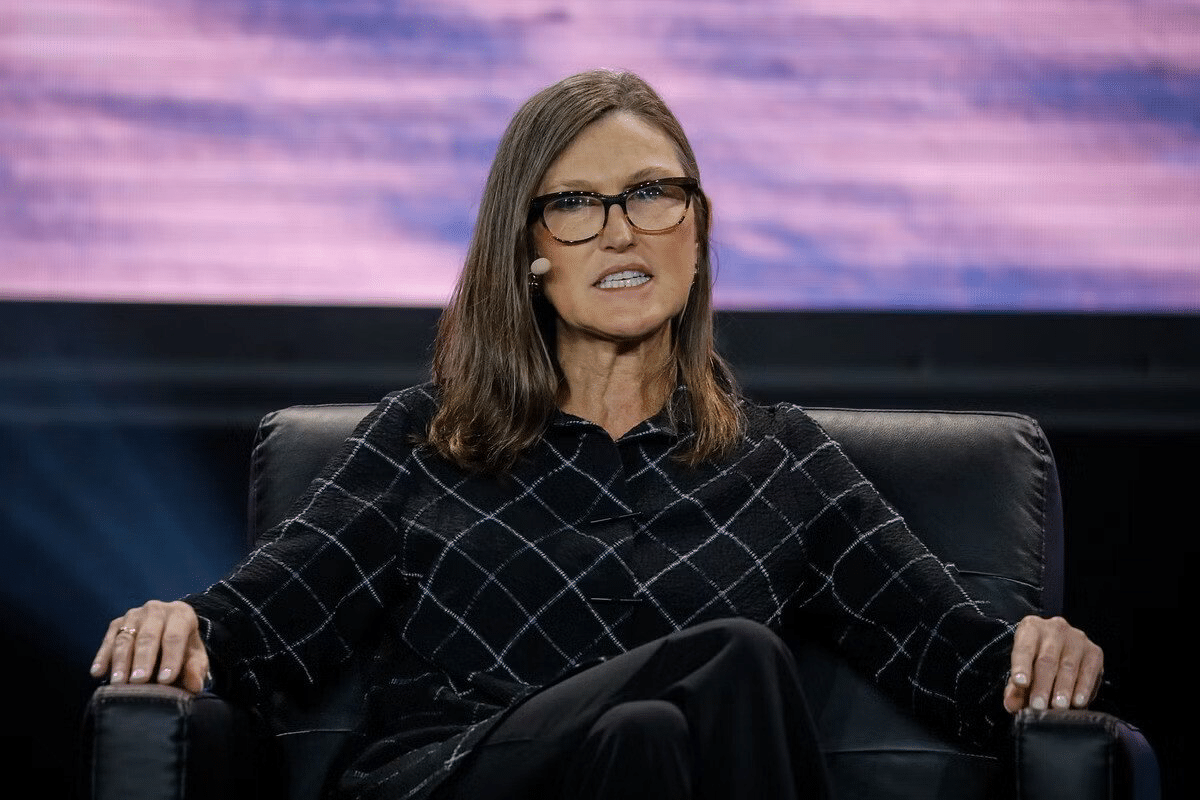

While the crypto market is under pressure and listed crypto companies fell sharply, top investor Cathie Wood seized her opportunity. Her fund Ark Invest bought tens of millions of dollars worth of shares in well-known crypto-related companies in one day.

BitMine largest purchase during red trading day

The American stock exchanges turned red for companies active in crypto. Yet Ark Invest bought heavily at that time. New trading reports show that the fund added large amounts of shares to three of its ETFs: ARKK, ARKW and ARKF.

The largest purchase was BitMine. Ark invested $17 million in the company, which is known as the largest Ethereum (ETH) treasury company in the world. The stock lost more than eleven percent that day and closed at $30.95.

Coinbase was also heavily purchased. Ark paid $16.26 million for shares of the crypto exchange after the stock fell 6.37 percent to $250.42.

Circle Internet Group, the company behind the stablecoin USDC, took a hit of almost ten percent. Ark still bought $10.8 million worth of shares.

In addition, the fund expanded its positions in Block Inc., Bullish and its own Ark 21Shares Bitcoin (BTC) ETF. Those purchases were worth $5.94 million, $5.2 million and $1.24 million, respectively.

Bitcoin and Ethereum under pressure

The price drops in crypto companies did not come out of the blue. The broader crypto market is under pressure. Bitcoin fell 3.6 percent in 24 hours to $86,000. Ethereum (ETH) lost six percent and is at $ 2,930.

For Ark Invest, these are precisely the moments to step in. Cathie Wood recently reiterated in a webinar that new technologies reduce costs for businesses and consumers. That trend could put pressure on inflation next year.

According to Ark, crypto companies are well positioned to benefit from that structural change in the long term. Instead of fleeing when price falls, the fund sees buying opportunities in the dip.

Source: https://newsbit.nl/cathie-wood-slaat-toe-tijdens-crypto-dip-miljoenen-geinvesteerd-in-bitmine-en-coinbase/