US employment data increases tension on Wall Street, with focus on the Fed and signs of a market dominated by macroeconomic correlations

It wasn’t supposed to be like this. With the economy booming, a supportive Federal Reserve and Donald Trump on his way to the White House, Wall Street saw nothing but opportunity as the calendar turned.

Ten days into 2025, hopes of a calm year for markets are in doubt. A choppy start to the year turned into a sell-off on Friday as signs of strengthening in the US labor market were interpreted negatively by traders, who saw it as a closing of the door on further monetary stimulus soon.

Friday’s action was the clearest sign yet that good economic news is not necessarily a simple blessing for markets, particularly threatening interest rate-sensitive strategies and debt-laden companies across corporate America. A report showing rising jobs and falling unemployment has caused headaches for those expecting additional stimulus from the Jerome Powell-led Federal Reserve in 2025.

“The last few weeks could be a good harbinger of what the entire year will look like,” said Priya Misra, portfolio manager at JP Morgan Asset Management. “It won’t be easy, but volatile and messy – we have a combination of the Fed on pause, high valuations (with all assets pricing in optimism and a soft landing) and political uncertainty on both sides.”

Stocks tumbled, with the S&P 500 on track to end the week 1.5% lower, the biggest weekly drop since Fed Chairman Powell rattled markets last month by signaling that the specter of inflation had not yet been lifted. defeated. Treasury yields have continued their nearly uninterrupted upward march since then, with 30-year rates briefly topping 5%. Bitcoin rose, but only after losing 9% in the previous three sessions.

One of the biggest losers in the turmoil was the so-called “Trump trade” — the bullish half, which saw tax cuts and deregulation boosting stocks, even after the impressive gains of the past two years. Instead, investors face the side of the trade they didn’t want: spiraling bond yields due to concerns that runaway spending and trade tariffs will fuel inflation.

While Bitcoin remains considerably higher since Election Day, gains in the S&P 500 have slowed significantly. Small business stocks – an almost pure bet on the president-elect’s pro-growth, protectionist policies – fell further. Rising bond yields also threaten to increase the cost of financing Trump’s policy agenda, with 10-year rates now nearly 20 basis points higher at the end of the year.

“There is too much optimism based on the consensus idea that the Fed will continue to cut interest rates,” Max Wasserman, senior portfolio manager at Miramar Capital, said in an interview. “People are overly dependent on a ‘put’ from the Fed.”

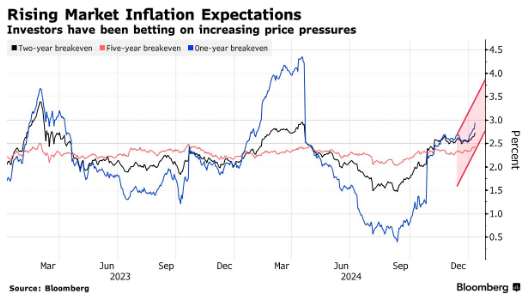

Unlike last year, when evidence of a low-inflation expansion in the US boosted stocks and kept bonds in check, January saw a resumption of synchronized and negative moves across asset classes, reflecting the renewed emphasis on inflation. The 40-day correlation between the two markets turned positive in December after weakening for much of the fourth quarter, highlighting growing anxiety that price pressures could limit the Fed’s attempt to ease policy.

The combined return of stocks and bonds has been negative for five consecutive weeks, the longest period since September 2023, as measured by the world’s largest ETFs that track the S&P 500 and long-term Treasury bonds.

Among the few who predicted the scenario is Bill Harnisch. His $1.9 billion Peconic Partners hedge fund, which has beaten the market over the past four years with a 192% return, has reduced leverage, sold housing-related stocks and cut exposure to tech megacaps due to concern that both a weak and a strong economy create risks for optimists.

“You’re in a lose-lose situation,” Harnisch said by phone, citing the risk that accelerated growth will trigger a reaction from the Fed. “We think it’s a very risky market.”

Friday’s jobs report is the latest in a series to show a strengthening U.S. economy and a potential increase in price pressures. A University of Michigan survey showed that consumers’ long-term inflation expectations rose to the highest level since 2008.

Market expectations for inflation over the next two years, measured by two-year breakevens, are at 2.7%, the highest level since April. Commodity prices are expected to rise 4% this week, with Brent crude hitting $80 per barrel for the first time since October on news of US sanctions.

“The more growth surprises positively, the more investors worry about what it means for inflation,” said Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors. “The closer we move towards no cuts, towards possible increases, and the closer 10-year yields approach new cycle peaks, the more investors begin to worry about the impact on liquidity, growth and credit. ”

With information from Bloomberg*

Source: https://www.ocafezinho.com/2025/01/11/explosao-no-mercado-de-trabalho-acende-o-pavio-do-caos-em-wall-street/