Record in record. It has been the tonic of the results of the banks in recent years, after the increase in interest rates initiated by the European Central Bank (ECB) to try to stop the inflationist spiral that caused the war in Ukraine. An increase that improved considerably the remuneration of the liquidity of the Eurozone entities and fattened its benefits.

For a year, that monetary policy has turned down, although this summer the cuts have been paused. But the results of the financial institutions remain significantly resilient, to the point that in the first half of the year the great Spanish banks have won, together, more than 94 million euros every day.

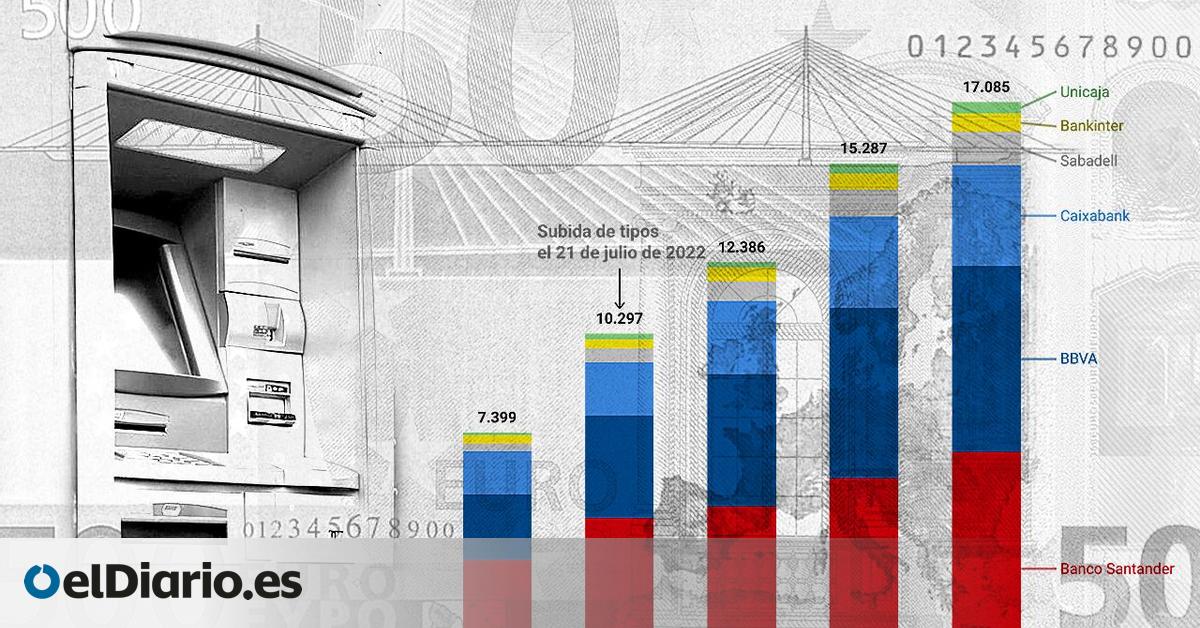

If the data of the six great banking entities that are headded in Spain are seen (Santander, BBVA, Caixabank, Banco Sabadell, Bankinter and Unicaja), they added a joint benefit of 17,085 million between January 1 and June 30 of this year. It is the equivalent of 94.4 million per day.

The following graphic detailed the evolution of the benefit of each of those entities in the first half of each year throughout the last five years.

In that evolution it can be seen that, since the increase in interest rates in the Eurozone began, the results of the six great banks have shot 65%. The ECB began to raise interest rates in July 2022. Between January and June of that year, these six entities earned about 10,300 million, that is, almost 7,000 million euros less than in the same period of this year.

This graph also reflects that, in 2021, that joint benefit stood at 7,400 million, but it must be taken into account that it was a year with several peculiarities. On the one hand, it was the first complete after the outbreak of the pandemic. On the other, it was an exercise in which the Spanish banking landscape changed considerably, because the merger of Bankia and Caixabank materialized.

As for the breakdown of the results of the banks during the first half of 2025, the one that won the most was Santander (6,833 million), ahead of BBVA (5,447 million), Caixabank (2,951 million), Banco Sabadell (975 million), Bankinter (541 million) and Unicaja (338 million).

However, if you see the second quarter in a watertight way, there is a slight contraction of the joint benefit of the six great banks, which slightly exceeds 2% compared to a year ago.

Specifically, they stayed in a joint profitability, from March to June, from 8,598 million. We will have to wait for the next quarters to see if there is a change in tendency as a result of monetary policy, although the ECB stopped last July the reduction of types that began in June 2024. The body headed by Christine Lagarde wants to wait to know the impact on the prices of the commercial war caused by the tariffs of the American Donald Trump.

Tax change

In this evolution of semiannual results over the last years, banks continue to spray their benefit figures while maintaining criticism of the temporal tax. This lien was approved after the entity’s gains records in 2022 and 2023, after the types of types. Months ago it was modified and made progressive, although the criticisms of the sector have not loved.

Specifically, the tax planned for 2025, 2026 and 2027 falls on the margin of interest and commissions obtained by credit entities and branches in Spain of foreign entities. It is now progressive because it has a scale of between 1% and 7%, depending on the liquidable base. Its collection does not remain in the hands of the State, but is distributed among the autonomous communities.

As a reference, in 2023 and 2024, the six major entities paid for the tax, together, more than 2.5 billion. Broken, between those two exercises, that tax has assumed Caixabank a total of 866 million; to Santander, 559 million; to BBVA, 500 million; to Sabadell, 348 million; to Bankinter, 172; already Unicaja, just over 73 million, according to the data that the entities have been publishing.

So far this year, the temporary tax has been a first fractional payment of 566 million, according to the data published by the Tax Agency. This figure represents almost 40% of the scheduled for the year.

In fact, this tax periodification has been a positive point for entities when comparing their results. For example, Santander explains in his semiannual report that the interannual comparison “has been favored by the full position in the first quarter of 2024 of the temporary tax at the income obtained in Spain, against the periodification in 2025 of the income tax obtained in Spain expected for the year”. A year ago, there were 335 million. For this exercise, it does not break it down.

Meanwhile, Bankinter has recognized that this year you will pay “zero” for the tax thanks to a fiscal deduction to which, for the moment, it is the only bank that has signed up. “Now it is a tax with progressive scale and deductions, up to 25% of the liquid fee of the Corporation Tax,” argued his CEO, Gloria Ortiz, in the presentation of results of the first quarter.

The regulation approved in December 2024 determines that the Liquid Tax fee “will be the result of minoring the full fee in 25 percent of the liquid quota of the Corporation Tax or the Income Tax of non -residents of the taxpayer corresponding to the same tax period.”

Tax resources

There is still half a year to know how much temporary tax each bank will pay in this year. Meanwhile, criticism and resources against tax follow. They come, above all, from the hand of the two employers who represent the sector, the Spanish Banking Association (AEB), where Santander, BBVA or Bankinter are; and CECA, which represents the entities that in the past were savings boxes, such as CaixaBank or Unicaja.

Both associations and most of the great banks have resorted to the tax before the National Court. They are based on the fact that “Spanish banking is the only taxation by such a tax in Europe, which is a competitive decrease with respect to the rest of the entities.”

They are also covered by the ECB by arguing that it implies “limiting the ability of entities to grant credit and potentially contribute to less favorable conditions for clients of loans and other services” and that can have “unforeseen consequences for the solvency and competitiveness of the Spanish credit entities”.

Source: www.eldiario.es