For the first time since 2000, cash returns on paper better than shares. The profits of the S&P 500 companies for the coming months are lower than the yield on 3-month US government bonds. Historically, that is a signal that the market is at its peak.

Should we worry about stock market and Bitcoin price drops?

Would you like to receive a free macroeconomic newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Each Monday in Saturday you will receive everything you need to know about the financial markets directly in your mailbox.

Investors choose cash

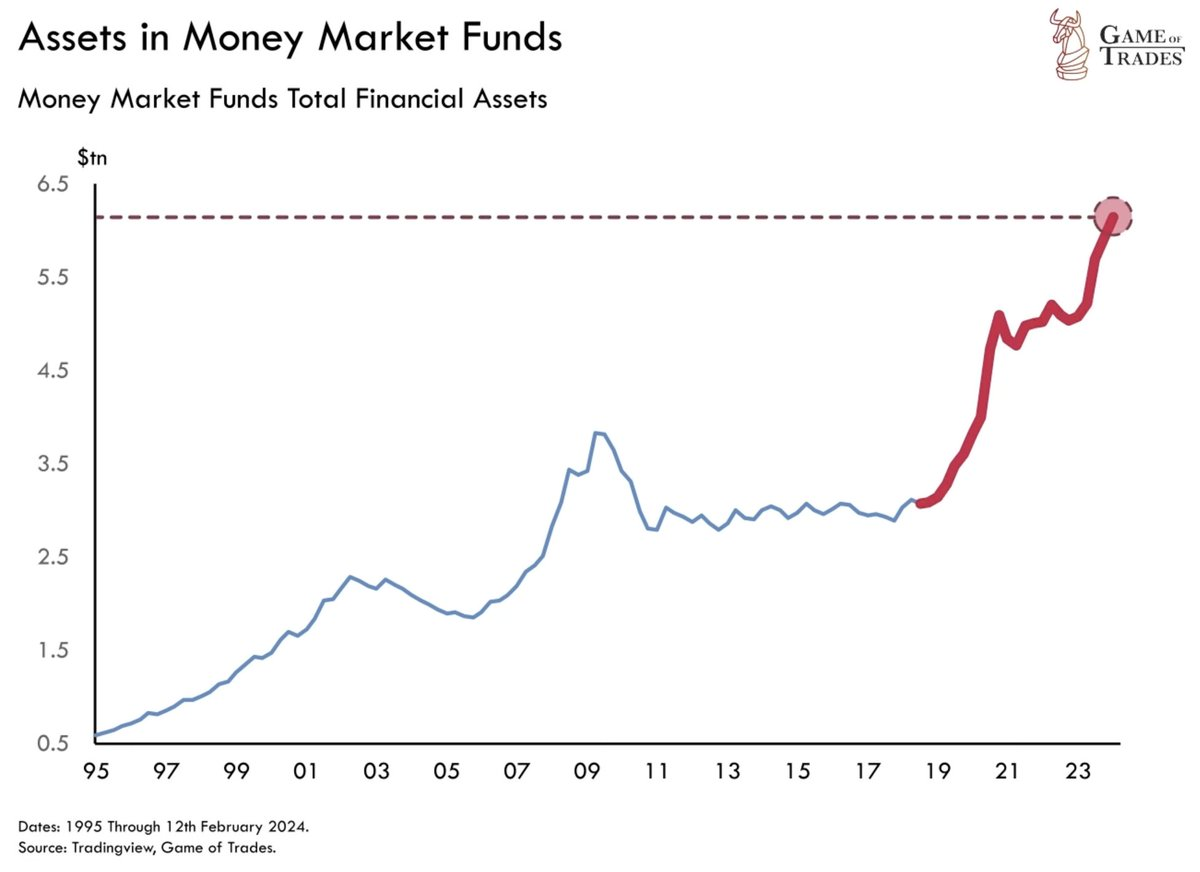

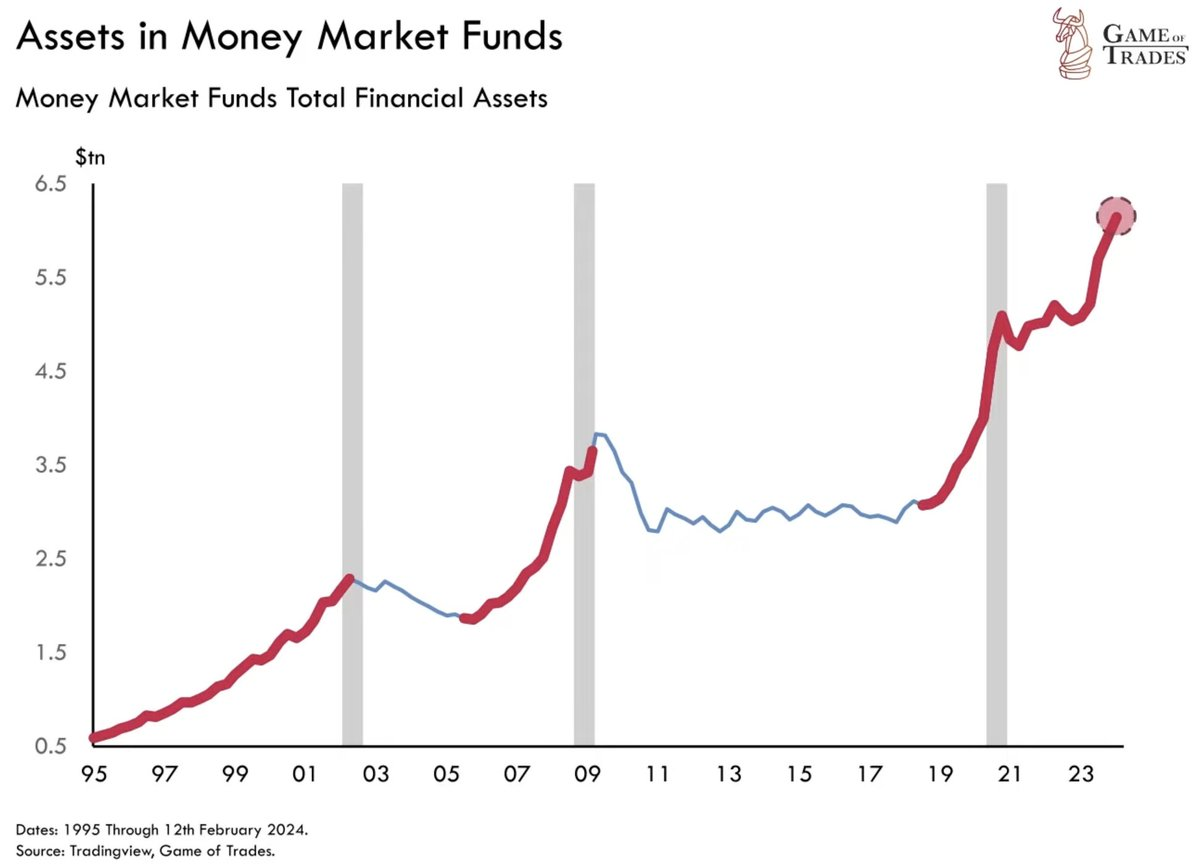

Investors now hold a total of $6 trillion in cash in money market funds. These are funds that invest in US government bonds with a short term (for example 3 months), which means they fall within the definition of “cash” because there is little maturity risk.

For example, a government bond with a term of 10 years is much more sensitive to interest rate changes than a bond with a term of 3 months.

In just 12 months, the amount of capital in money market funds has increased from $5 to $6 trillion. At the end of the 1990s, the same increase lasted 5 years (!).

Usually a “run on cash” accompanies global financial crises, recessions and we saw it before the pandemic as well. Should we still worry about price drops?

That goes very much against the sentiment and feeling that currently prevails around Bitcoin.

What does this mean for the Bitcoin price?

First of all, it is important to know that there are always graphs that point towards a crash. In that respect, this data is not immediately a signal to sell everything and secure the profits made in recent months.

This does not alter the fact that the Bitcoin price has already risen by 47 percent this year and the sentiment with a score of 80/100 for the Fear & Greed Index points to extreme greed for Bitcoin.

We’re at a point in the cycle where it feels like you can never have enough Bitcoin. Usually that is a signal to trade against your feelings and sell some Bitcoin, but that is difficult.

Especially because the Spot Bitcoin ETFs perform so well. After all, who can tell you that things will stop there and Bitcoin will start a correction from here, only to resume its increases later in the year?

Nobody knows that and that makes it so difficult to make these kinds of decisions. Personally, I just stick to my weekly purchases when it comes to Bitcoin. If the price drops, so be it.

My view is that it is practically impossible to predict short-term price movements. There are good arguments for both camps, although my feeling is in favor of a correction. So I’m not going to act on that.

Would you like to receive a free financial newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Every Monday and Saturday you receive everything you need to know about the financial markets directly in your mailbox.

Trade €10,000 for free and get a 20 euro bonus

Do you want to enter the crypto world and perhaps buy Bitcoin or another crypto? Then grab your chance now with this exclusive December offer! Thanks to a special deal between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers receive an exclusive offer.

Only in the month of December: register with Bitvavo via the button below and receive a welcome gift of 20 euros completely free. And that’s not all – you also don’t pay trading fees on your first 10,000 euros in transactions. Register now!

Source: https://newsbit.nl/dit-is-het-signaal-dat-bitcoin-en-aandelen-hun-top-bereikt-hebben/