Disclaimer: This article is a press release and Newsbit is not responsible for the content, accuracy or completeness of the information provided. This article does not constitute financial advice. Investing in cryptocurrencies or pre-sales involves significant risks, including the risk of losing your entire investment. Always do your own research before making any investment decisions.

Cardano is once again in a period where patience is rewarded. After a long history of disappointing performance compared to faster-moving altcoins, long-term sentiment around ADA is starting to shift positively. This change comes as the broader crypto market stabilizes and investors reconsider which assets they want to hold for the rest of the year.

Instead of focusing on temporary rallies, most crypto investors are now focusing on blockchain projects with potential for real-world adoption, strong on-chain activity, and usability during both bull and bear markets.

In that context, the conversation about the Cardano price forecast has evolved from short-term frustration to long-term opportunities. Will ADA be able to continue its promising breakout? Let’s check it out.

Cardano (ADA): A slow but steady bullish structure is developing

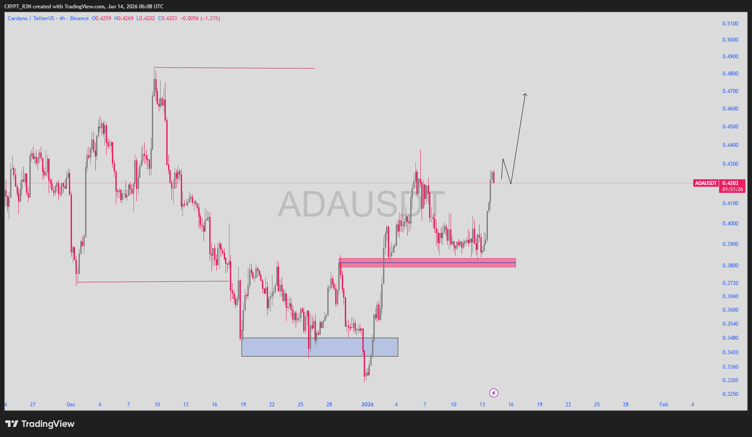

According to Cardano’s (ADA) recent crypto analysis, on-chain metrics are improving, such as the expansion of smart contracts, rising participation in decentralized applications (dApps), and stable staking activity. Cardano’s recent strength was evident after a strong rebound from the major support zone of $0.32-$0.34, which held at the end of 2025.

The recovery was supported by high trading volume, leading to a break above previous consolidation resistance and the formation of a higher bottom — a positive signal that buyers are returning. The $0.38-$0.39 zone now represents important short-term support and is crucial to keep the recovery structure intact.

At a fundamental level, the Cardano ecosystem is steadily developing. The recent increase in on-chain activity, continued work on Hydra scaling, and growing participation in DeFi and governance through Voltaire increase the usefulness of the network.

If ADA manages to maintain its momentum and break above the $0.45-$0.46 resistance, it could create room for a rise towards the $0.48-$0.50 range, supported by the appeal of the growing ecosystem.

Remittix (RTX): Utility-based growth to complement ADA’s long-term case

While Cardano is a mature and structured blockchain ecosystem, Remittix (RTX) focuses on a more pressing and practical problem: the friction between crypto and traditional finance. Remittix is designed as a crypto-to-fiat payment platform and intended for real-world use, not speculation — something that is becoming increasingly popular among investors looking for asymmetric profit opportunities.

The Remittix wallet is already available in the Apple App Store and will soon appear in Google Play — a sign of action rather than promises. Momentum is rapidly building ahead of the PayFi platform’s launch on February 9, 2026, a moment that many analysts see as a potential tipping point.

Key features of Remittix:

- Send crypto directly to real bank accounts in seconds

- Developed for cross-border payments with global reach

- Supports more than 40 cryptocurrencies and more than 30 fiat currencies

- Real-time currency conversion with transparent rates

- Audited by CertiK, which reinforces a safety-based framework

What increases the urgency: a limited 200% presale bonus is currently active, with only 5 million tokens available, of which 25% have already been sold within 24 hours. For investors weighing Cardano price expectations against higher-risk, potentially higher-reward opportunities, RTX offers exposure to real utility with a potential 100x upside — a nice complement to ADA’s slower-paced, fundamentally driven profile.

Cardano price forecast (closing thoughts): what matters most this year?

Looking ahead, analysts frame the Cardano price forecast around consistency rather than spectacle. Continued development activity, steady DeFi expansion, and broader market sentiment tied to Bitcoin’s trend will be the key drivers. In a renewed crypto bull run, ADA’s conservative design could attract capital seeking stability. In a down market, staking incentives and a strong holder base can help limit downside risk.

Discover the future of PayFi with Remittix through the project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

FAQ’s

What is turning long-term sentiment around Cardano (ADA) bullish?

Investors’ attention shifts from short-term hype to projects with strong fundamentals. Cardano’s consistent on-chain growth, development and roadmap ensure renewed confidence in the long term.

Which price levels are most important in the current Cardano price forecast?

The main support is at the $0.38 – $0.39 level after a rebound from the $0.32 – $0.34 range. A continuation of the upward move beyond the $0.45-$0.46 band could open the way to the $0.48-$0.50 range.

Is Cardano still a good investment despite the slowing price performance?

Yes. While ADA may not explode like meme coins, its gradual accumulation and staking model will appeal to long-term and institutional investors looking for returns with less risk.

How does RTX complement ADA as a long-term investment?

RTX focuses more on true crypto-to-fiat payments, with more risk and more potential reward. ADA and RTX provide stability and exposure to asymmetric growth, respectively.

Disclaimer: This article is a press release and Newsbit is not responsible for the content, accuracy or completeness of the information provided. This article does not constitute financial advice. Investing in cryptocurrencies or pre-sales involves significant risks, including the risk of losing your entire investment. Always do your own research before making any investment decisions.

Source: https://newsbit.nl/persberichten/cardano-koersverwachting-is-ada-de-beste-crypto-om-dit-jaar-vast-te-houden-nu-het-langetermijnsentiment-bullish-wordt/