Walmart is in a strong operational position, but that success raises a new question for investors: has the share become too expensive?

The world’s largest retailer continues to gain market share, attract wealthier customers and benefit from its reputation as a stable haven in uncertain times. Yet the current valuation suggests that a lot of optimism is already incorporated into the price, according to Spencer Jakab of the Wall Street Journal.

Free financial newsletter!

Want to stay informed about the most important developments in the financial world? Then subscribe for free The Money Press.

Join over 6,000 others who every Monday receive a full market update in their inbox. And best of all? It’s completely free.

You can register here!

Strong performance and defensive appeal

Walmart’s bottom line remains impressive. Sales growth is clearly above that of competitors such as Target, while both physical stores and online sales channels are performing well.

In a world full of trade tensions, pressure on household budgets and rapid technological change, investors are looking for companies with predictable cash flows and economies of scale, which is exactly what Walmart is known for.

In addition, the group is considered a so-called “dividend aristocrat”, with more than fifty years of annual dividend increases. In an uncertain market, these types of classic, tangible companies have become popular again.

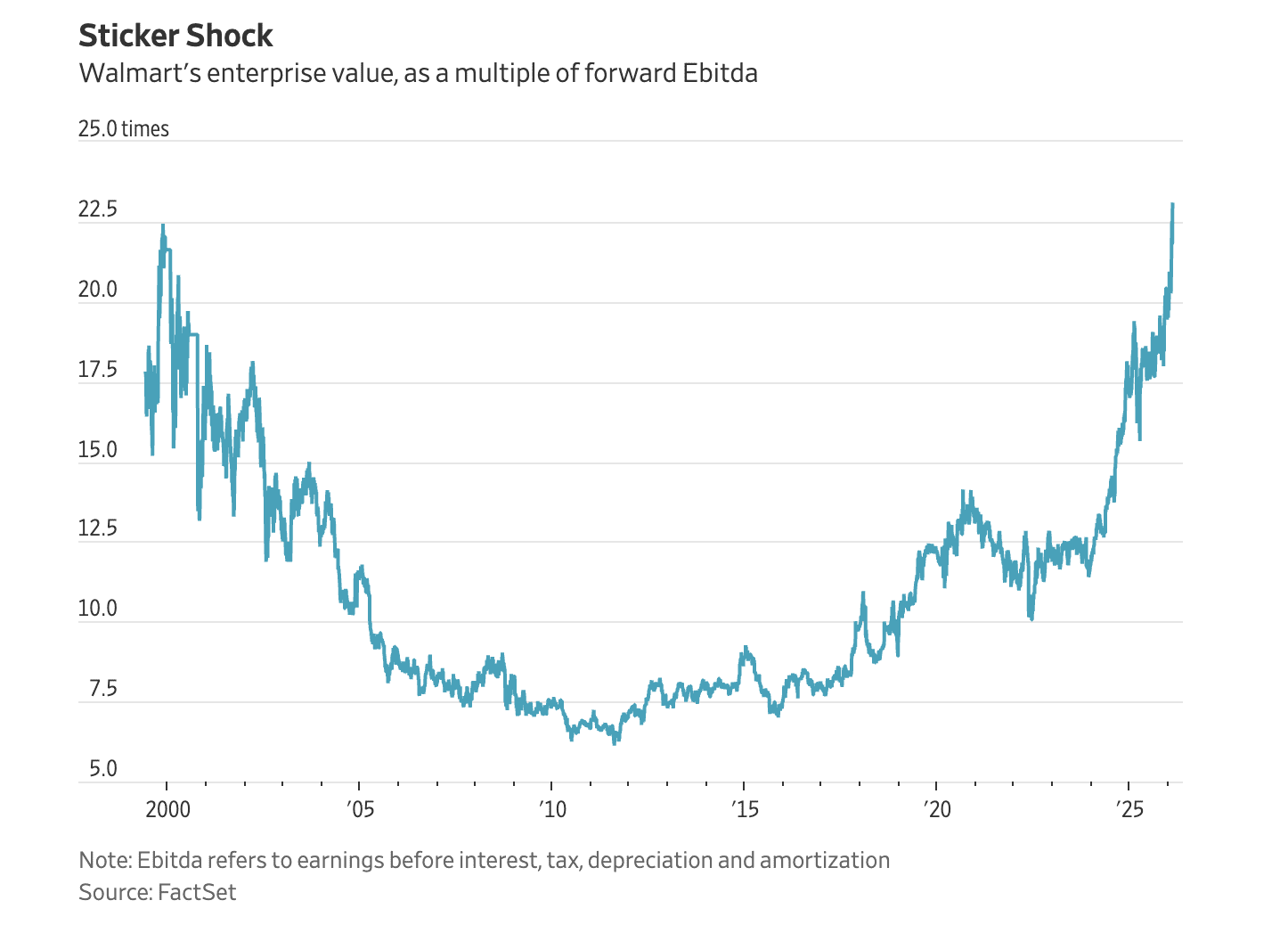

Appreciation at a historically high level

It is precisely this popularity that has significantly increased its appreciation. Based on a commonly used measure for cash flow valuation, Walmart is now trading above a level that has rarely been achieved historically. This has made the share even more expensive than large technology companies such as Microsoft, Amazon and Meta, a striking shift for a traditional retailer.

A similar situation occurred in the late 1990s, when investors also discovered Walmart as a defensive alternative to the technology sector. At the time, the stock rose explosively in a short time and also reached extreme valuation levels.

Lesson from the past

However, history shows that a strong company does not automatically remain a strong investment if the price is too high. After peaking around 1999, Walmart continued to grow operationally, with sales and profits increasing sharply over the next decade. Yet years later the share price was still lower than at its peak.

This underlines a classic investment principle: valuation matters. Even excellent companies can experience long periods of weak stock returns when expectations run too high.

Free financial newsletter!

Want to stay informed about the most important developments in the financial world? Then subscribe for free The Money Press.

Join over 6,000 others who every Monday receive a full market update in their inbox. And best of all? It’s completely free.

You can register here!

Source: https://newsbit.nl/aandeel-walmart-is-nu-duurder-dan-microsoft-amazon-meta-en-andere-techreuzen/