The financial markets in emerging countries have started 2026 remarkably strongly. Stocks, bonds and currencies in these regions are benefiting from a US dollar that has fallen to its lowest level in four years. That is prompting investors to broaden their view beyond the United States and take a fresh look at underlying fundamentals.

Weaker dollar exposes fundamentals

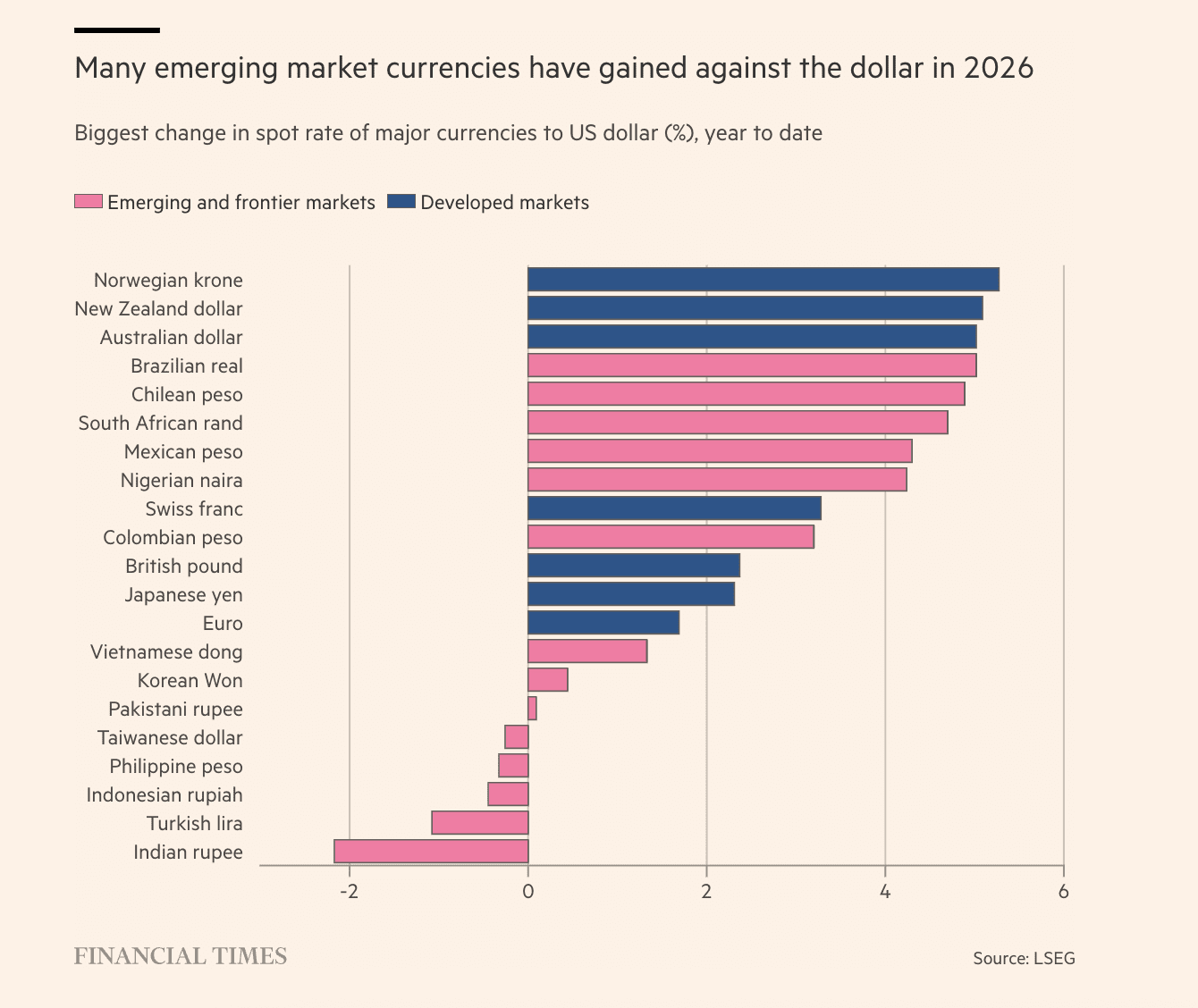

Stock markets in Brazil, Mexico, South Africa, Chile and Taiwan, among others, have already risen more than 10 percent this month in dollars. Countries such as Colombia and South Korea even go a step further. It’s not just equities that are benefiting: local currencies and bond markets are also showing strong gains.

According to analysts, this is not a sudden turnaround, but rather a catch-up process. “Fundamentals in emerging markets have been improving for some time, but only now that the dollar is weakening are they receiving renewed attention,” said David Hauner of Bank of America. For years, the strong dollar attracted capital from emerging countries, despite higher interest rates and improved policies.

Many central banks in these economies have raised their interest rates sharply in recent years to preserve capital. Now that the dollar cycle appears to be turning, Morgan Stanley says they are “beginning to reap the benefits of that established credibility.”

Equities lead the way

A broad index of emerging markets from MSCI is up almost 11 percent in January, after an exceptionally strong 2025. By comparison, the global stock index is up only a few percent this year, while the US S&P 500 is barely making any progress.

An important driver behind the rally is Asia. Chipmakers in Taiwan and South Korea are benefiting from continued demand for AI hardware, while resource-rich countries are riding the wave of rising prices for metals such as gold, silver and copper. In South Africa, it is mainly banks and mining companies that are driving up the stock market.

Bonds also in demand

It’s not just shares that are doing well. Emerging market local currency bonds are also showing strong performance. A JPMorgan index for this segment is already more than 2 percent higher this year, on top of an exceptional return in 2025. Latin American bonds in particular stand out, partly thanks to currency gains.

According to fund managers, this is not about a flight from the dollar, but about diversification of new capital. Investors are looking for alternatives now that American assets are less obviously dominant.

Structural shift?

Importantly, this move appears broader than speculative carry trades. Even concerns about possible interventions in the Japanese yen market have hardly slowed the rally. This indicates that there are structural allocations, and not just short-term positions.

The weakening dollar therefore acts as a catalyst for a trend that has been under the surface for some time: a revaluation of emerging markets, based on policy, growth and balance sheet improvement. Whether this move holds will depend on the further course of the dollar cycle, but the start of 2026 shows that interest appears to be anything but temporary.

Source: https://newsbit.nl/beurzen-in-opkomende-economieen-schieten-omhoog-dankzij-zwakke-amerikaanse-dollar/