this government what was lost during the Macri administration. It is likely that, in the final months of the year, if prices are released, purchasing power will deteriorate further.

- Another focus of attention is what will happen with the IMF and the debt. Immediately, the country has debt maturities in dollars for about US$5,000 million between December and January. More exchange rate pressure.

- Although the Fund has to send a disbursement to our country for about US$3.3 billion and it is said that another US$12,000 would be available to put on a negotiating table later in December. It is clear, all these eventual shipments will be tied to conditionalities. The more adjustment.

- This adjustment will reinforce the recessionary tendencies that are already acting on the economy. In the accumulated period until August, the economy fell 1.8% compared to the same period in 2022. The consolidation of recessive trends is something that can be expected in the coming months. More so if a greater adjustment is agreed with the IMF.

- The candidate minister, Sergio Massa, participated this Thursday, 11/16, in a meeting with businessmen at the Inter-American Council of Commerce and Production (Cicyp). The country’s main companies participate in this Council and it is currently chaired by the vice president of the Rural Society, Marcos Pereda.

- At this meeting, Massa explained part of his program. Perhaps because of the business audience in front of him, perhaps out of conviction, what he spoke of was more adjustment in public spending, in addition to what is already taking place this year: the Congressional Budget Office estimated that, discounting inflation , the cut in public spending that Massa made was 4.3% accumulated between January and October.

- The candidate minister gave a very strong signal regarding fiscal adjustment. He said, “We’re going to try to get Congress to pass a zero deficit or positive budget.”

- Not only that. At the same time, he talked about reducing taxes on big business. In this sense, he stated that he is going to lower withholdings: “We are going to lower withholdings for wheat, corn and soybean crops.”

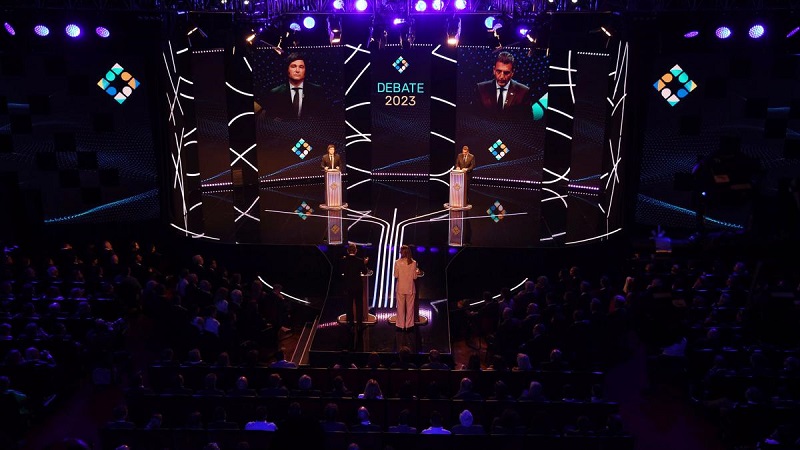

- Milei also reaffirmed his program, much more aggressive, by the way, in terms of a change in the monetary regime with dollarization that would imply a tsunami on prices and would, therefore, further devastate the purchasing power of salaries. The deposits that savers keep in banks would also enter the danger zone.

- On Sunday night there will be a winner in the elections. And there will be the opportunity to confront the promises we hear these days with harsh reality.

Economy / National Economy / Dollar / IMF / Sergio Massa / Javier Milei / The Red Circle

Source: www.laizquierdadiario.com