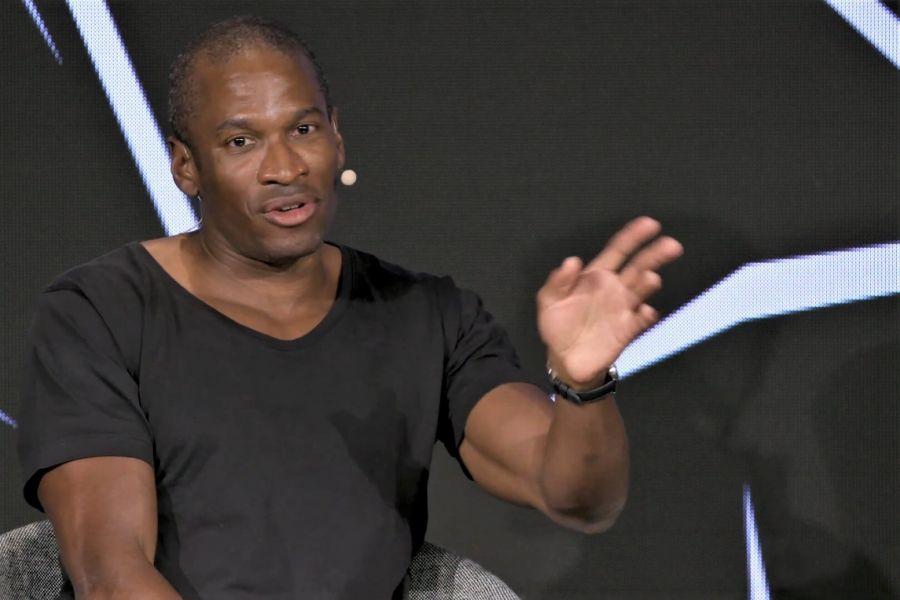

Arthur Hayes, co-founder of crypto exchange BitMEX, warns that the United States is on the verge of radical economic policies. In a recent blog post he outlines a scenario in which political interests and financial markets are increasingly intertwined, possibly resulting in large-scale currency depreciation.

Political interest leads to money creation

In his post, Hayes argues that American elections ultimately revolve around one thing: the economy. “When voters feel better economically, politicians win votes. And the most important signal for the American voter? The price at the pump,” he says.

That is why Hayes expects that Donald Trump will want to keep the economy running “hot” in the coming years. That means more credit, more debt and, above all, more dollars in circulation. It is crucial that energy prices, especially oil, remain low.

According to Hayes, everything revolves around the price of oil. If oil remains cheap while the economy grows, that is good news for Trump and his party. But as oil becomes more expensive, inflation rises and voters turn against him.

Oil plays a major role in inflation because it is an essential and indispensable part of the global economy, as financial expert Keith also explains. If oil becomes more expensive, people will notice this immediately, not only at the pump, but also in the price of products and services.

If oil prices remain stable, Hayes predicts that Trump, Congress, the Treasury Department and the central bank will jointly open the money tap completely. “That is structurally and politically inevitable.”

Venezuelan oil at the center of American politics

For this reason, Hayes and financial expert Keith see the American focus on Venezuelan oil as a smart move to keep fuel prices low. Trump had President Maduro arrested in a swift military operation on January 3.

It is not entirely coincidental that Venezuela has the largest proven oil reserves in the world. According to Hayes, America may be able to use this to keep domestic inflation under control.

Venezuela is also rumored to possibly hold up to around 600,000 Bitcoin (BTC), a so-called ‘shadow reserve’, worth around $55.2 billion at the current Bitcoin price.

This estimate is based on reports suggesting that Venezuela has been accumulating Bitcoin through gold and oil-related transactions since 2018. There is speculation that the United States may want to claim these coins if it turns out that this hidden stash actually exists.

Bitcoin benefits from money creation

Hayes calls Bitcoin the “purest monetary hedge” in this scenario. Unlike oil or stocks, BTC is not directly dependent on energy prices. In fact, according to him, more dollar liquidity almost automatically leads to higher Bitcoin and crypto prices.

His investment advice is clear: as long as oil prices remain under control, it is ‘risk-on’. That means investing in Bitcoin, altcoins and in particular privacy coins. He only advises reducing risky positions if oil, interest rates and volatility rise at the same time.

Source: https://newsbit.nl/waarom-bitcoin-volgens-hayes-profiteert-van-trumps-economische-plannen/