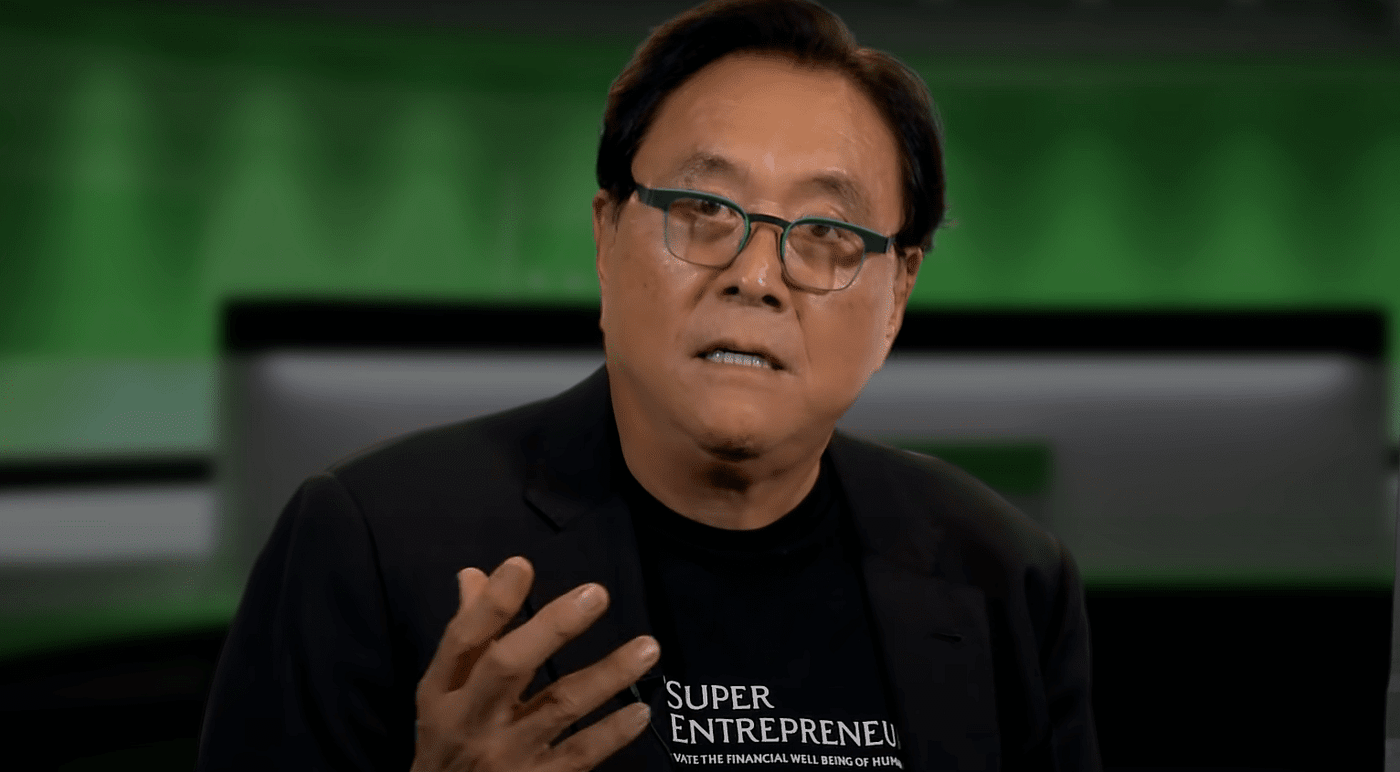

The famous American author and entrepreneur Robert Kiyosaki has again expressed his skepticism about the value of ETFs as an investment instrument in a recent message. In a message on X he compares Exchange-Traded Funds (ETFs) with having “a photo of a weapon” instead of tangible possession. What exactly does he mean?

According to Kiyosaki, physical assets remain essential

Kiyosaki acknowledges that ETF’s investing makes accessible to the general public, but at the same time emphasizes that it is “paper assets” that are not the same as physical gold, silver or bitcoin (BTC):

“ETFs make investing easier for the average investor. So I recommend them. But an ETF is like a photo of a weapon for personal defense.”

According to the author of the book Rich Poor Dad, gold, silver and BTC ETFs are especially useful in times of crisis, provided that investors understand how these funds work and what limitations are attached to it. He advises investors not only to focus on digital or paper forms of power.

With this, Kiyosaki repeats his structural criticism of Fiatgeld and the current financial system. He often warns against the burden of several financial bubbles and states that a possible BTC crash is likely to be accompanied by a simultaneous fall in gold and silver. Yet he sees such a scenario as an opportunity to further expand physical property.

Bitcoin ETFs remain extremely popular

Despite the persistent warnings from Kiyosaki, Bitcoin Spot ETFs continue to attract a lot of capital. On July 24, according to data from Farside, these funds registered a joint net inflow of 227 million dollars. The Fidelity fund was responsible for $ 107 million. The inflow into the BTC ETFs came out after three consecutive days.

The total net asset value of all BTC spot ETFs is currently $ 154.45 billion, accounting for around 6.54 percent of the full market capitalization of BTC. The historical net inflow over all ETFs is now $ 54.69 billion.

Source: https://newsbit.nl/kiyosaki-waarschuwt-een-etf-is-net-zo-nutteloos-als-een-foto-van-een-pistool/