Companies like BlackRock and Pimco form a committee and hire consultants to negotiate an agreement.

Ukraine’s creditors said Kiev could wait to pay them after Russian troops invaded the country two years ago. Now, their patience is starting to run out.

A group of foreign bondholders including BlackRock and Pimco plan to pressure Ukraine to start paying interest on its debt again as early as next year, according to people familiar with the matter.

The group, which holds about a fifth of Ukraine’s $20 billion in outstanding Eurobonds, recently formed a committee and hired lawyers from Weil Gotshal & Manges and bankers from PJT Partners to negotiate on its behalf.

The group wants Kiev, which has just won around $60 billion in US aid, to reach a deal in which it would resume payments in exchange for forgiveness of a large portion of the country’s outstanding debt. Some of the group’s bondholders have discussed the plans with senior officials in Kiev.

A spokesperson for the bondholder group said it “looks forward to engaging constructively to help with Ukraine’s sovereign debt.”

Ukraine is preparing to begin negotiations with bondholders this month, and Kiev’s advisers are working to get the U.S. and other governments on board.

This approval is not guaranteed. The US and its allies are concerned that taxpayers’ money could end up in the hands of bondholders if Ukraine resumes any kind of debt servicing. The countries agreed to give Ukraine a debt reprieve on about $4 billion of its own loans until 2027, and expressed concerns that bondholders could start being repaid before they do.

Without a deal, Ukraine could default after its bondholder debt suspension period ends in August, tarnishing its reputation with investors and complicating its ability to borrow more.

International Monetary Fund officials and some members of the bondholder group met in April in Washington, D.C., where fund representatives indicated that total private sector debt relief may have to be greater than currently indicated by bond markets. Ukrainian bonds trade between 25 and 35 cents on the dollar, according to AdvantageData, implying losses of up to $15 billion.

When bondholders agreed to a two-year debt suspension in 2022, many thought the war would already be over.

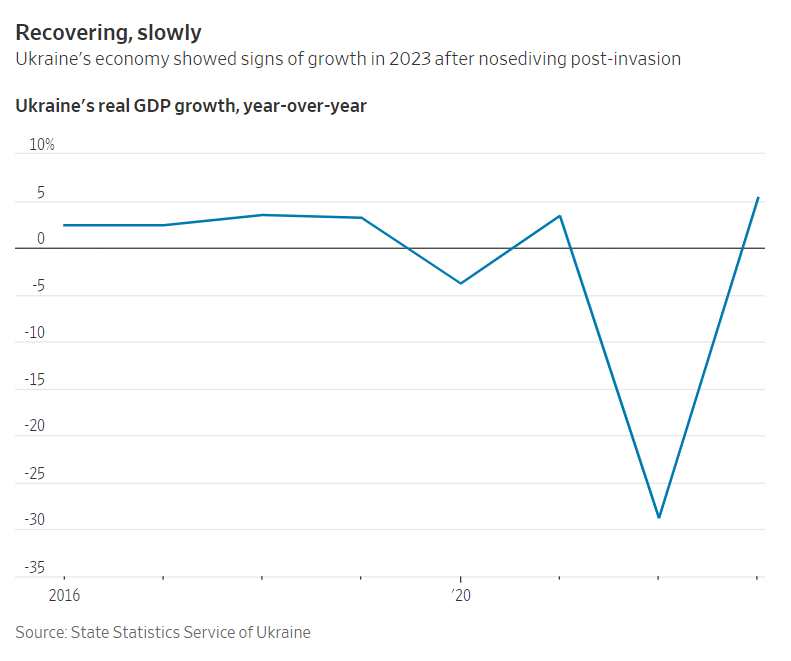

Although the conflict continues, creditors say they are optimistic about stabilizing Ukraine’s finances. The country got crucially needed aid from the US and Europe and increased its foreign exchange reserves to an all-time high in April, while Ukraine’s central bank is considering a rollback of capital controls this year.

Bondholders expect to receive up to $500 million in annual interest payments after agreeing to debt relief. They signaled they might be willing to provide more help later.

Some bondholders have suggested that Russian assets frozen in Europe and North America be used to help pay off some of what they are owed.

The IMF and several G-7 countries so far do not agree with this idea, but have indicated that they could support lower interest payments until 2027 – at rates well below market rates. Ukraine would be reluctant to resume a normal debt repayment schedule before 2027 at the earliest, some people said.

If a deal is reached, it could be financially rewarding for investors who bought Ukrainian bonds at bargain prices.

Via The Wall Street Journal.

Source: https://www.ocafezinho.com/2024/05/06/credores-pressionarao-ucrania-a-retomar-pagamentos-da-divida-apos-hiato/