While the Bitcoin price has clearly lagged behind traditional safe havens such as gold and silver in recent months, a large majority of institutional investors see opportunities. New research from Coinbase shows that approximately 70 percent of institutional investors currently view Bitcoin as undervalued.

Prices significantly lower, but conviction remains

The finding comes from Coinbase’s Charting Crypto Q1 2026 report, based on a survey of 75 institutional and 73 independent investors. The respondents gave their opinion in a period when the Bitcoin price moved almost completely between $85,000 and $95,000.

Bitcoin is currently trading around $87,000, which is more than 30 percent below the peak of over $126,000 reached in October. That decline followed a sharp market correction, with more than $19 billion in leveraged positions liquidated in a single day.

Since then, recovery has been difficult. Geopolitical tensions, new tariff threats from the US and uncertainty about interest rate policy are weighing on sentiment.

At the same time, gold and silver rose sharply: gold recently even touched the USD 5,000 per ounce mark, while silver has almost doubled since October. The S&P 500 managed to gain only a few percent during the same period.

Yet a large group of professional investors do not see this as a reason to abandon Bitcoin. On the contrary.

“Undervalued” is the dominant judgment

According to the survey, 71 percent of institutional investors believe Bitcoin is undervalued at its current price level. Another 25 percent call the rate “fairly priced”. Only a small minority, 4 percent, speaks of overvaluation.

That assessment suggests that many major investors are not seeing the recent weakness as a fundamental problem, but as a phase within a broader market cycle. More than half of respondents indicate that they view the current period in the market as an accumulation phase or even as a bear market in which positions are being built up.

Dips are seen as a buying opportunity

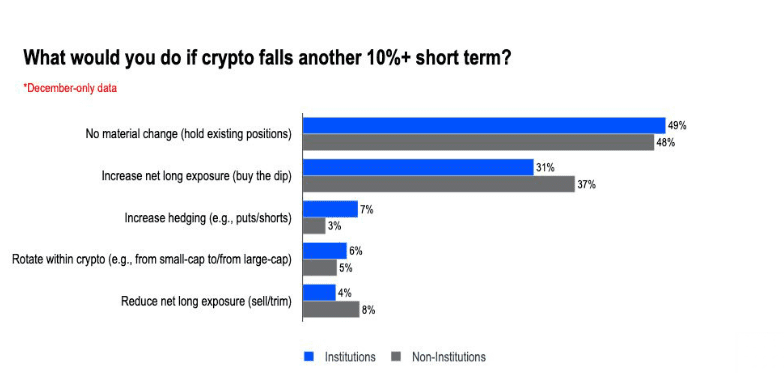

It is striking how institutional investors say they will respond to further price falls. About 80 percent indicate that they would like to hold Bitcoin or even buy more if the market were to fall another 10 percent. More than 60 percent say they have kept their Bitcoin position the same or expanded since October.

This points to a long-term view, where temporary volatility is accepted as part of the investment process.

Macroeconomic support in prospect?

Coinbase also sees possible macroeconomic tailwinds emerging. The American economy is growing strongly, inflation remains relatively stable and the Federal Reserve is expected to implement two interest rate cuts in 2026. Lower interest rates generally increase the attractiveness of riskier investments, including Bitcoin.

Although geopolitical risks can cause unrest in the short term, this research shows that many institutional investors are actually seeing through the noise. For them, Bitcoin seems less a speculative hype, and more and more a strategic position within a broader portfolio.

The price may be moving sideways, but beneath the surface confidence seems remarkably high.

Source: https://newsbit.nl/rijke-beleggers-bitcoin-is-ondergewaardeerd-ondanks-zwakke-koersprestatie/