The market for tokenization of real-world assets (RWA) is skyrocketing. In just six months, the total value of blocked funds (TVL) in RWA protocols has doubled to a staggering $8 billion.

This spectacular growth is driven by increasing investor interest in debt-based investments (bonds) with high returns, and marks an important step forward in the integration of traditional finance with the decentralized world.

Explosive growth for tokenization

Protocols for tokenization of real-world assets (RWA) have experienced explosive growth over the past year. The total value of blocked funds (TVL) in this sector has risen to a record high.

In a message dated May 1 to X wrote blockchain analytics and research firm Messari that the TVL for RWA protocols had risen to almost $8 billion as of April 26.

The analytics firm reported that RWA protocols have seen a “remarkable revival” over the past year, adding that the sector’s growth has been driven by a “market preference for debt-based, high-yield investments.”

The $8 billion TVL figure excludes fiat-backed stablecoins such as Tether and USD Coin and includes carry trade protocols, underwriting, interest-generating stablecoins, commodities, securities, and real estate tokenization protocols.

Since February, TVL in RWA protocols has increased by almost 60%.

RWA protocols show strong growth despite slight decline in TVL

Decentralized financial analytics platform DeFiLlama reported a slightly lower figure of $6 billion in combined TVL for RWA protocols. It also shows monumental growth of approximately 700% in protocol TVL since early 2023.

Notably, total escrow isn’t the only metric to see impressive growth this year.

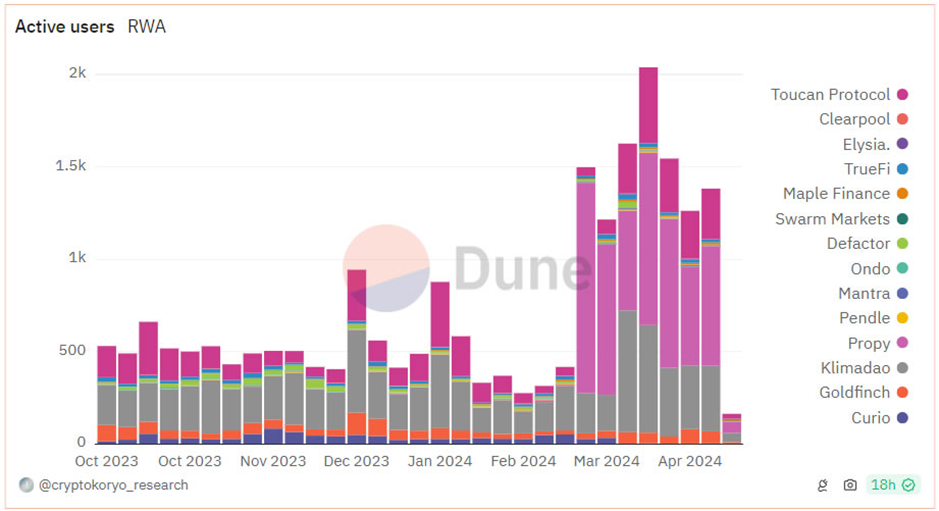

The number of active users on RWA protocols has also increased since February, indicating an increasing popularity of the sector among smaller retail users, according to data from Dune Analytics.

Protocols such as digital carbon market platforms Toucan and KlimaDAO, and real estate tokenization protocol Propy have seen proportionately the most growth in terms of active users.

Stolen tokens and record amounts in tokenized government bonds

Tokenized government bonds have also seen tremendous growth as yields remain high in an environment of high inflation and interest rates in the United States.

Currently, a record $1.29 billion is locked up in tokenized US Treasuries and bonds, according to RWA.xyz. This figure has increased by 80% since the start of 2024, mainly driven by protocols such as Securitize and Ondo.

The recent performance of BlackRock’s Ethereum-based Institutional Digital Liquidity Fund (BUIDL) – which just became the world’s largest tokenized government bond fund – and the Franklin OnChain US Government Money Fund (FOBXX) have strongly contributed to the growth of this segment of the RWA -market.

Source: https://newsbit.nl/rwa-protocollen-naderen-totale-waarde-van-8-miljard-messari/