The Inflation in Argentina seems to have no brake and hits the income of the vast majority day by day. According to various surveys, it is in first place in the ranking of concerns and is one of the central debates ahead of the upcoming elections. Wanting to take advantage of this Javier Miley has been marking, with its characteristic intensity, that the dollarization would be an unbeatable solution. “If we dollarize, the wages of workers will rise like a diver’s fart” or that in a year inflation would end are some of his most resonant statements. Dollarizing is an infrequent measure and there is no case for an economy as large as Argentina’s; the closest is the example of Ecuador, let’s see how its application was and what consequences it had.

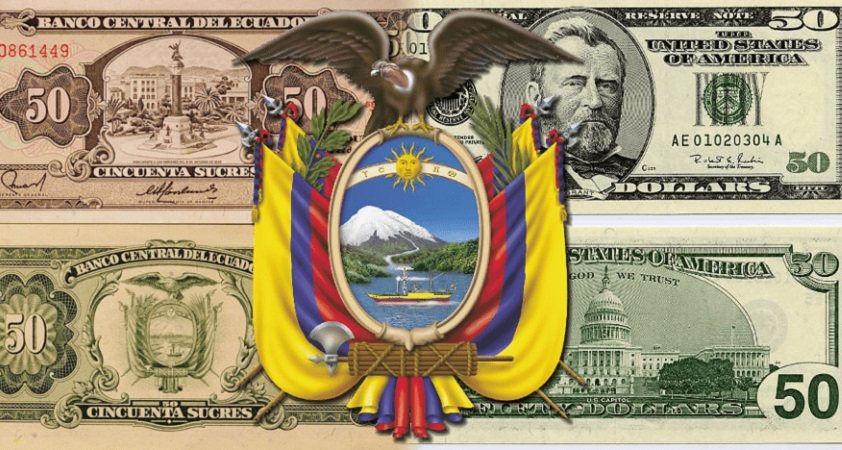

Since the mid-twentieth century, Ecuador’s economy has depended on oil exports, the abrupt drop in the price of this raw material in the late ’90s unleashed a strong crisis in the country. In less than two years (1998-2000), due to the devaluation, they went from needing 4,000 sucres (the national currency) to 25,000 to buy a dollar and in 1999 inflation jumped to 60.8% per year (an extraordinary value for the country). The then President of the Republic of Ecuador, Jamil Mahuadon Sunday, January 9 of the year 2000, issued a decree with which he substituted the sucre for the dollar; 12 days later he was forced to resign in the face of the massive mobilizations against him led by the Confederation of Indigenous Nationalities (CONAIE).

The immediate consequences of dollarization took the acute social situation to the extreme. The basic salary was reduced to US$50, less than half that of December 1998 and thousands of retirees received salaries below US$13, with prices growing at a faster rate since inflation reached 96% per year . In particular, service rates multiplied when they became dollars, the Conelec (National Electricity Council) announced increases of up to 135% in electricity rates. Thus, inequality was enhanced, of the total population, the 20% with the lowest income obtained less than 2.5% of GDP and the richest 20% was left with 61% (according to IMF estimates). With these conditions, in 2020, 71% of the inhabitants became submerged in poverty (according to Unicef data), reaching more than 9 million people.

The savers experienced a situation similar to that faced by their peers in Argentina a short time later with the “corralito”. At the beginning of 1999 their deposits had been frozen until dollarization occurred and, due to the devaluation of the sucre that we had mentioned, when they regained access to their accounts the funds had lost up to 78% of their purchasing power.

How did dollarization come about?

Dollarization in Ecuador was not a planned measure, but rather a backlash response. Since 1998, most banking entities have been in trouble, beginning with Filanbanco, which was rescued by the State; then the bankruptcy of Banco del Progreso or Banco del Pacífico occurred, among others. In fact, During the crisis, 70% of private financial institutions went bankrupt or went to the State. This meant bailouts for almost 1.6 billion dollars and bond issues by the Deposit Guarantee Agency for 1.4 billion dollars. It is estimated that all these transfers to the financial system represented 15.3% of GDP in 1999.

To cover these costs (and the drop in revenues due to the collapse of the oil price), the government chose to go into debt. According to data from the Central Bank of Ecuador, the funds earmarked for debt services went from 8.7% of GDP in 1998 to almost 13% in 1999, while social investment did not reach 1.5% of GDP. The high indebtedness, which came to exceed 100% of GDP, the lack of foreign currency and the insolvency of the banking system put pressure on the exchange rate and caused an accelerated devaluation. Between August ’98 and March ’99, the dollar went from trading at 4,000 to 18,000 sucres. As part of the process, on these dates, there was a flight to the dollar, 47% of the deposits were in dollars and 67% of the credits were also in foreign currency.

To dollarize an economy, it is required, at least, to convert the entire existence of banknotes, deposits and loans from the local currency to dollars; the amount of currencies available to the country to do so determines the conversion price to apply it. Due to the devaluation and partial dollarization, the government of Jamil Mahuad already had an important part of the “work” done. Argentina is far from being in that situation, so the devaluation jump would be even more abrupt.

A dollarized economy in the fragile international situation

With the rise in the price of oil, starting in 2001, the Ecuadorian economy was slowly coming out of the depression, but at the social level, although a partial improvement was registered in some items, the mass of the population could only return to the bad pre-crisis conditions in terms of employment, retirement, income, etc. However, the increased dependence on dollar income left it more exposed to acute international problemssuch as the collapse unleashed after the fall of Lehman Brothers in 2008 or the last crisis that ended with the pandemic in 2020, but affected the country early.

In recent years, unable to obtain internal financing, the State had to resort to external debt to obtain foreign currency, significantly increasing the scope of the debt as a percentage of GDP, which went from representing 18% in 2010 to 56 % by 2022, according to ECLAC statistics. for worse, the government of Lenín Moreno, had chosen to resort to the International Monetary Fund, which once again demanded harsh adjustment measures in exchange for transferring the funds.

The attempt in 2019 to raise the price of fuel, apply a labor reform and a harsh budget cut (including key areas such as health and education), caused a great uprising that put Lenín Moreno in check, who had to back down partially. The current administration of Guillermo Lasso seeks to implement a similar plan and faces resistance from the vast majority.

Since 2003, when inflation has not exceeded 10% per year, this may be the only “achievement” of dollarization. But incomes are so low that relative price stability has not brought benefits to the population. In order to avoid fluctuations in the currency, the Ecuadorian State has sacrificed everything else. Argentina has an economy whose GDP is almost four times that of Ecuador and with a more complex productive framework, especially due to the greater presence of the industry that would be devastated with dollarization. Milei’s plan would bring even more devastating consequences.

Change currency or change the economic structure?

In relation to the dollar, Ecuador and Argentina followed almost reverse paths. Two years after the dollarization imposed by Jamil Mahuad, Eduardo Duhalde ended the convertibility of Menem and Cavallo by devaluing the Argentine peso. But more than 20 years later, the results obtained for the living conditions of the population are not very different.

According to data from the Ecuadorian statistics institute (INEC), the multidimensional poverty rate (which includes food, housing, work and education) in 2022 was 38.1% and 54.3% of workers have informal jobs . In Argentina, also in 2022 and according to INDEC, 39.2% of the population is submerged in poverty (measured by income) and 38% of jobs are unregistered.

Dollarization has as its main objective to execute a violent adjustment plan on workersis a way to put into practice the shock recipes recommended by the IMF. It does not solve any structural problem, on the contrary it tends to aggravate them.

If something expresses the constant lack of dollars in Argentina, it is its dependence on the foreign market and particularly on the United States. Ending this condition is one of the keys to guarantee decent living conditions for the entire population. This requires forceful measures such as the nationalization of the banks (among others), but dollarization is not one of them.

Source: www.laizquierdadiario.com