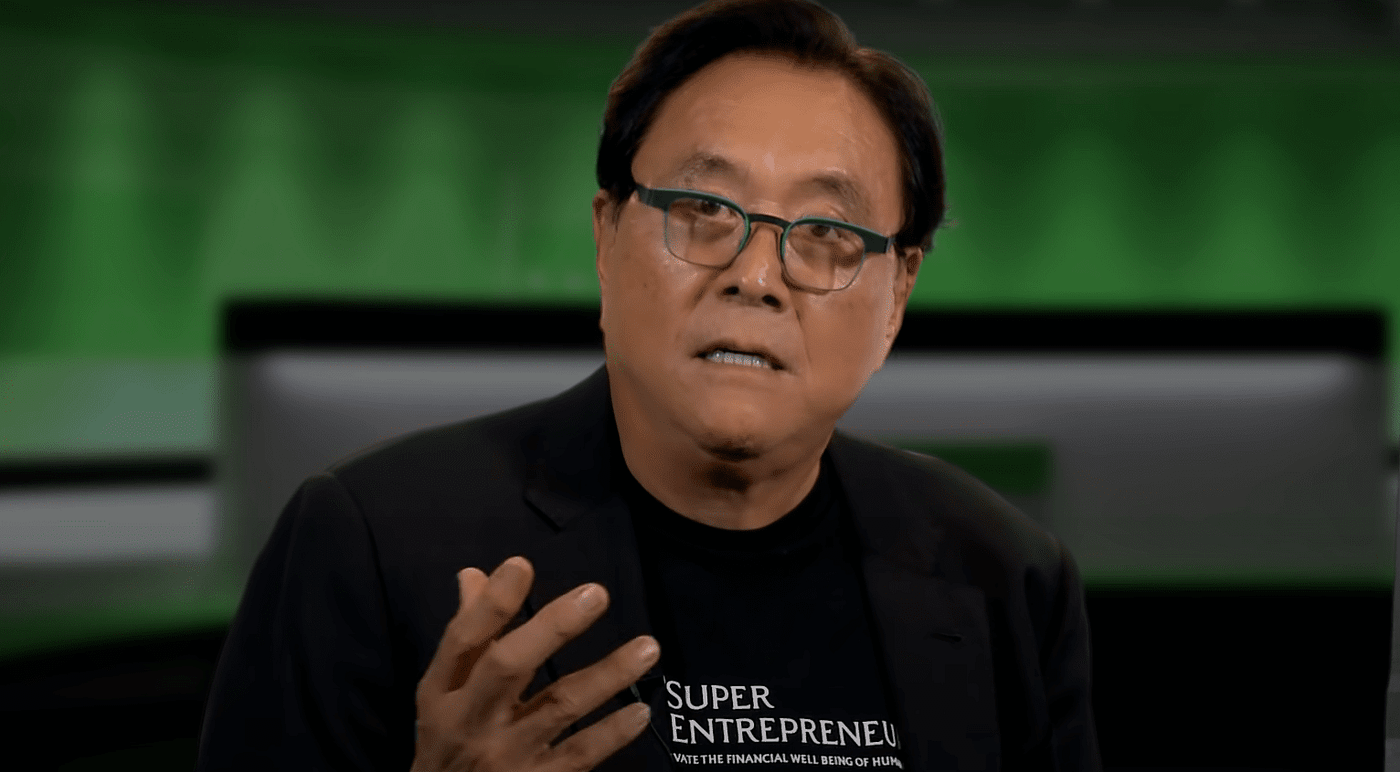

Robert Kiyosaki, author of the world-famous book Rich Dad Poor Dadis known for often making predictions about his favorite assets: Bitcoin, gold, and silver. After a period of disappointing performance, he believes these assets are poised to rise significantly in value, provided the Federal Reserve (Fed) follows through on its expected rate cuts.

Fed rate cuts as catalyst

The Fed is scheduled for a crucial meeting on September 18, where more clarity on possible rate cuts will be provided. It is expected that the rate will be cut by at least 25 basis points (0.25%). According to Kiyosaki, a rate cut would encourage investors to move their capital out of traditional financial products such as US Treasuries and reinvest it in “real assets” such as real estate, gold, silver and Bitcoin. These assets, he says, offer better protection against inflation and loss of value.

Loss of confidence in fiat money

Kiyosaki doesn’t differentiate between gold and Bitcoin, comparing it to choosing between a Ferrari and a Lamborghini – both are strong options. He also points to the declining confidence in fiat currencies, such as the US dollar, and warns of a potential repeat of historical currency crashes, such as those of the German Reichsmark and the Zimbabwean dollar.

Bitcoin on the eve of a bull run

Several analysts share Kiyosaki’s optimism about Bitcoin. The digital currency is expected to be on the cusp of a new bull market, despite recent price declines. A much-discussed cup-and-handle-pattern that has been forming since 2021 could even take Bitcoin to a value of $100,000 or $150,000. This would represent an increase of almost 160%.

Source: https://newsbit.nl/robert-kiyosaki-voorspelt-stijging-van-bitcoin-goud-en-zilver/