Crypto analyst TechDev concludes that Bitcoin is still in the early stages of its bull market based on three indicators. He bases this on Bitcoin’s liquidity cycle, Relative Strength Index and Fisher Transform Indicator.

Bullish over Bitcoin

The first chart from TechDev shows a line for the Bitcoin price and a line plotting 10-year Chinese government bonds (CN10Y) against M2SL, the money supply in the United States.

Based on the chart, TechDev seems to suggest that a rise in the CN10Y against the M2SL could trigger major gains for Bitcoin.

Furthermore, the RSI (momentum indicator) and the Fisher Transform (trend reversals) point to patterns similar to what we saw earlier in 2017. As such, TechDev believes that we are in for a 2017-like rally and that Bitcoin is far from done with its bull run.

At the time of writing, we see little of that. The Bitcoin price clocks in at 57,941 dollars. This means an increase of 2.62% for the past week, but we are of course quite far from the all-time high.

Focus on next week

For now, the market seems to be focused on next week. That’s when the US central bank will have another interest rate meeting. They will decide whether to opt for a 0.25% cut or whether an unexpected 0.50% meeting would be more appropriate.

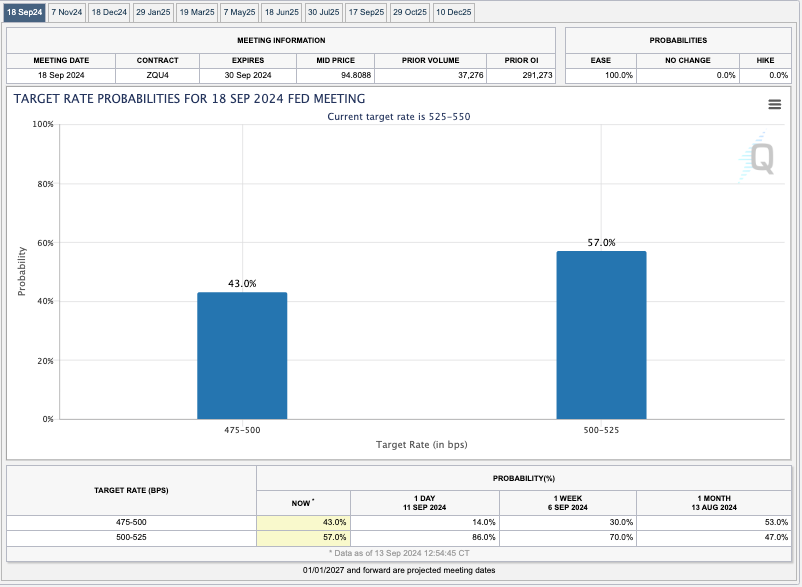

If you ask the futures market, the table below currently shows the probability distribution.

Here we see that there is a 43% chance of a 0.50% rate cut according to the futures market. That would make for an unusual start to the rate cuts. A 0.50% cut would mean that the US central bank is also worried about the economy.

That may not be exactly the story we as investors are waiting for.

Source: https://newsbit.nl/analist-bitcoin-zit-nog-in-beginfase-bullmarkt/