While the company reaches historical value, its members sell shares at a rapid pace, indicating strategy and possible caution amid the market euphoria

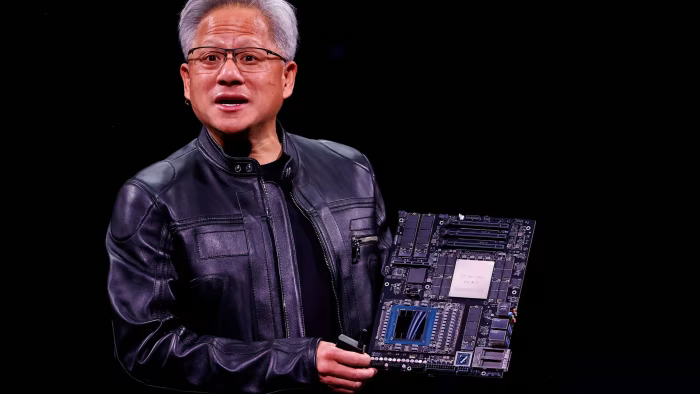

In the last twelve months, Nvidia’s tall executives and internal shareholders have defined more than $ 1 billion in the company’s roles-a movement that reveals both the euphoria of the market and personal strategies of semiconductor giant managers. CEO Jensen Huang heads the operations, making sales after months of inactivity, while the global explosion by artificial intelligence chips catapults the company to unpublished levels.

Sales wave coincides with high records

The pace of operations has accelerated in recent weeks: in June alone, half a billion dollars in stocks were settled, just as Nvidia’s papers hit successive records. The company, based in Santa Clara, has become one of the most valuable on the planet, with capitalization that exceeds $ 3.8 trillion-a reflection of its domain in the supply of essential AI processors.

But the way here was not without obstacles. Commercial sanctions between US and China, added to the advance of Asian rivals, even threatened the demand for their products. Still, Nvidia’s resilience impresses: after a fall in April, the company recovered an impressive $ 1.5 trillion in market value.

Huang triggers strategic plan after waiting for the right moment

Jensen Huang, co -founder and charismatic leader of Nvidia, resumed sales this week after nine months of break. Transactions follow a predefined plan, registered in March, that automates operations to avoid suspicions of use of privileged information.

“He demonstrated impeccable timing,” says Ben Silverman of VerityData. “He kept the actions during the fall of the first quarter and only released them now, with the recovery.” The scheme allows Huang to sell up to 6 million shares by December – which, quoted today, would yield about $ 900 million. Even after sales, its equity remains estimated at $ 138 billion.

Other weight names follow the movement

The strategy is not limited to the CEO. Mark Stevens, a historic investor and former partner part of the capital, plans to dispose of up to 4 million shares ($ 550 million at the current price), having already performed US $ 288 million. Jay Pus, vice president of global operations, settled $ 25 million in papers on Wednesday.

Two board members also entered the dance: Tench Coxe, a veteran that has been with NVIDIA since its founding in 1993 in a Denny’s cafeteria, sold $ 143 million earlier this month. Brooke Seawell of the New Enterprise Associates, made $ 48 million.

Legacy and Future: From video game signs to global power

Nvidia’s trajectory mirrors the evolution of technology in recent decades. Starting with game graphics, the company reinvented itself as a key piece in the AI revolution. Even with geopolitical challenges and the rise of competitors like Chinese DeepSeek, their influence only grows – shaping not only the future of computing but also the direction of the global economy.

While the market speculates about their next steps, one thing is certain: Nvidia executives are writing their own financial script, combining long -term vision with calculated opportunism.

With information from Financial Times*

Source: https://www.ocafezinho.com/2025/06/30/executivos-pulam-fora-da-nvidia-com-o-bolso-cheio/