Since the US central bank implemented its first interest rate cut on September 18, 2024, bond yields have actually risen. How can interest rates on the market rise if the central bank actually lowers them? What exactly is going on here? And what does this mean for the Bitcoin price?

Receive a free Financial Newsletter?

Do you want to stay informed of all developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 3,500 bankers, fund managers, lawyers and investors went before you!

Each Monday in Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

What’s going on?

Bond yields have therefore risen since the US central bank started lowering interest rates.

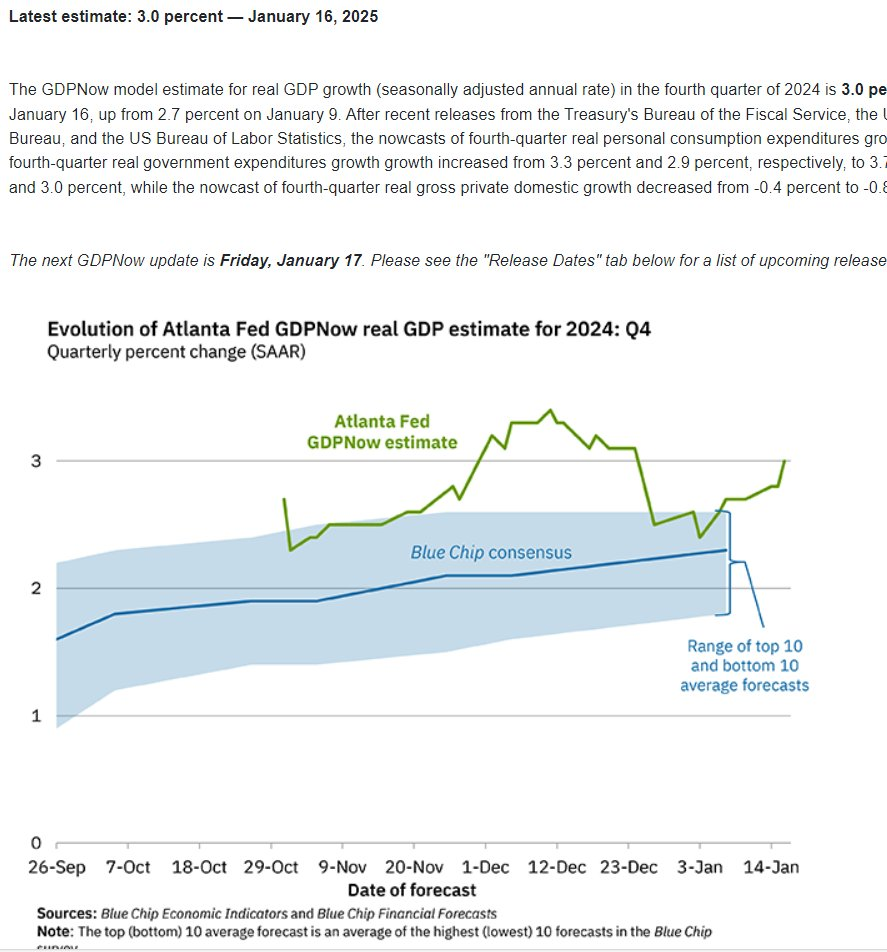

In effect, the market is saying that the American economy has no need for interest rate cuts. Economic growth is still very solid, and inflation is stagnant around 3%.

Why would you then stimulate the economy with interest rate cuts? And in that climate, why would you lend your capital at lower interest rates over a period of 10 years to, for example, the American government?

Well, you don’t do that. If economic growth remains strong, investors will naturally demand higher interest on their capital. Otherwise, they would be better off investing that capital in, for example, the stock market.

So what we actually see in this rise in interest rates is that the American economy is very strong.

In principle, that is a good sign for Bitcoin.

What does this mean for Bitcoin?

The American economy is still solid and appears to be unaffected by the interest rate increases that the central bank has implemented in recent years to combat inflation.

That is important for the Bitcoin bull market, because without a strong economy this would no longer be the case. If the American economy enters a recession, we no longer have to count on new all-time highs.

In that respect, it is a good sign that we are now receiving positive signals again. For example, in the form of the graph below about American industry.

What a chart.. Don't think we are late-cycle. We are EARLY pic.twitter.com/4oeAWI55eV

— Andreas Steno Larsen (@AndreasSteno) January 16, 2025

On this basis, Andreas Steno Larsen concludes that we are only at the beginning of the business cycle.

Receive a free Financial Newsletter?

Do you want to stay informed of all developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 3,500 bankers, fund managers, lawyers and investors went before you!

Each Monday in Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

Claim €10 free today and pay no trading fees on the first €10,000!

Grab this unique opportunity with Newsbit and Bitvavo by creating an account now via the button below. Deposit just €10 and immediately receive €10 free. In addition, you can trade your first €10,000 in trades for 7 days without any fees. Start today and benefit immediately from the growing popularity of crypto!

Create your account and claim your €10 free.

Don’t miss this opportunity to immediately benefit from the growing popularity of Crypto!

Source: https://newsbit.nl/amerikaanse-economie-explodeert-bullish-voor-bitcoin/