The American stock markets are again under pressure and we immediately feel this in other markets. While the S&P 500 continues to decline, gold, silver and oil are also taking a hard hit. At the same time, Bitcoin (BTC) is moving downwards.

Investors appear to be bracing for new inflation figures, while fresh economic data is shaking up interest rate expectations.

S&P 500 continues to decline due to tech sales and macro data

The S&P 500 fell around one percent on Thursday, heading for a third consecutive day of losses. Tech stocks in particular were under pressure. According to CNBC, investors are moving money from growth stocks to sectors that benefit from a stronger economy, such as industrials, financials and energy.

That twist came as new U.S. numbers came in. The number of new applications for unemployment benefits was slightly higher than expected. Sales of new homes were also lower. Such figures can dampen hopes for rapid interest rate cuts, which affects the most ‘interest-rate sensitive’ parts of the stock market, such as tech.

Gold and silver take a hit and oil falls along with it

It is striking that the traditional ‘safe havens’ were having a hard time. Spot gold fell more than three percent to around $4,900, according to Bloomberg. Silver went even faster. Within thirty minutes, the silver price fell almost ten percent and fell back to 76 dollars per ounce.

Oil was also under pressure after the International Energy Agency (IEA) issued a lower demand forecast. Oil prices fell more than one dollar on that news.

Bitcoin price moves downward while tension rises towards CPI

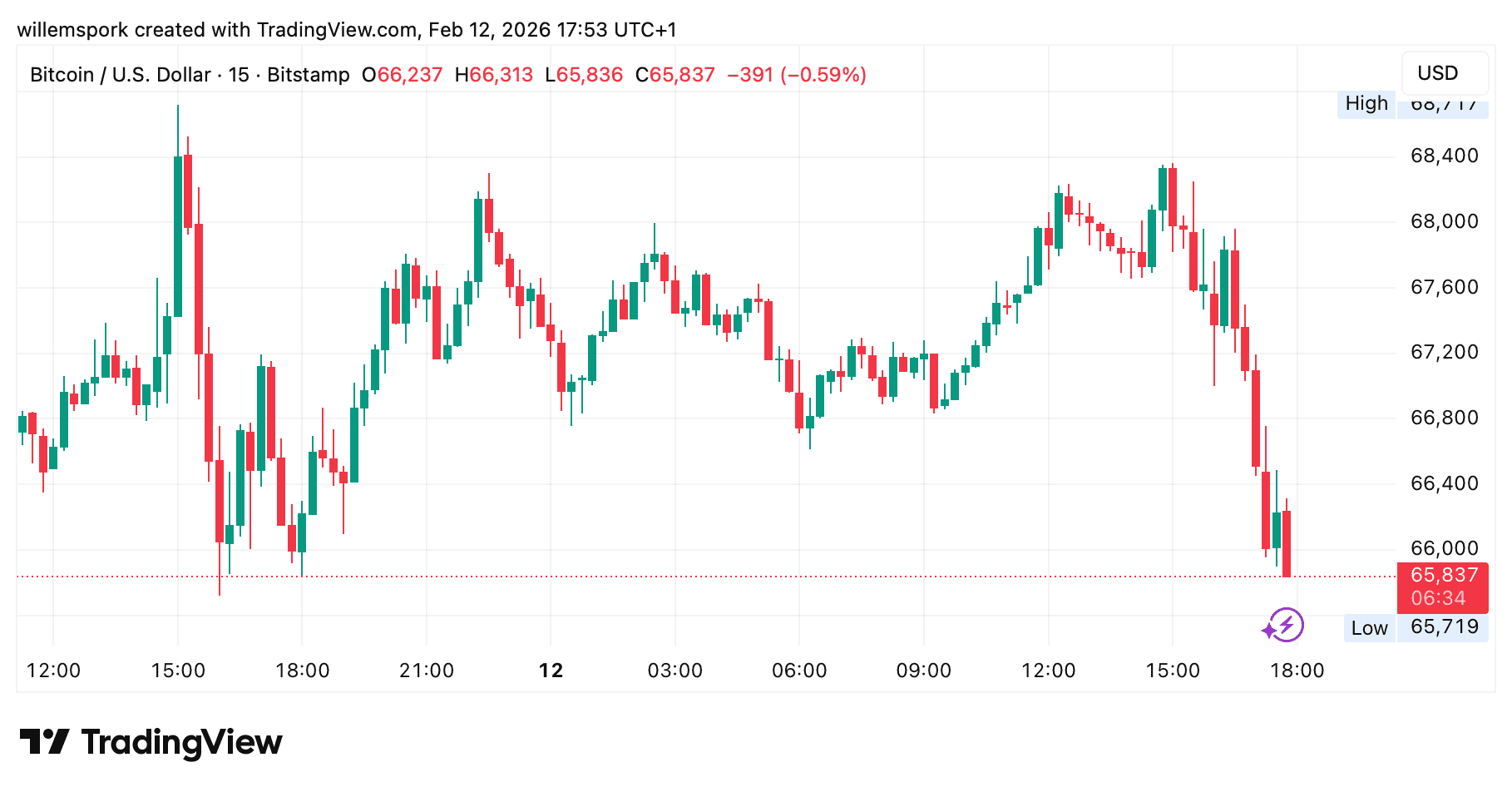

The Bitcoin price also fell when the sell-off on Wall Street accelerated. The chart shows that BTC briefly dipped below $66,000 and then rebounded slightly. Such movements are consistent with a market that is on edge: risk out when shares fall, risk back in as soon as there is some breathing space.

What adds to the excitement is that investors are already looking ahead to the latest US inflation figures. CNBC points out that the market is less confident about quick rate cuts after a strong jobs report. Higher inflation could keep the Federal Reserve on the brakes for longer. That scenario is usually bad news for shares and often also for crypto, because money then remains relatively expensive.

Anyone who follows the market will see that this combination can be dangerous: a falling stock market, sharp movements in precious metals and a Bitcoin price that moves along with it. This makes the coming trading hours extra sensitive to new data and unexpected outliers.

Source: https://newsbit.nl/zilver-crasht-bijna-tien-procent-in-30-minuten-sp-500-en-bitcoin-dalen-mee/