After an unprecedented rally lasting months, both gold and silver have suddenly fallen sharply. Both precious metals achieved record prices at the beginning of 2026, but suffered significant losses this week. What’s behind this and what does it mean for investors?

Gold and silver correct sharply after explosive rise

The gold price has risen by more than 31 percent since January 1 to an all-time high of $5,600 per ounce (about 31 grams). That record price was reached just two days ago, but gold is now around $5,170. That amounts to a loss of 7.7 percent in just a few days.

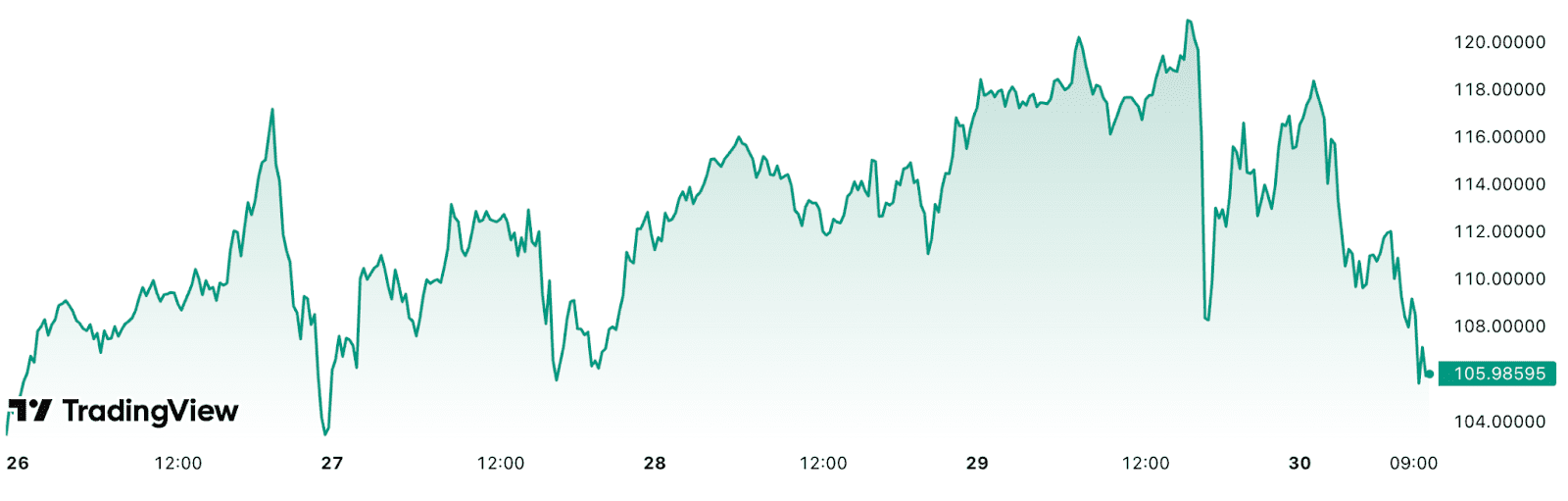

Silver also saw a spectacular rise this year. The price has tripled since January, reaching a peak of $121.60 per ounce yesterday. That value has now fallen to $107.50, a drop of 11.6 percent.

Yet year-on-year performance remains impressive. At the beginning of 2025, gold was still trading at $2,630 per ounce and silver at only $29. Despite the correction, gold has almost doubled in one year, while silver has even become more than three times more expensive.

The sudden decline was triggered by news of a possible appointment of Kevin Warsh as the new chairman of the Federal Reserve (Fed). Donald Trump would like to put him forward for this influential role.

Warsh is known as ‘hawkish’. He has traditionally been reluctant to cut interest rates and advocates stricter monetary policy. This immediately led to fear in the markets of less liquidity and higher interest rates, which usually has a negative impact on assets such as gold and silver.

The crypto market was also hit hard. Bitcoin (BTC) fell 6.4 percent and Ethereum (ETH) lost 7.1 percent in the past 24 hours.

Analyst: ‘No ordinary correction’

According to market analyst NoLimit, almost $6 trillion in value has disappeared from the market in just half an hour. On X he speaks of a “historically unprecedented” movement, especially in assets that are normally considered a safe haven.

According to him, the correction is not only technical in nature. It involves forced sales, debt reduction and margin calls that quickly reinforced each other. “We don’t see an ordinary correction here, but a fundamental shift in the financial system,” NoLimit said. He expects more turbulence on the financial markets.

Despite the sharp decline, underlying demand for precious metals remains strong. Macroeconomic uncertainties and geopolitical tensions further fuel the flight to safe havens. Many investors doubt the stability of the US as a world power and opt for gold and silver as protection.

Silver also benefits from its role in industrial applications. The metal is crucial for the energy transition, solar panels and applications in artificial intelligence. As a result, the structural demand for silver continues to increase.

Source: https://newsbit.nl/goud-en-zilver-crashen-plots-wat-zit-er-achter-deze-klap/