The US central bank is about to cut interest rates and that is good news for Bitcoin, provided we do not get a recession. Now we have seen the labor market in the United States weaken considerably in recent months, but according to Torsten Slok (chief economist Apollo Research) we do not have to worry.

Receive a Free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 3,000 bankers, fund managers, lawyers and investors went before you!

Each Monday in Thursday receive everything you need to know about the financial markets directly in your mailbox.

The chance of a recession decreases

To support his story, Torsten Slok shares the graph below with data from Bloomberg. From this we can conclude that the chance of a recession in America and Europe is currently about 30%.

So there is indeed a chance of a recession, but it is not great. Economic growth in America is still solid and the labor market is cooling, but not yet to the point where serious fear of a recession is justified.

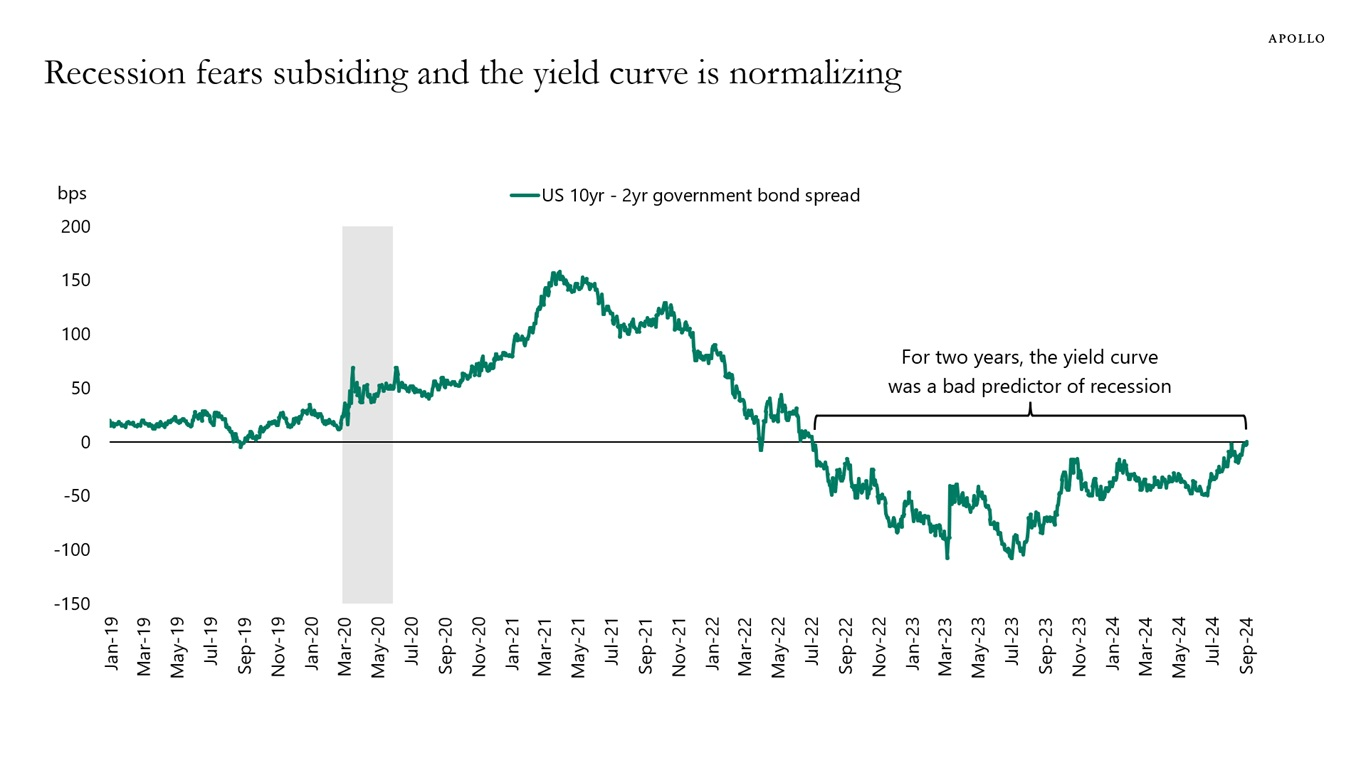

Many people say that the normalization of the yield curve (see above graph) is a signal for the beginning of a recession. In the past, this was often the case, but that is because a yield curve normalizes when a central bank starts lowering interest rates.

In many cases, there is a recession when the central bank intervenes with interest rate cuts, which is why people wrongly label the normalization of the yield curve as such a signal. Fire and the fire department are also a combination that we often see, but that does not mean that we can say that the fire department causes fires.

According to Torsten Slok, we should look at the incoming data and it “still looks fine,” the analyst said.

What does the data say?

Looking at his statements, Torsten Slok seems very convinced of the soft landingThat is to say: reducing inflation to 2.0% by the central bank, while we do not get a recession.

Why? Because according to him, the incoming data is still positive.

- Unemployment fell in August and there are no signs of slowing job growth, according to the Establishment Survey and the Household Survey.

- Wage growth accelerated to 3.8% in August, remaining well above pre-pandemic standards.

- U.S. consumer spending has accelerated in recent weeks, including on clothing, restaurants and bars, sporting goods, vehicles and parts dealers.

- Weekly retail sales data increased last week and remains solid.

- The weekly number of new unemployed people (people applying for benefits) has been declining for several weeks.

- Continuing unemployment claims (people who can’t find a job) have been declining for several weeks.

- The number of bankruptcies is decreasing.

- Well-known models still point to economic growth of 2.1%-2.4%.

- The weekly forward earnings data for S&P 500 companies is at all-time highs.

“The bottom line is that the US economy is not in recession. There are no signs of recession visible on the horizon,” concludes Torsten Slok. We can’t make it any clearer.

If he is right, that would be good news for the Bitcoin price. A recession and a bull market do not go well together. If you are still hoping for a second round of the bull market, you should definitely hope that Torsten Slok is right.

Receive a Free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 3,000 bankers, fund managers, lawyers and investors went before you!

Each Monday in Thursday receive everything you need to know about the financial markets directly in your mailbox.

Trade €10,000 for free and get €10 bonus

Want to enter the crypto world and perhaps buy Bitcoin or another crypto? Now is your chance! Thanks to a special deal between Newsbit and Bitvavo, our readers get an exclusive offer.

Create an account at Bitvavo using the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you will also pay no trading fees on your first 10,000 euros in transactions for 7 days after registering your account.* Sign up now!

*Please note that terms and conditions apply to this promotion.

Source: https://newsbit.nl/bullish-voor-bitcoin-kans-op-een-recessie-daalt/