Bitcoin surged after US core inflation (Core CPI) showed an initial signal of slowdown this week.

Why? Because this gives investors hope for quick(er) interest rate cuts from the Federal Reserve – the American central bank. Now we have to wait for inflation to drop to the desired 2% or a significant weakening of the economy/labor market to force the Federal Reserve to cut interest rates.

Receive a free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,300 people went before you!

Each Monday in Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

Looking for weakness

A weaker labor market or economy naturally also causes the (upward) pressure on inflation to disappear. For that reason, weak economic data can also be received positively by the market.

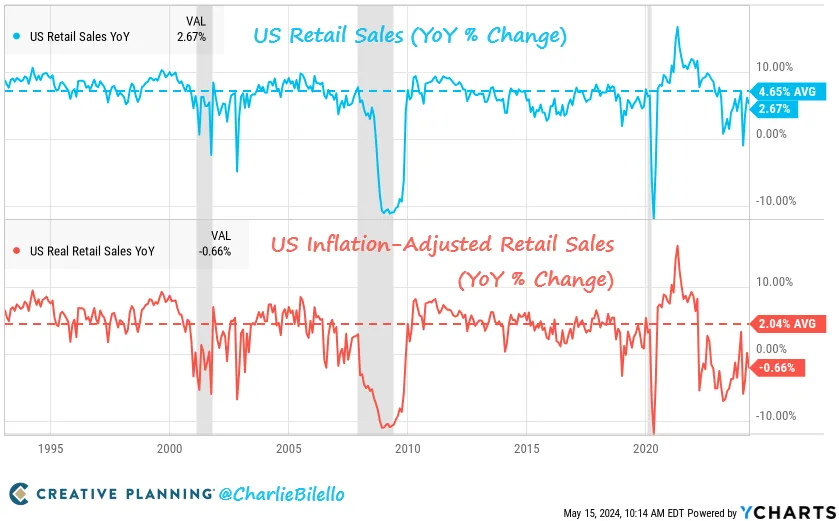

This week, for example, the Bitcoin price also shot up after it was announced that Retail Sales on a real basis, i.e. adjusted for inflation, had fallen by 0.7%.

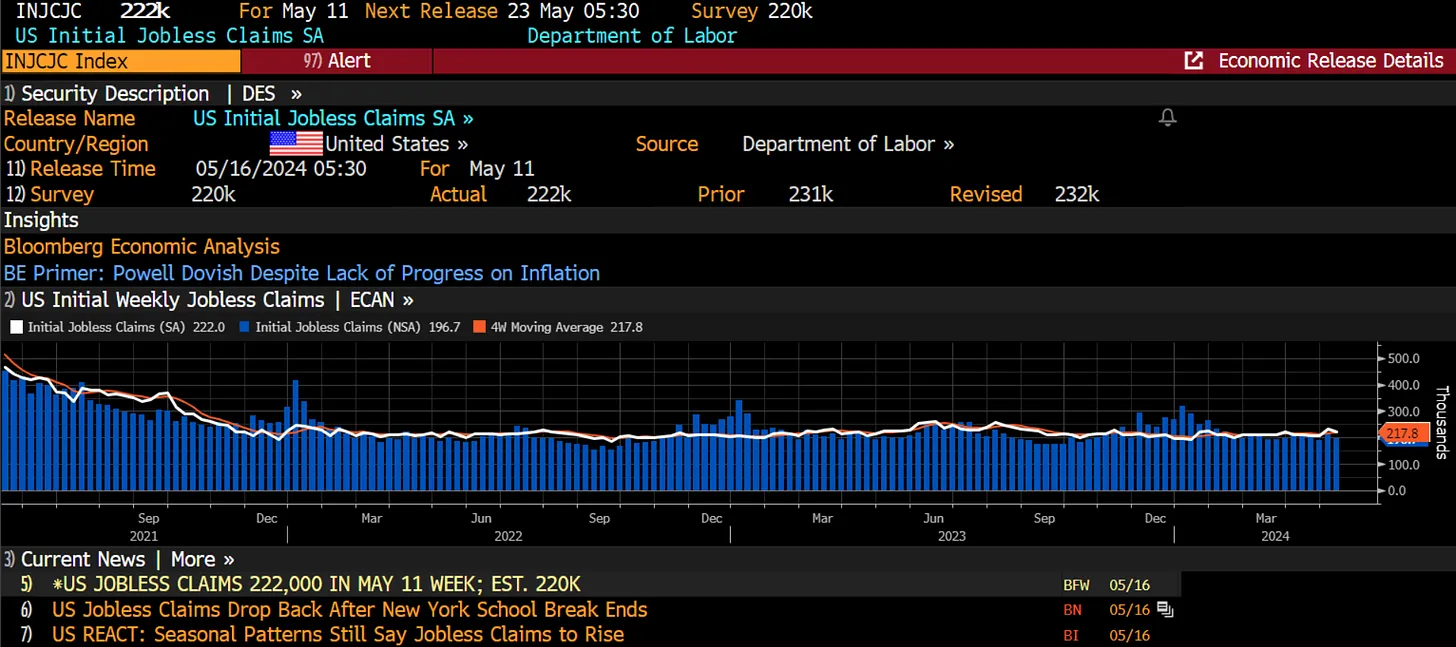

In terms of the labor market, last Thursday’s weekly unemployment claims gave little away. These arrived at 222,000 pieces, while a score of 220,000 was expected. This indicator only becomes interesting when we dive above 250,000 pieces.

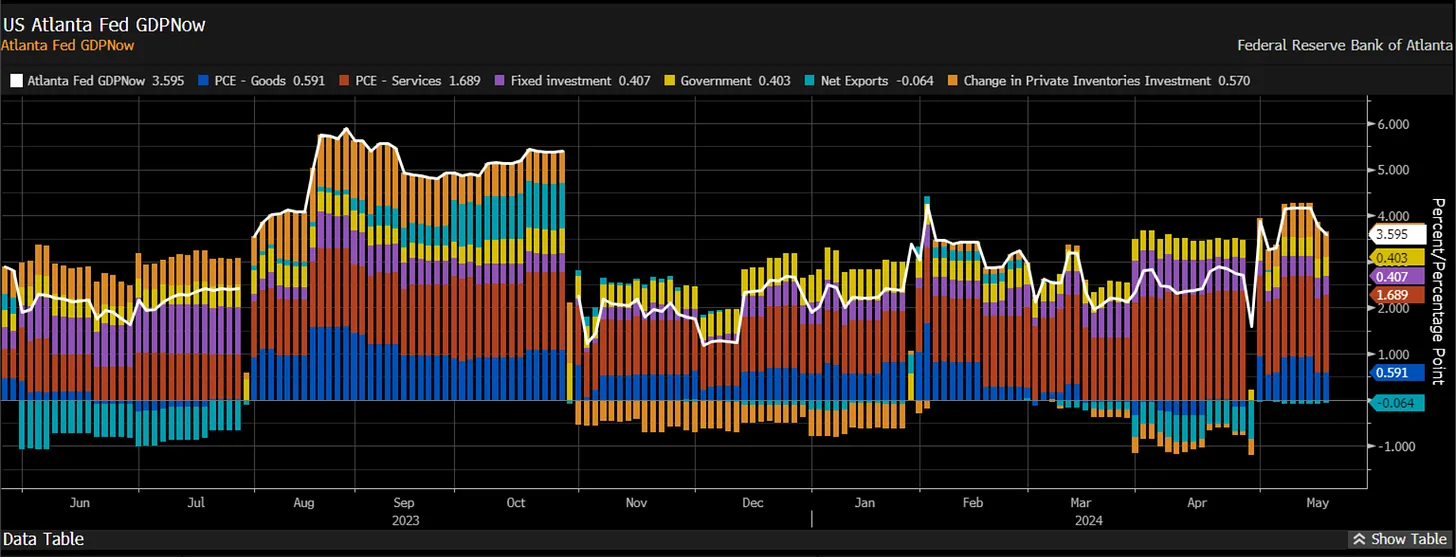

In addition, the Atlanta Fed’s GDP forecast shows that the American economy is still in very strong shape on paper.

In that respect, concerns about the economy seem a bit exaggerated at the moment. It is important to keep an eye on the situation surrounding the American consumer. We are receiving some cautious warning signals about this from various quarters.

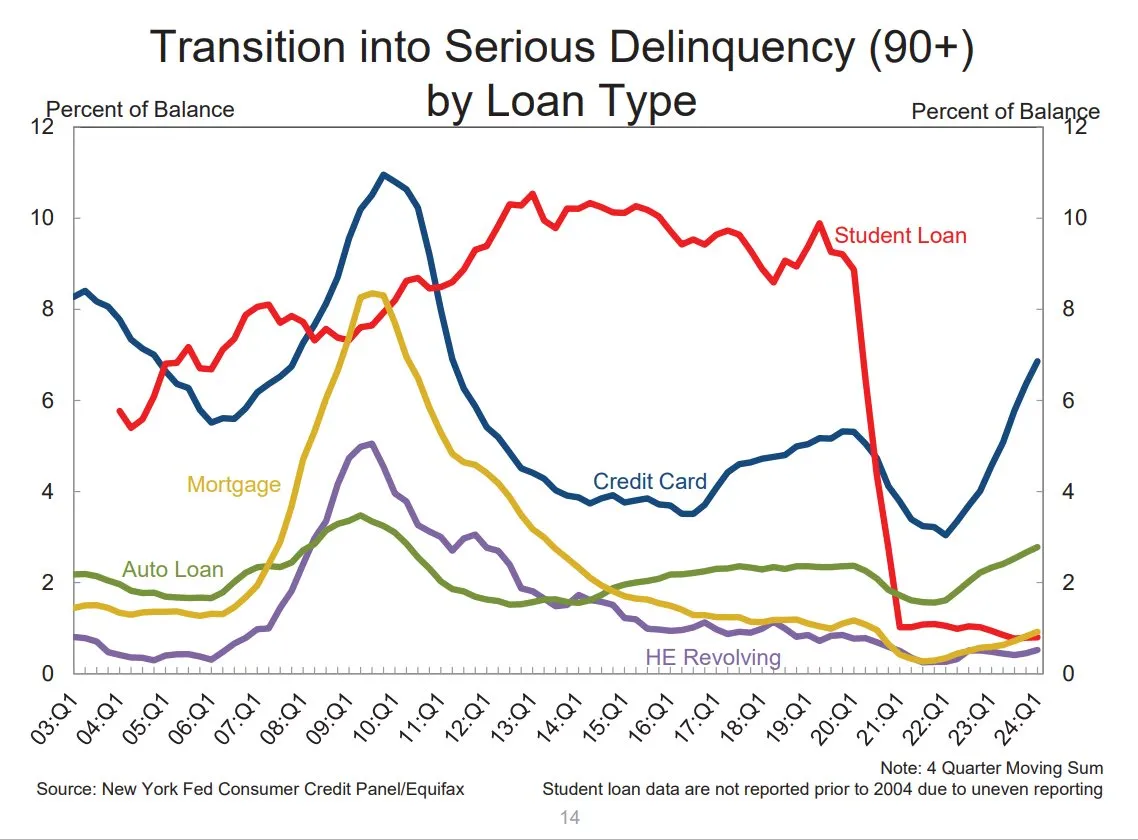

For example, in the form of the rising rate of default on credit card debt, which is starting to rise towards 2008 levels.

Still bullish on Bitcoin

All in all, however, I remain bullish on Bitcoin and expect us to continue the bull market heading into H2 of 2024. This shortstop has been especially good for washing out excesses (hurting leverage/leverage traders).

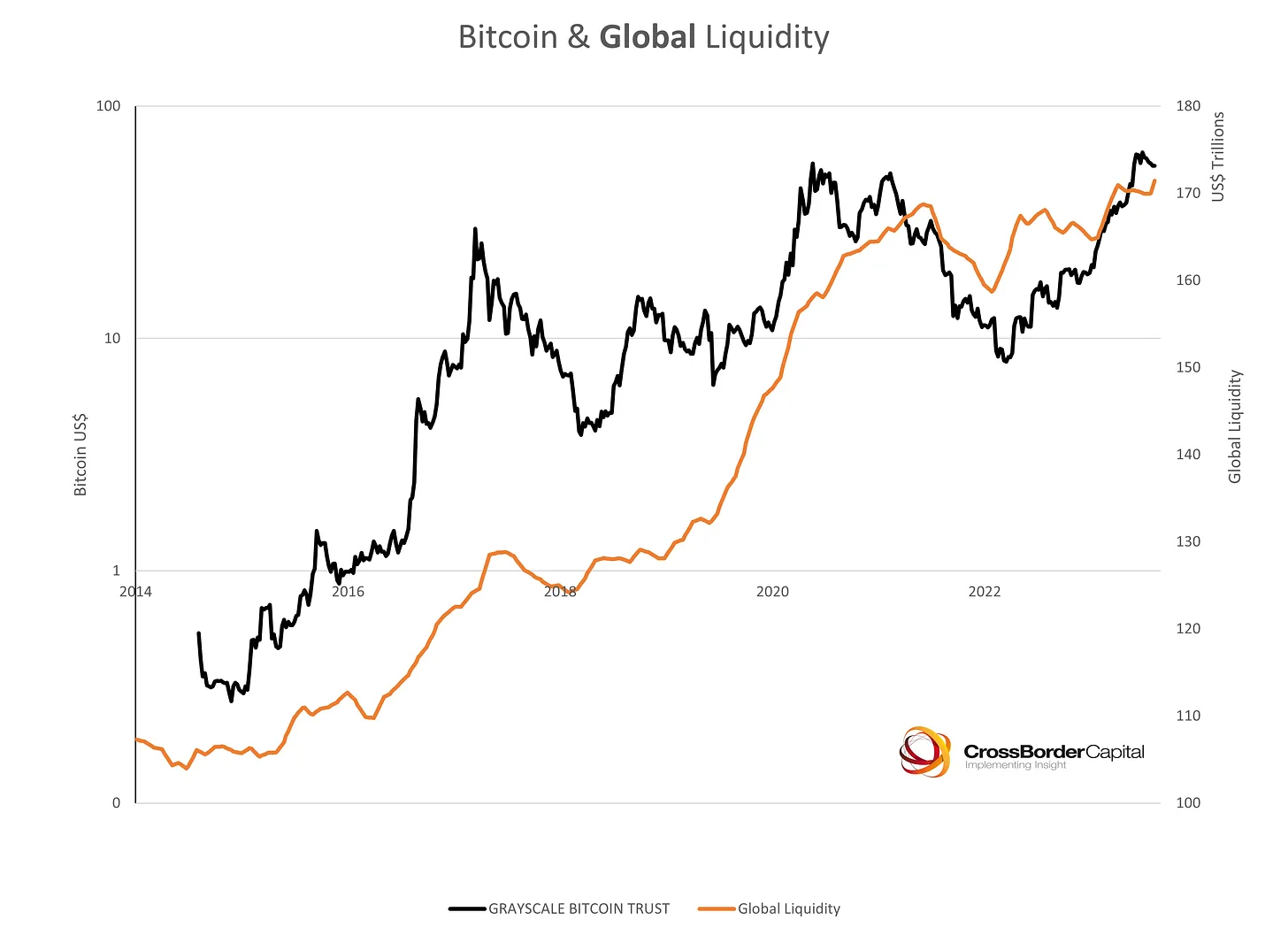

Over the coming months, I expect global liquidity (orange line in the chart above) to continue its upward trajectory.

Global liquidity indicates how much capital is available in the financial system for investment. If it increases, you often see the Bitcoin price also rise.

Before April I was already counting on a slowdown in liquidity, partly due to the climax of the tax season in America.

Now the stage appears to be slowly clearing for a resumption of the upward trend for global liquidity. The European Central Bank (ECB) will probably start its cycle of interest rate cuts in June and the Federal Reserve will also not be long in coming (probably September).

Receive a free Financial Newsletter?

Do you want to easily stay informed about these types of developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,300 people went before you!

Each Monday in Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

Trade €10,000 for free and get a 10 euro bonus

Do you want to enter the crypto world and perhaps buy Bitcoin or another crypto? Then grab your chance now with this exclusive offer! Thanks to a special deal between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers receive an exclusive offer.

Create an account with Bitvavo via the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you also don’t pay trading fees on your first 10,000 euros in transactions. Register now!

Source: https://newsbit.nl/bitcoin-is-klaar-voor-het-vervolgen-van-zijn-bullmarkt-in-h2-2024/