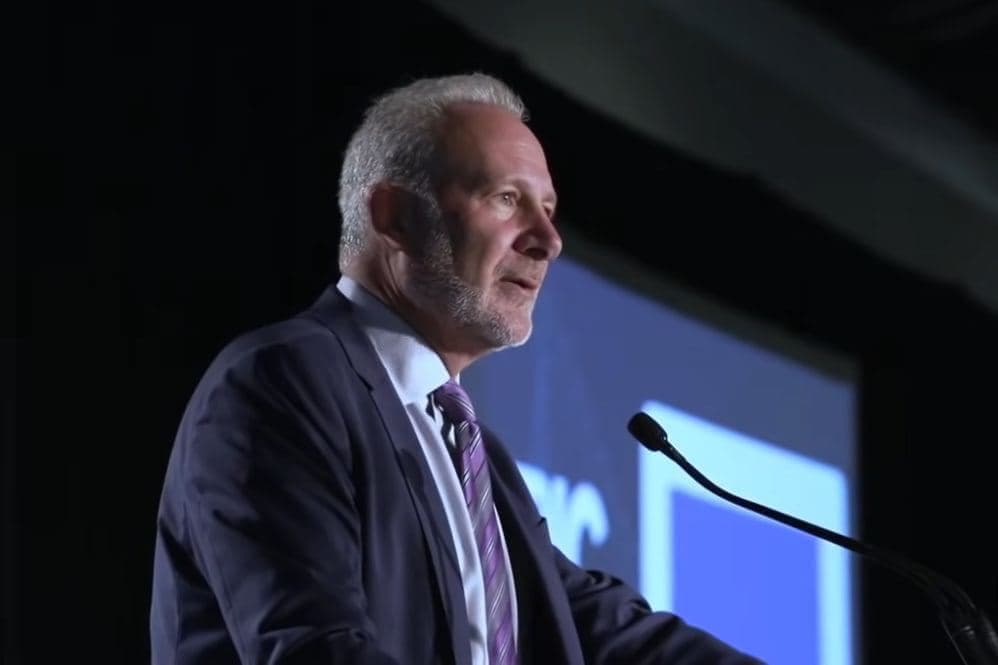

According to economist and gold -in -law Peter Schiff, we are in one of the strongest bull markets for gold ever. Yet the sentiment among investors remains remarkably cautious.

In a recent post on X, Schiff expressed his frustration about the wait -and -see attitude of investors, right now that the gold price has been over to above $ 3,000 per ounce.

Gold rises, but gold mine shares are left behind

“This is the strongest bullmarkt in gold we have ever seen, but at the same time there is a strikingly weak investor sentiment,” says Schiff. While the gold price record breaks after record, gold mine shares are left behind. According to the economist, that is unjustified. Small corrections, such as a decrease from $ 3,035 to $ 3,028, should not deter investors – certainly not in a market that, according to him, is fundamentally strong.

Schiff calls gold mine shares “undervalued, even with a sharp fall in the gold price”, and sees the current low prices as an attractive opportunity for long -term investors.

Weak dollars can push gold further

According to Schiff, the role of the US dollar also plays an important role. It is striking that the gold price rises, despite the relatively strong position of the dollar – something that he believes not to be ignored. “Moreover, there is a good chance that the dollar will weaken further in the near future,” he says. A weaker dollar could further push the gold price and expose the undervaluation of gold mine shares even more sharper.

Inflation masks bear market in shares

Schiff does not limit his analysis to gold alone, but also looks at wider market trends. For example, he compares traditional stock market indices with the gold price and draws a striking conclusion: “If you praise shares in real money, you only see the impact of actual inflation.”

According to its calculation, the S&P 500 has fallen by no less than 60 percent since the end of 2000 when it is expressed in gold. According to him, that points to a long -term bear market for shares, which is concealed by the falling purchasing power of the dollar. According to Schiff, Bitcoin has also been in a bear market for years compared to gold.

‘Goudrally is just the beginning’

With this analysis, Schiff confirms his long -held beliefs: gold is the ultimate form of power protection, especially in times of monetary uncertainty and rising inflation. According to him, the current Goudrally is therefore the beginning.

Since gold broke through the $ 2,000 border about a year ago, the price has almost continuously continued towards $ 3,000. According to Schiff, this increase is mainly driven by inflation and geopolitical tensions. Nevertheless, he warns against possible risks: the higher the gold price rises, the greater the chance of a correction.

Claim € 10 free today and do not pay trading costs over the first € 10,000!

Grab this unique opportunity with Newsbit and Bitvavo by creating an account now via the button below. Only deposit € 10 and receive € 10 free of charge. Moreover, you can act without costs for 7 days over your first € 10,000 in transactions. Start today and take advantage of the growing popularity of Crypto!

Make your account and claim € 10 for free.

Don’t miss this opportunity to take advantage of the growing popularity of Crypto!

Source: https://newsbit.nl/peter-schiff-sterkste-goud-bullmarkt-ooit-maar-niemand-durft-in-te-stappen/