This week is all about the American inflation figures, which will partly determine whether the US central bank will lower interest rates in 2024. Today we get the Producer Price Index (PPI) and on Wednesday the Consumer Price Index (CPI) will follow.

These are two data points that can significantly influence the interest rate policy of the US central bank and therefore the Bitcoin price.

Small chance of interest rate cuts

According to traders on the futures market, there is currently only a 28% chance that we will see the first interest rate cuts from the US central bank (Federal Reserve) in July.

They are even less optimistic for the interest rate meeting in June and see only an 8.9% chance of interest rate cuts.

In that regard, we still have to be patient. Tedtalksmacro expects volatility for this week at least. “Expect volatility. Although this is the first time in a long time where we are likely to see inflation data slowing down,” the analyst said.

The analyst explains that slowing inflation is good for risk assets like Bitcoin, putting the market on the verge of a rally. At least, that’s what Tedtalksmacro thinks.

The pseudonymous analyst Seth expects a lot from this week. He noted on May 12 that Bitcoin has broken its downward trend for the RSI on the daily chart. This means that the momentum is starting to become neutral again.

“Jerome Powell is going to pump our investments. The US economy is not as strong as the data suggests,” Seth said.

Bitcoin revives as Coinbase premium turns negative?

After reaching its all-time high, Bitcoin has started a series of lower highs and lows. In addition, Bitcoin’s RSI also fell further and further until it reached its provisional bottom around May 1. On the technical front, it looks like we’ve seen the bottom.

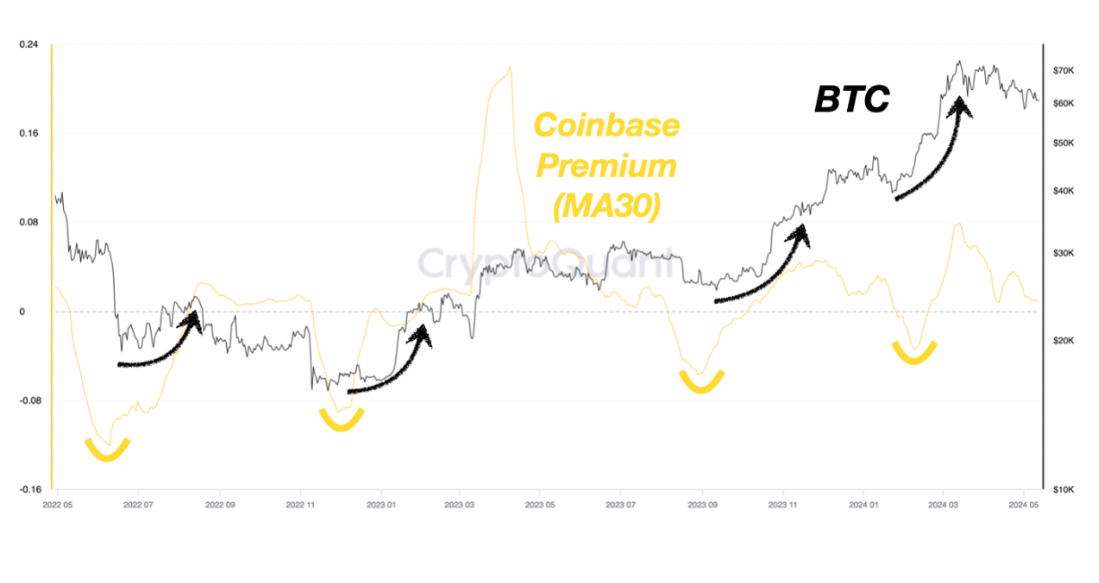

According to data from CryptoQuant, the Coinbase Premium Index has trailed Bitcoin’s price action. This fell from $0.08 to zero over the same period.

The Coinbase Premium Index is an indicator that shows the price difference between Bitcoin on Coinbase and Binance.

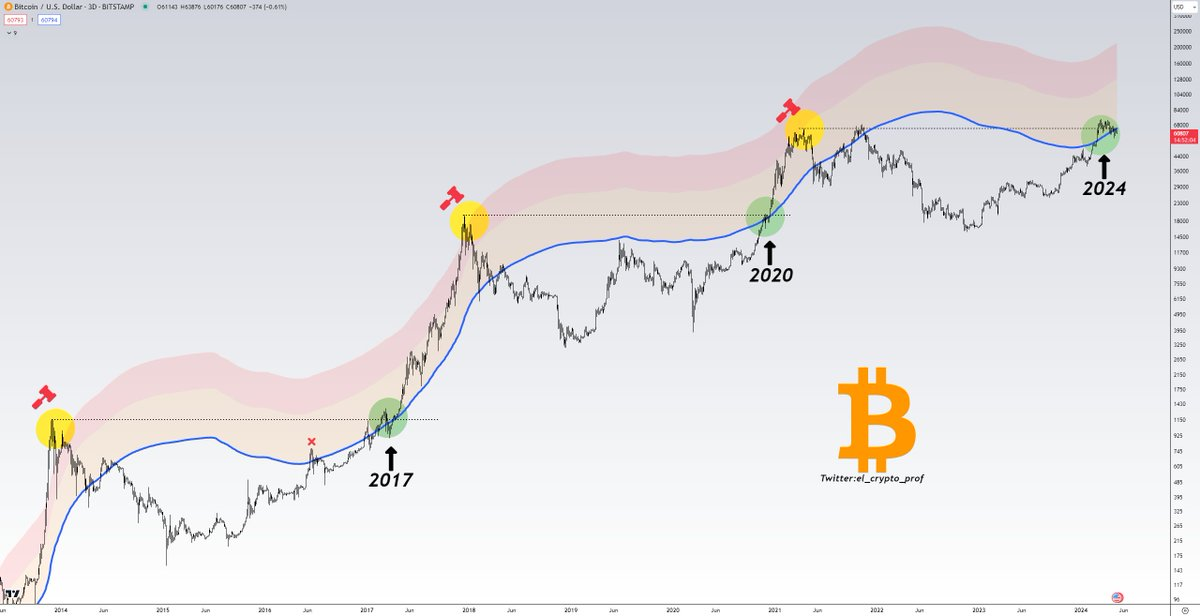

The pseudonymous analyst Mustache is also optimistic. However, he thinks that the “weak hands” must first be removed from the market before Bitcoin can rise to $80,000.

“It has always been that way in the past. The structure is the same, just the price is different,” Mustache said.

Trade €10,000 for free and get a 10 euro bonus

Do you want to enter the crypto world and perhaps buy Bitcoin or another crypto? Then grab your chance now with this exclusive offer! Thanks to a special deal between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers receive an exclusive offer.

Create an account with Bitvavo via the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you also don’t pay trading fees on your first 10,000 euros in transactions. Register now!

Source: https://newsbit.nl/inflatiedata-vandaag-en-morgen-cruciaal-voor-bitcoin-koers/