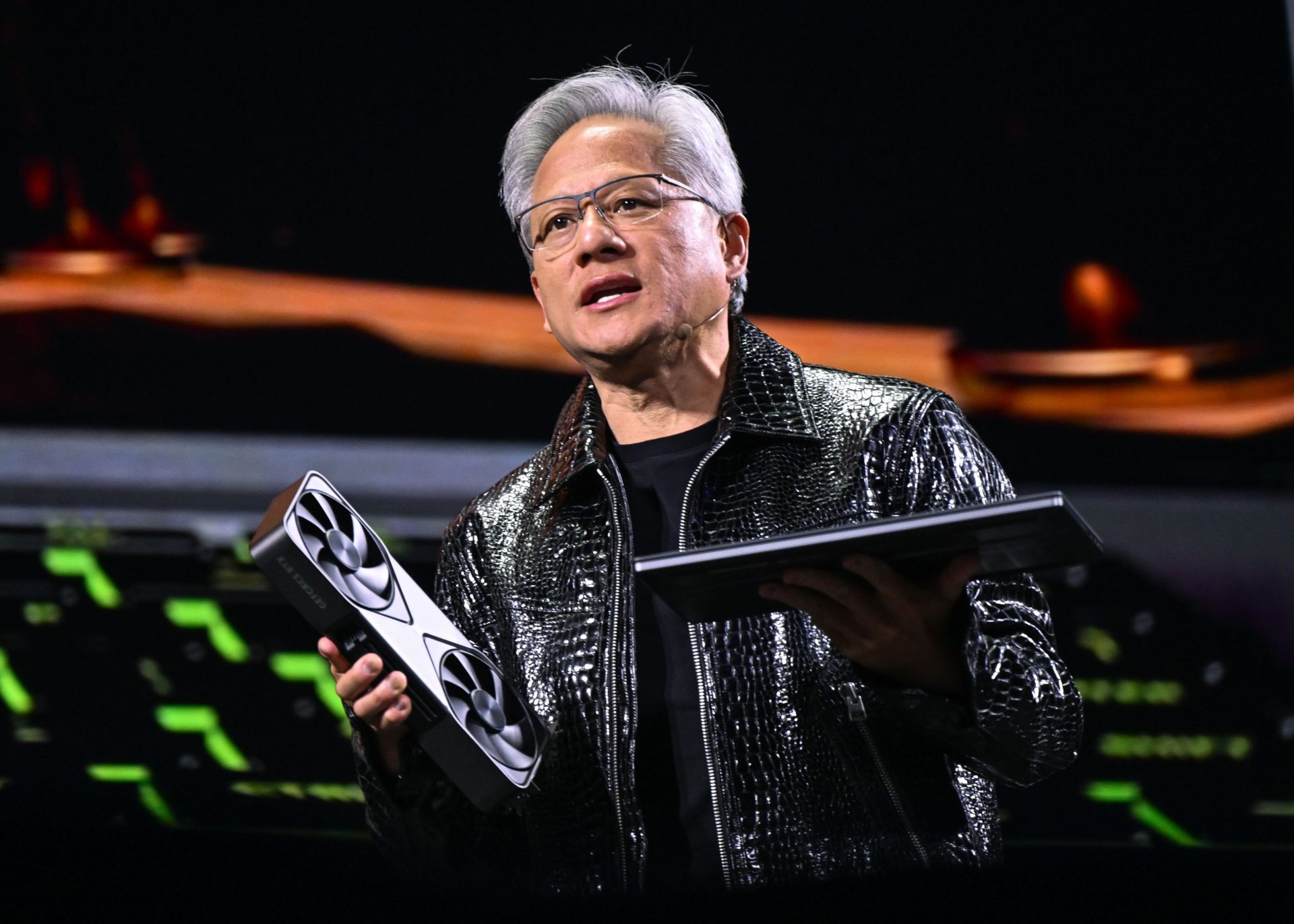

The demand for computing power is increasing rapidly due to the rapid development of artificial intelligence. Nvidia CEO Jensen Huang said this during an Nvidia event in Las Vegas.

According to Huang, there is an “intense race” to build increasingly powerful AI models, with computing power being the main limiting factor.

AI development puts pressure on available capacity

“The amount of computing power needed for AI is skyrocketing,” Huang said. “The demand for Nvidia GPUs is growing because AI models are increasing by a factor of ten every year. Those who can calculate faster also achieve the next technological breakthrough faster.”

According to Huang, virtually every advance in AI is ultimately a computational problem. Companies compete not only on software, but mainly on access to powerful chips and data centers. That battle is becoming increasingly fierce as AI applications expand from text and images to more complex forms such as video, simulations and real-time decision-making.

Nvidia plays a key role in this as a supplier of graphics processors, which are used for both training and running AI models. During the event, Huang confirmed that Nvidia’s next-generation chips, Rubin and Vera, are now in full production. Together they would deliver up to five times more AI computing power than previous models.

Implications for Bitcoin Mining

The growing demand for AI computing power also has consequences beyond the traditional technology sector. In recent years, several Bitcoin mining companies have started to partially or completely focus their activities on AI computing. This has to do with the increasing difficulty of mining Bitcoin, which puts pressure on profit margins.

AI offers miners an alternative revenue model: existing infrastructure, such as data centers and power contracts, can be used relatively easily for AI applications. If demand for AI computing power continues to increase, this shift could accelerate.

Competition for chips is increasing

At the same time, the explosive growth of AI raises the question of how much computing power remains available for other applications, including crypto mining. Nvidia chips are increasingly allocated to AI projects with long contracts and high margins, which could limit access for other sectors.

According to analysts, this could lead to a further separation between AI computing and crypto mining. As AI companies build increasingly larger and more expensive clusters, Bitcoin miners may increasingly have to choose between continuing to mine at rising costs, or switching to AI services.

Huang’s message is clear: the coming years will not only be determined by software innovation, but mainly by who has access to sufficient computing power.

Source: https://newsbit.nl/nvidia-baas-jensen-huang-waarschuwt-ai-slokt-alle-rekenkracht-op/