The fight for dominance in chip technology between the US and China is reshaping global geopolitics. Chris Miller examines the challenges and impacts of this race.

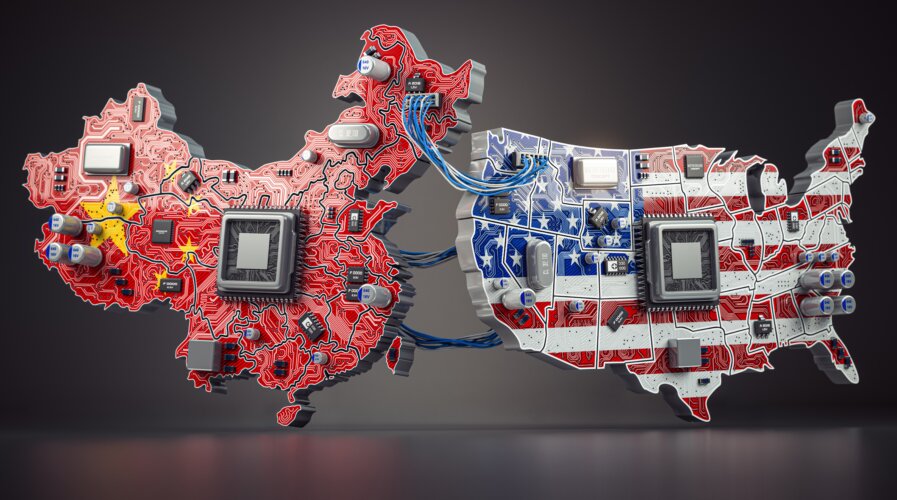

The growing tension between the United States and China for technological supremacy has put the chip industry at the center of a strategic war. Chips not only power devices like smartphones and cars, but also control essential technologies, from children’s toys to nuclear reactors. In an interview with the podcast “The Economics Show” with Soumaya Keynes, for the Financial Times website, expert Chris Miller, author of the book Chip War: The Fight for the World’s Most Critical Technologyoffers a detailed look at this dispute and its global impacts.

The US position in the chip wars

Miller explains that five years ago, the US was in a relatively comfortable position in the chip wars, with a score of 8 on a scale of 1 to 10. Today, that ranking has fallen to a 6, due to the rise of China’s competitive edge. He points out that this war is not just between the US and China; it involves a global supply chain that includes countries such as Taiwan, Japan and the Netherlands. Taiwan, in particular, is a key player, producing 90% of the world’s high-end chips.

According to Miller, the US’s decline in position is mainly due to the Chinese government’s policies. Over the past 10 years, China has made great efforts to become self-sufficient in chip production, a move that has involved massive investments and industrial plans.

The threat to the supply chain

Miller highlights two major risks for the US. The first is its dependence on Taiwanese-made chips, which, in the event of a conflict in the region, would leave the US without access to critical components. The second is the direct link between the quality of chips and the ability to train advanced artificial intelligence (AI) systems. Losing access to cutting-edge chips would therefore impact both the economy and military and intelligence applications.

If the U.S. were to lose access to chip production in Taiwan, Miller predicts an immediate disruption to the production of smartphones, computers and telecommunications infrastructure. He notes that, in addition to high-tech chips, a shortage of low-tech chips, used in everyday items like toothbrushes and cars, would cause the biggest disruption to global GDP.

The role of chips in the military and economic domain

Chips are essential for developing autonomous systems and training AI, giving powers that master this technology a significant strategic advantage. Both the US and China recognize the importance of chips in the technology war, and the race to develop cutting-edge AI is directly tied to the production capacity of advanced chips.

China’s policies and US goals

China is now the world’s largest importer of chips, spending as much on chips as it does on oil. China’s dependence on chip imports from countries such as Taiwan, South Korea, Japan and the US makes the country vulnerable. This has prompted China to seek self-sufficiency in chip production.

Miller outlines three main goals for the U.S. in this race:

- Maintain technological leadership with allies such as Taiwan, Japan and the Netherlands.

- Diversify the manufacturing base to reduce dependence on Taiwan.

- Prevent China from becoming dominant in the production of low-tech chips.

These goals require different policy tools, such as the Chips Act, which focuses on encouraging domestic chip production in the US.

China’s advance and its challenges

Miller acknowledges that China has been successful in increasing chip production, but stresses that advancing high-tech chip production remains a challenge. He likens the race to a “never-ending race” where constant innovation is essential to maintain leadership.

China’s success in achieving partial self-sufficiency depends on its ability to produce low-tech chips, something that is easier to achieve than developing cutting-edge chips, which are constantly evolving technologically. China is investing heavily in national and regional funds to boost its semiconductor industry.

Export Controls and the Role of the US

The U.S. has imposed export controls to prevent China from obtaining advanced chipmaking tools. Miller notes that these controls have had some success, especially in the case of cutting-edge lithography tools, which are crucial to producing advanced chips. However, China has explored ways to get around these restrictions by using lower-tech tools to produce higher-capacity chips, albeit less efficiently.

International coordination

The global supply chain for chip manufacturing is highly interconnected, with countries such as the US, Japan and the Netherlands playing key roles in the production of manufacturing equipment. While there are trade rivalries, there is broad international coordination that makes it difficult for China to gain ground in the semiconductor value chain. This is exemplified by the alignment of several countries against China, a phenomenon that Miller said was unforeseen 10 years ago.

The Future of the Chip Wars

Miller concludes that the race for high-tech chips is far from over. He sees Western investment in chip technology as a kind of “insurance” against a potential crisis in the Taiwan Strait, which could cause trillions of dollars in global economic losses. Such investment, while expensive, is seen as necessary to avoid massive disruptions to the supply chain.

He also believes that US policy on chips will remain bipartisan regardless of the outcome of the presidential election, as there is a general consensus on the importance of technological leadership and supply chain diversification.

The interview ends with Miller stating that while China has made great strides, the US and its allies still maintain a significant advantage in the chip wars, but that this advantage can only be maintained through constant innovation and international coordination.

Source: https://www.ocafezinho.com/2024/09/08/quem-esta-vencendo-a-guerra-dos-chips-uma-entrevista-com-chris-miller/