The Bitcoin price reached its provisional all-time high of $73,800 on March 14. Then things went wrong, the bulls seemingly lost control, we fell back to $60,800 and confidence suddenly disappeared. Now Bitcoin is slowly climbing back up, consolidating around $70,000 and the chart is starting to give positive signals again.

In the daily chart we see the MACD (bottom of the chart) slowly moving towards one bullish crossover to move. If that happens (blue crosses orange), Bitcoin could theoretically start another price explosion.

Would you like to receive a free financial newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,000 people went before you!

Each Monday in Saturday you will receive everything you need to know about the financial markets directly in your mailbox.

The ‘real bull market’ has not yet started

Ki Young Ju, the CEO of on-chain analytics platform CryptoQuant, shares this view. According to the analyst, the “real bull market” for Bitcoin has not yet started. He splits Bitcoin’s cycle into three phases: recovery, the bull market to the old all-time high and the “real bull market” in which Bitcoin sets new price records.

“Bitcoin gives me the same feeling as four years ago.

2020-21:

– $3,000 – $9,000 (repair)

– $9000 – $19,000 (bull market to old all-time high)

– $20,000 – $68,000 (the real bull market)

2023-24

– $15,000 – $45,000 (repair)

– $45,000 – $68,000 (bull market to old all-time high)

– $68,000 – $???.??? (the real bull market).”

Ki Young Yu finds that on-chain data shows wealthy investors are selling Bitcoin around the all-time high of $69,000. On the other hand, the traditional financial world is currently buying up a lot of Bitcoin (Spot Bitcoin ETFs).

“Old whales sell Bitcoin to new whales (TradFi), not to private individuals. We can clearly see this on the blockchain,” said the analyst.

Economic climate points to continued Bitcoin bull market?

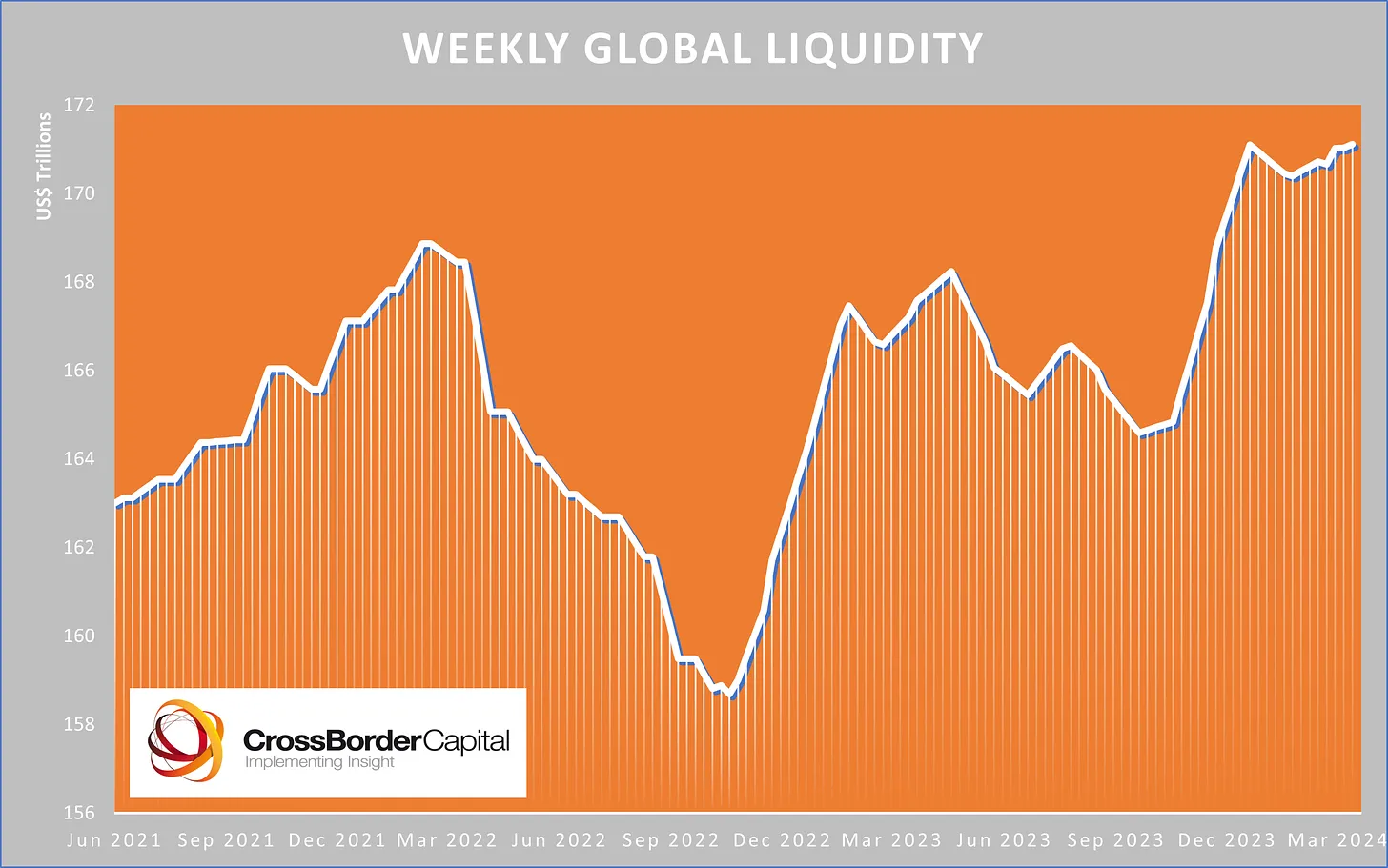

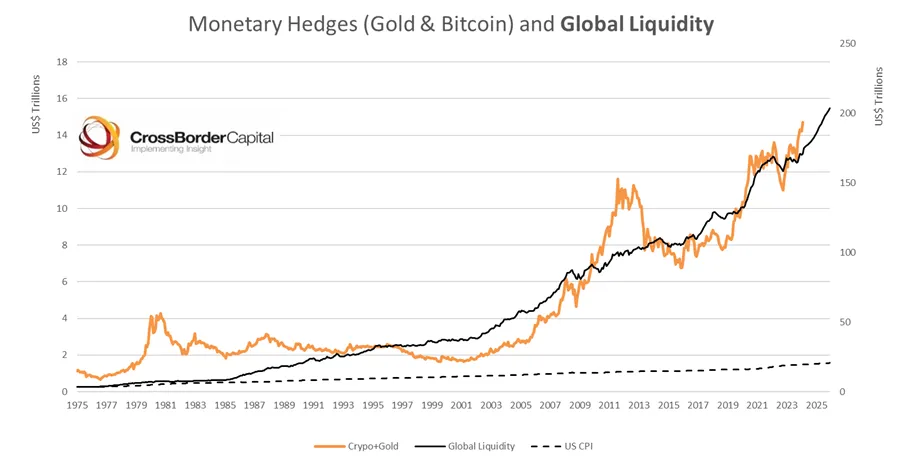

Things are also looking increasingly good for Bitcoin on a macroeconomic level. Global liquidity has been on the rise since reaching the bottom in Q4 2022 and since then we have also seen the Bitcoin price rebound.

Simply put, global liquidity indicates how much capital there is in the global economy. When liquidity increases, that capital has to go somewhere and because of inflation in fiat money, it increasingly looks for scarcity. The chart below shows the relationship between global liquidity and Bitcoin and gold prices.

We see the same pattern with shares. Of course, other factors play a role in the prices of financial assets, but based on these graphs it is difficult to refute that global liquidity is extremely important for the financial markets.

We are currently waiting for the first interest rate cuts from central banks (Federal Reserve and ECB), which means that liquidity conditions are likely to improve in 2024 and 2025.

That reinforces the idea that Bitcoin’s bull run is not over yet and that Ki Young Ju may be right that the “real bull market” has yet to begin.

Would you like to receive a free financial newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,000 people went before you!

Each Monday in Saturday you will receive everything you need to know about the financial markets directly in your mailbox.

1 day left: Grab your 20 Euro bonus at Bitvavo now

Are you about to discover the crypto world and are you considering buying Bitcoin or another crypto? Then grab your chance now with this exclusive offer! Thanks to a special deal between Newsbit and the Dutch crypto exchange Bitvavo, our readers receive an exclusive offer

Only 1 Day Available: register with Bitvavo via the button below and receive a welcome gift of 20 euros completely free. And that’s not all – you also don’t pay trading fees on your first 10,000 euros in transactions. Register now!

Source: https://newsbit.nl/is-de-bullrun-van-bitcoin-voorbij-of-komt-er-nog-meer/