During the SEC Speaks conference, Hester Peirce criticized the policies of the U.S. Securities and Exchange Commission. She believes that there is too much uncertainty surrounding the SEC’s policies and that the organization should strive for more transparency. The SEC’s mission is to protect investors, while at the same time it is creating confusion and causing problems for investors.

What is striking is that Hester Peirce also works at the SEC. So she is critical of her own boss, which is of course not necessarily a bad thing.

Crypto Mom lashes out at SEC again

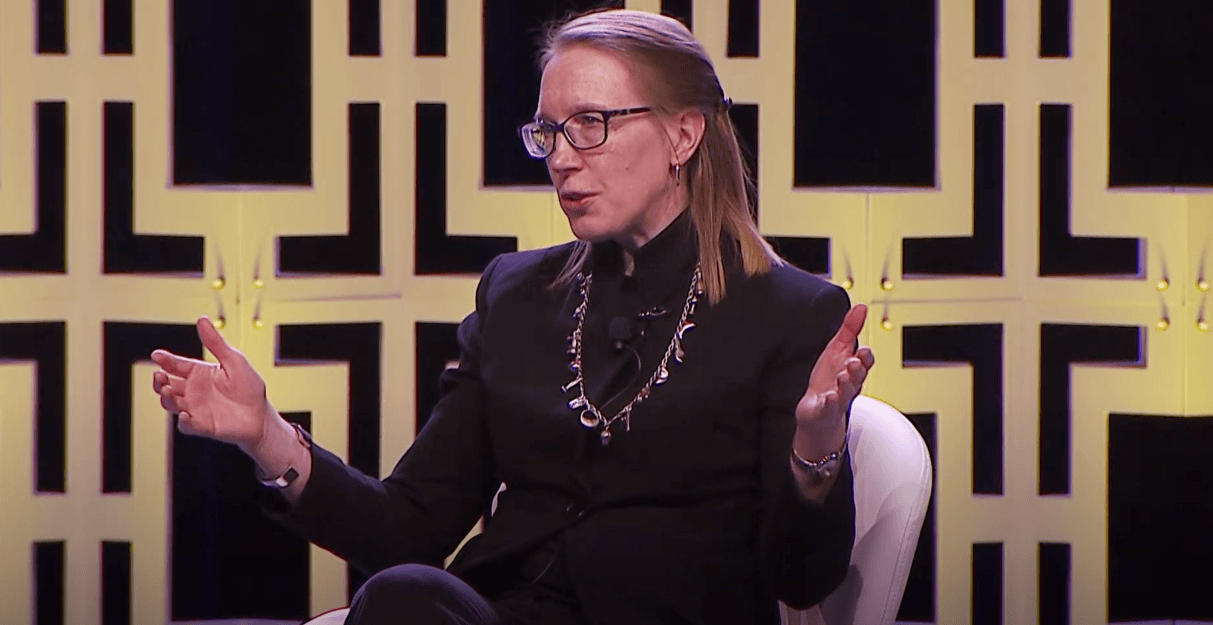

Hester Peirce, commissioner of the American Securities and Exchange Commission (SEC), is once again lashing out at her own organization. She criticizes the previously discussed unclear rules for crypto custody and demands more interaction with the sector.

At the annual SEC Speaks conference on April 2, Peirce, nicknamed “Crypto Mom” by crypto enthusiasts, compared the SEC’s policies to a “secret garden” where “weeds” thrive.

She was referring to the controversial Staff Accounting Bulletin 121 (SAB 121). In March 2022, the SEC issued this guidance, which describes the accounting rules for institutions that want to hold crypto assets. However, SAB 121 makes it impossible for many banks to hold crypto assets for their customers.

Peirce emphasized that SAB 121 – which was established without the involvement of the banking sector – does not protect investors. Instead, the rules keep experienced banks and brokers out of the crypto custody market due to high capital requirements.

“This forces brokers to either invest a lot of money in their crypto custody business, or to stop altogether. SAB 121 therefore does not protect investors, as claimed.” Furthermore, if the custodian goes bankrupt, customers’ crypto assets could be lost, Peirce warned.

More dialogue and clarity

On March 1, the House Financial Services Committee (HSFC) agreed to a proposal to repeal SAB 121. Republican Congressman Tom Emmer called the directive “illegal” and an example of SEC Chairman Gary Gensler’s “bias” against the crypto sector.

Peirce further stated that the SEC is increasingly closing itself off from the outside world, especially when it comes to new technologies such as crypto. “The culture at the top of the SEC has hardened, and that has led to a different way of interacting with the public,” Peirce said.

Investors and companies no longer dare to approach the SEC due to fear of enforcement measures, especially in the field of crypto, where the regulator wants to take stricter action.

“People tell me that they would like to talk to the SEC, but are afraid that they will then be called by the enforcement agency.” Peirce demands that the SEC reopen dialogue with the public, establish clear rules and encourage rather than hinder responsible innovation in the crypto sector.

On April 3, Coinbase chief legal officer Paul Grewal issued a statement message on X his unconditional support for Peirce’s criticism. He advocates the establishment of an advisory committee to investigate how the rules “work out” in practice.

Trade €10,000 for free and get a 10 euro bonus

Do you want to enter the crypto world and perhaps buy Bitcoin or another crypto? Then grab your chance now with this exclusive offer! Thanks to a special deal between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers receive an exclusive offer.

Create an account with Bitvavo via the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you also don’t pay trading fees on your first 10,000 euros in transactions. Register now!

Source: https://newsbit.nl/gesloten-beleid-sec-houdt-crypto-innovatie-tegen-zegt-hester-peirce/