A survey by the German central bank showed that most Germans have never heard of the digital euro. Of those who were aware of it, some mistakenly thought it was a cryptocurrency.

Although there are many stories circulating about a digital euro from the European Central Bank (CBDC), it is still not concrete.

Digital euro attracts interest, despite uncertainty

Half of Germans who took part in a recent survey said they could imagine using the digital euro, despite many having never heard of it or not knowing exactly what it is.

In a Deutsche Bundesbank survey of 2,012 people published on June 4, 50% said they could “certainly” or “probably” imagine using the digital euro.

A quarter said they “definitely wouldn’t” use it, about the same number said they “probably wouldn’t” use it – 1% said they didn’t know.

Three out of five respondents also said they had never heard, read or seen anything about the digital euro. That’s almost unimaginable when you consider how much news has come out on this subject.

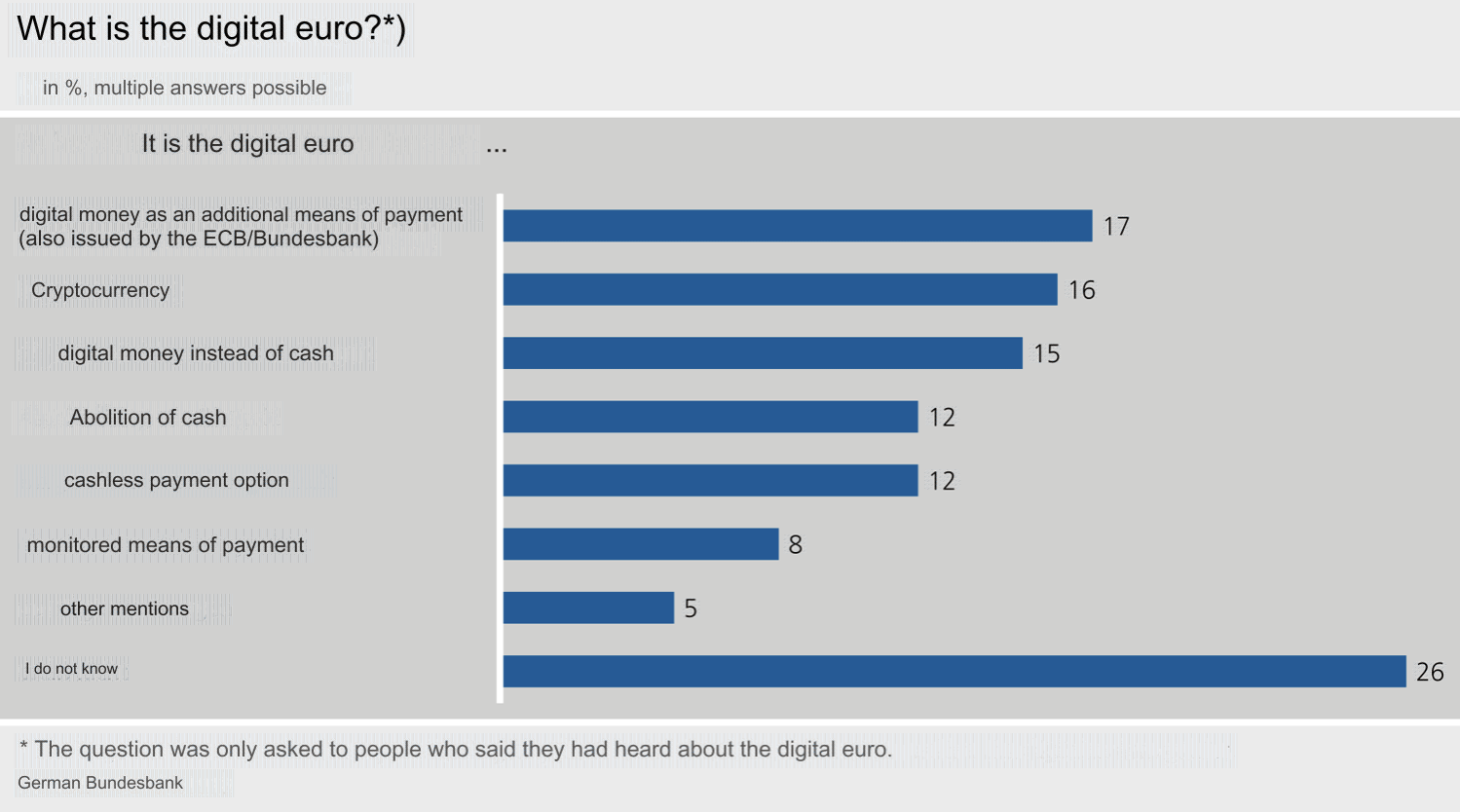

Of the remaining respondents who had heard about it, about a quarter said they didn’t know what it was – 16% thought it was a cryptocurrency, while almost 30% thought the digital euro was intended to replace cash or believed that cash would be abolished if introduced.

Only 17% answered correctly that it is a form of digital euro money issued by Europe’s central banks, which the ECB said would be available alongside other payment methods such as cash.

Bundesbank President Joachim Nagel said in a statement that the survey shows “much information still needs to be provided.”

Privacy the biggest concern for digital euro

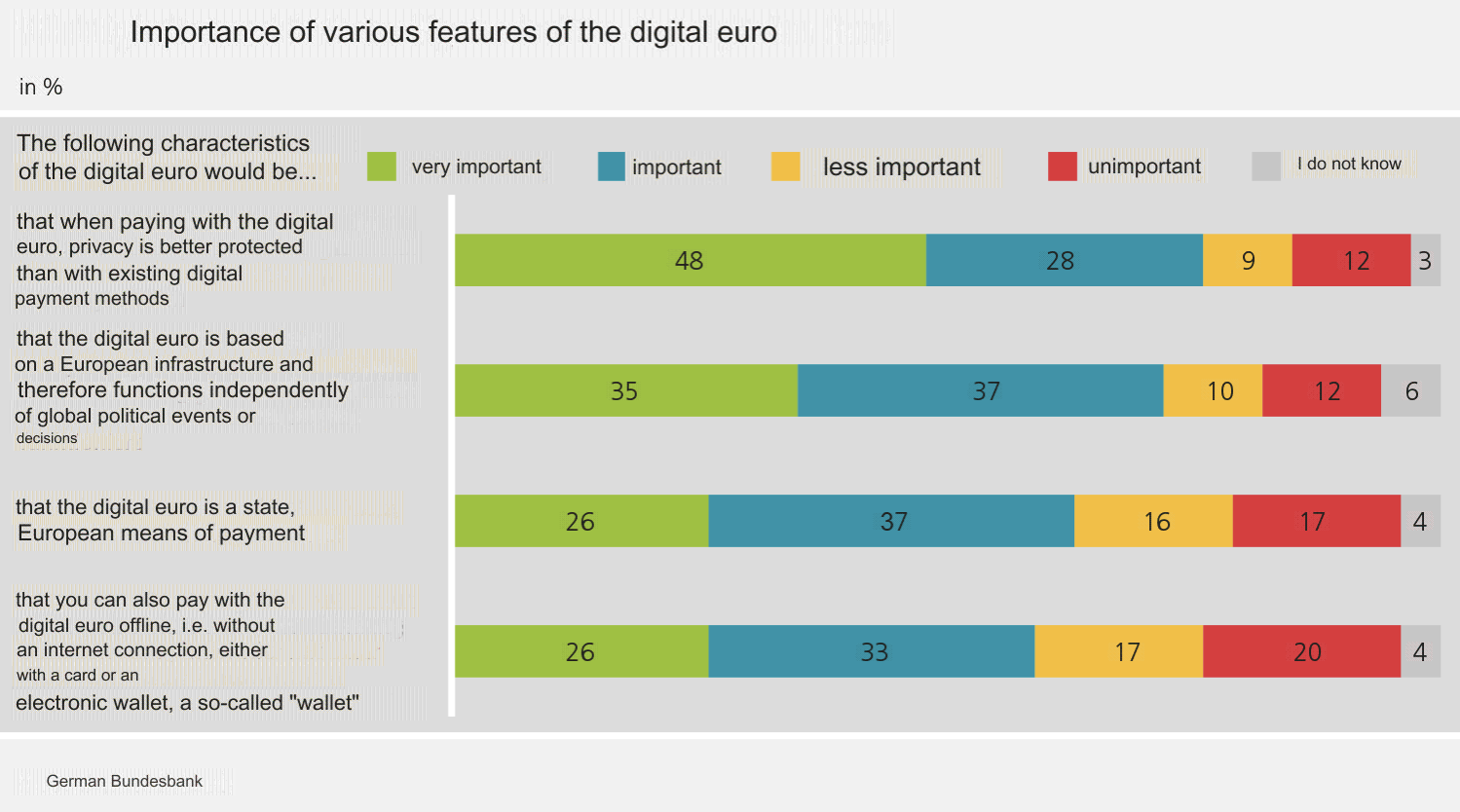

Ensuring better privacy over existing digital payment options was the most important function for respondents, with more than three-quarters rating this as “very important” or “important”.

More than 70% think it is important that the CBDC is based on European infrastructure, while more than 60% think it is important that the digital euro is issued by the government, just like cash, and that it can be paid offline.

“European central banks are not interested in user data,” Nagel said. He claimed that the digital euro would protect privacy “much more effectively than current commercial payment solutions.”

The ECB claims that the digital euro can be used offline and that transaction data “would only be known by the payer and the recipient.”

The project is currently in a preparatory phase that is expected to be completed in October 2025. The focus is on finalizing rules and finding possible publishers.

Last June, the European Commission submitted a draft regulation providing a legal framework for the digital euro and a proposal to ensure the use of cash.

Burkhard Balz, Bundesbank board member responsible for the digital euro project, said in a statement that under current plans, “people will not be able to make their first payments with the digital euro until 2028 at the earliest.”

Source: https://newsbit.nl/digitale-euro-interesse-ondanks-onwetendheid-en-misvattingen/