Washington plans rules limiting semiconductor shipments to some countries accused of supplying Beijing

The US is preparing rules that would restrict the sale of advanced artificial intelligence chips in certain parts of the world in an attempt to limit China’s ability to access them, according to people familiar with the matter.

The rules are aimed at China, but they threaten to create conflict between the US and nations that may not want their chip purchases micromanaged from Washington.

In a series of measures dating back to October 2022 and updated this month, the Biden administration has sought to block Chinese access to the most advanced chips, as well as chipmaking equipment and other technologies. He says the goal is to prevent China from using AI to develop its military and surveillance capabilities.

The latest round of restrictions could come this month, weeks before President-elect Donald Trump’s inauguration. Among the restrictions, the government plans to introduce limits on shipments of AI chips to certain countries for use in large computing facilities, people familiar with the plans said.

One group of countries — close U.S. allies — would have no restrictions, the people said, while another group of countries would face limits on the number of chips that can go into data centers used for AI. Chinese companies are prohibited from purchasing advanced AI chips without a license from the Commerce Department.

The purchasing limits mainly apply to regions such as Southeast Asia and the Middle East, the people said. The rules cover high-end processors known as GPUs, or graphics processing units, which are used to train and run large-scale AI models.

The regulations aim to block China’s access to computing power located in other countries, some people said. The rule, titled Export Control Framework for Diffusion of AI, was submitted to the Center for Regulatory Information Services on Monday, according to the center’s website. The website does not detail the rule.

US authorities are also considering other options. The administration is considering imposing controls on exports of the so-called pesos that underlie advanced AI models, according to people familiar with the matter, and weighing other China-specific restrictions on chip production.

The government recently sent letters to major chipmakers, including Taiwan Semiconductor Manufacturing and Samsung Electronics, informing them of some of the restrictions, these people said. The letters said companies needed to apply for a license to transfer chips made with advanced chipmaking technology or that meet other criteria to China.

Those criteria include a limit on the size and number of transistors, as well as any indication that the chips are for use in training AI models, the people said. Previous regulations already limit the shipment of advanced GPUs and memory chips to China, but the new rules more clearly explain to manufacturers what is prohibited.

The Commerce Department typically sends these letters to companies before new rules are drafted, but the restrictions may change or may not be enforced at all.

TSMC declined to comment on specifics and said it complies with rules and regulations. Samsung declined to comment.

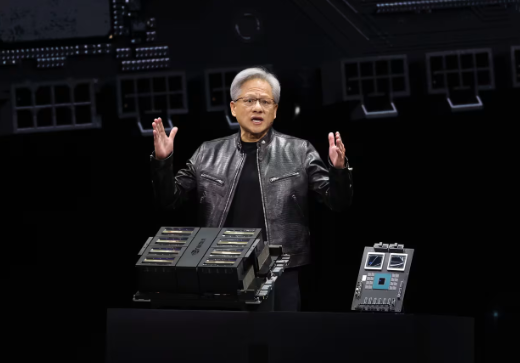

Nvidia has developed AI chips for the Chinese market that meet previous U.S. restrictions, and China still accounts for about an eighth of its revenue.

Any limit on shipments to projects in countries outside of China could have an impact on Nvidia, depending on how the final rule is written.

“While we do not comment on unpublished rules, we stand ready to provide the government with any necessary information,” Nvidia said. Advanced computing drives innovation and strengthens economies around the world, he said.

Some companies have expressed concerns about potential new rules that will be hastily implemented as the current administration comes to an end.

The South China Morning Post previously reported the country limits, and Reuters reported the restrictions on TSMC’s advanced chips.

China denounced the US restrictions and retaliated by limiting the export of some minerals used in chip production. This month, the country said it was opening an antitrust investigation into Nvidia.

Washington first imposed widespread restrictions on the sale of high-end processors and chip equipment to China in October 2022, seeking to prevent China from using AI to develop its military and surveillance capabilities.

AI is increasingly viewed through a national security lens by policymakers, in part because it can enhance weapons capabilities.

Despite limits on exports, China has managed to make progress with advanced technologies, frustrating Congress. The recent discovery of TSMC-produced core circuits in Huawei’s AI chips has also highlighted the difficulty of trying to isolate China from commercial technologies.

Southeast Asian nations are often seen by industry chiefs as a backdoor for China to buy advanced AI chips that it cannot obtain directly from the US. An informal market for these chips has emerged in countries like Singapore, with smugglers stealing Nvidia’s flagship chips. cutting-edge AI chips to China through channels such as common freight or individuals moving them through customs.

Additionally, Chinese entities created subsidiaries in Southeast Asia to bypass US restrictions and acquire processors.

The Middle East has emerged on Washington’s radar over the past year, with states such as the United Arab Emirates and Saudi Arabia investing billions of dollars to develop their own AI ecosystems.

In January, the Chinese Communist Party’s House Select Committee sent a letter to Commerce Secretary Gina Raimondo raising concerns about G42, an Emirati company backed by that country’s national security adviser. Citing relationships with blacklisted Chinese entities, the committee said the G42 could divert technology to China.

The G42 said at the time that it categorically denied allegations regarding links to the Chinese government and its military-industrial complex. The company said it is an international company with worldwide partnerships, including with Chinese companies.

In July, US lawmakers called for an investigation into Microsoft’s $1.5 billion investment in G42, citing similar concerns.

The new chip regulations will test relations between the US, the Middle East and Southeast Asia, regions with Muslim-majority nations already unhappy with American support for Israel’s war in Gaza.

Setting a maximum purchase limit and establishing new U.S. government oversight could hamper the ambitions of countries like Malaysia, which enjoys friendly ties with the U.S. and China, to transform into hubs for AI and other types of computing. .

With information from WSJ*

Source: https://www.ocafezinho.com/2024/12/16/eua-quer-sancionar-mundo-inteiro-pra-conter-a-china/