The Bitcoin price has started off well again today and is at 58,671 dollars, an increase of 1.76% over the past 24 hours. With that, Bitcoin is doing well in the run-up to perhaps the most important day of the month of July. Tomorrow it is time for a new inflation print in the United States.

Receive a Free Financial Newsletter?

Do you want to stay informed of all developments in the financial world and learn about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,500 people went before you!

Each Monday in Thursday receive everything you need to know about the financial markets directly in your mailbox.

Tomorrow will be crucial for Bitcoin

The year 2024 started off great for the digital currency, until inflation in the United States started to rise. This made people fear a second wave of inflation, which caused the Federal Reserve to postpone the interest rate cuts.

Where the market at the beginning of the year still believed in 6 interest rate cuts, that expectation completely collapsed to 0-1. Inflation is now starting to fall again and optimism is slowly returning, which may also give Bitcoin the energy to start the second part of the bull run.

Jerome Powell, the chairman of the US central bank, said yesterday that the US economy is no longer overheated. That is a good sign, because it means that the Federal Reserve is also seeing that their interest rate hikes are having an effect.

Last month inflation was also lower than expected, but that was still too little for Powell to talk about rate cuts. Powell and the Federal Reserve want confirmation and they can get it tomorrow with the new consumer price index in America.

Economy weakens, unemployment rises

The chart below sums up the year for Bitcoin nicely. What we see here is the Citi Surprise Index; a positive score indicates stronger than expected economic data and vice versa.

At the start of 2024, economic data suddenly came in stronger than expected, resulting in higher inflation prints. Now, however, we see the index starting to nosedive, indicating a cooling of the US economy and inflation.

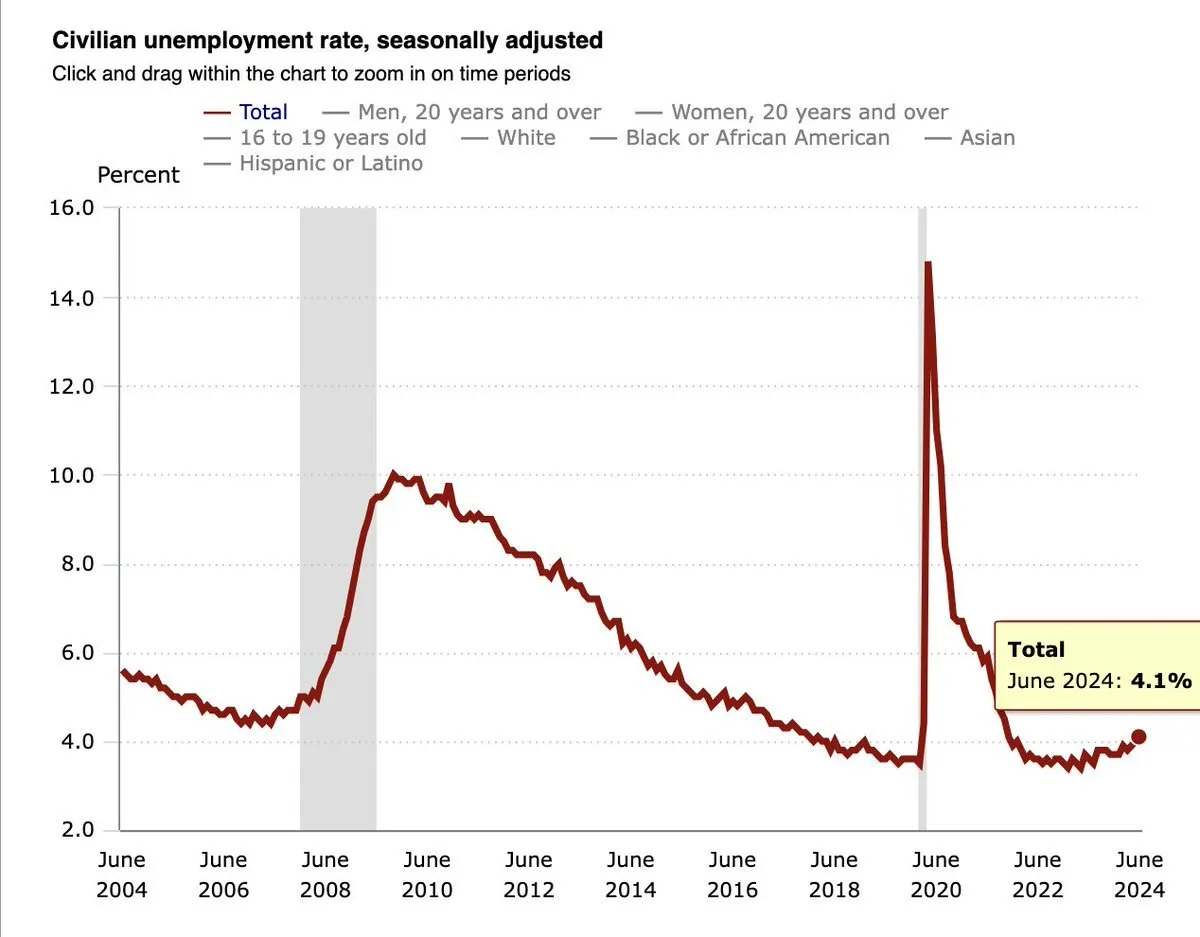

On Friday, unemployment came in higher than expected at 4.1% and job growth for both April and May was revised down significantly. These are further signs that inflation is starting to come down, which is positive for Bitcoin.

With the big caveat that the economy should not start a huge nosedive now, because a recession would not help Bitcoin. Jerome Powell also said something about that yesterday.

Powell and the Federal Reserve realize that they should not start cutting rates too late. All in all, a very exciting period is coming for the financial market.

Receive a Free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,500 people went before you!

Each Monday in Thursday receive everything you need to know about the financial markets directly in your mailbox.

Trade €10,000 for free and get €10 bonus

Want to enter the crypto world and perhaps buy Bitcoin or another crypto? Then seize your chance now with this exclusive offer! Thanks to a special deal between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers get an exclusive offer.

Create an account at Bitvavo using the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you also pay no trading fees on your first 10,000 euros in transactions. Sign up now!

Source: https://newsbit.nl/bitcoin-stijgt-in-aanloop-naar-belangrijkste-dag-van-juli-2024/