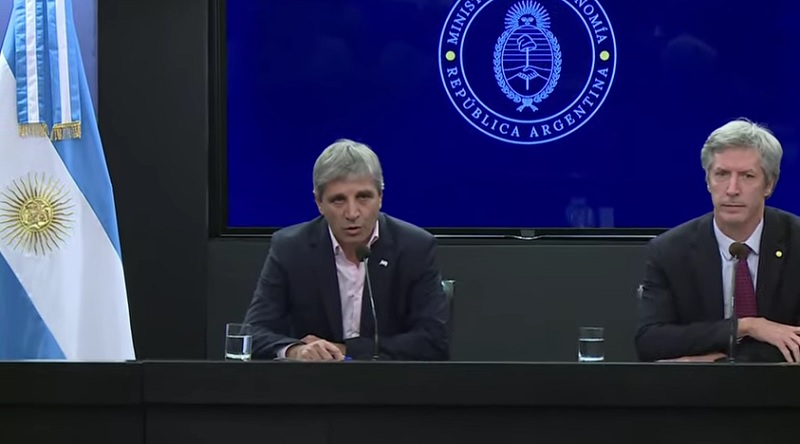

At the press conference, the Minister of Economy, Luis Caputo, together with the president of the Central Bank, Santiago Bausili, stated that there is still no date for the end of the restrictions and announced the entry into a “second stage of the stabilization plan.” Thus, there will be a emission reductionthe Treasury absorbs the debt of the Central Bank. The passes that the banks have will now be Treasury debt, and not from the BCRA. This will cause a greater stoppage of the economy and more unemployment.

Caputo’s announcement comes after tensions with the IMF, who demanded a devaluation, an increase in public service rates, and structural reforms. A devaluation means a income transfer from those who live off their wages to the most concentrated capital. The export sectors and financial capital win. The organization wants to guarantee the payments of the debt in dollars through the accumulation of reserves in the Central Bank.

The Minister of Economy insisted again that there will be no devaluation, that the 80/20 rate will continue (he is referring to the so-called “blend” dollar, a benefit for the agro-export sector that settles 80% of exports at the official exchange rate and the remaining 20% in the “cash with settlement”), and that the crawling peg of 2% will also be maintained, that is, the mini-devaluations carried out by the Government, which establishes a rise in the official dollar rate of 2% per month. The minister’s decisions contradict what the IMF questioned. Will the Fund push harder for its demands? We will have to wait and see.

Second stage?

Caputo maintained that now “it is the second stage of this stabilization plan that essentially consists of going to issue, I am not going to say zero because the president of the Central Bank is going to explain it well, but to close the issuance tap.”

The head of the Treasury explained that “we have three channels of monetary emission” and said that “one is the fiscal deficit, the second is the interest that the Central Bank pays for those famous remunerated liabilities and the third is when the BCRA buys dollars, which is the only effect of emission.”

Caputo announces a debt swap from the Central Bank to the Treasury (I open the thread)

Potentially, it is a way of more directly transferring the currency crisis into a banking crisis.

Ratifies the recessive path. Path to depression? Very likely

(go on)

— Pablo Anino (@PabloAnino) June 28, 2024

Regarding the exchange controls, the minister indicated that “for us, the end of the exchange controls is a third stage that will be a stage of growth and of the end of the exchange controls. We have not set a date but parameters that imply macroeconomic order so that when we do this we can be as sure as possible that it will not cause any surprise to the people. (…). This will allow us to deepen the process of disinflation and in this way give us the time we consider necessary to end the exchange restrictions when the macroeconomic conditions are met.”

Bausilli explained that “we are going to replace the remunerated liabilities of the Central Bank with liabilities of the Treasury that remunerate the Treasury. The BCRA will continue to manage monetary policy and operate in a very similar way to the one it operates today, but it no longer suffers the consequence of interest rate movements resulting in greater monetary issuance.

To carry out this transfer of liabilities, Bausili indicated, “there will be a sterilization mechanism, similar to what exists today with the BCRA repos, but they will be focused on a Monetary Regulation Letter, which is where the banks will place their excess liquidity. The BCRA will administer it, but it will be constituted in the Treasury’s balance sheet.”

Following the approval of the Ley Bases and the fiscal package, economic specialists warn that Caputo’s announcement was not enough, without a clear plan. The rise in parallel dollars expressed the tensions in the “markets” and reveals that the economic establishment considers that Luis Caputo’s “plan” is finding its limits. Will the exchange rate tensions continue?

Officials said they would meet with banks on Monday to negotiate the details. What will the banks ask for in return? New benefits?

On the way to a depression

The program of the government of La Libertad advances plunges the economy into depressionthat is, a prolonged, deep fall with a destructive impact that is very difficult to reverse on employment, wages and the productive network.

Last Monday, Indec reported that the Gross Domestic Product (GDP) from Argentina plummeted 5.1% in the first quarter of 2024, compared to the same period in 2023, the unemployment went up to 7,7% in the first three months of the year and inequality increased. The shutdown of the economy causes a drop in imports and this allows the BCRA to accumulate reserves, dollars that are not going to improve the quality of life of the popular majorities but rather to pay the fraudulent debt as the IMF wants. This seems to be the Government’s only plan.

The living conditions of the working class worsened under this Government, there is more poverty and unemployment. The measure announced by Caputo will imply that the debt that the Central Bank had will pass into the hands of the Treasury and, therefore, more resources will be allocated to pay that interest to the detriment of improving health, education, retirement, and social programs, which already They were adjusted. We must reject the ongoing adjustment of Milei, Caputo and the IMF and mobilize for the sovereign debt disavowal.

Source: www.laizquierdadiario.com