Bitcoin price shot up to $66,000 today and positive momentum seems to be back. On July 5, Bitcoin reached a bottom of $53,500 and 12 days later we are more than $12,500 higher for an increase of 23.36%.

Why is Bitcoin rising so much right now?

Receive a Free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,500 people went before you!

Each Monday in Thursday receive everything you need to know about the financial markets directly in your mailbox.

High time for a rise?

First, macroeconomic conditions have been improving for Bitcoin for weeks. Inflation in the United States is cooling, as is the labor market and the overall economy. This brings the Federal Reserve’s rate cuts closer.

We started this year with an impossibly high level of optimism about the Federal Reserve’s interest rate policy. According to the futures market, the Fed would make 6-7 rate cuts in 2024.

However, during the first quarter inflation started to rise and that optimism disappeared like snow in the sun. Suddenly analysts were speculating about new interest rate hikes again.

Inflation is now falling again, the US economy is cooling and everyone is becoming optimistic again about the Federal Reserve’s interest rate policy.

In that context, it was already strange that Bitcoin performed so poorly in recent weeks. Especially when you consider that stocks did make big returns. The chart above shows how Bitcoin performed dramatically in recent weeks compared to stocks and gold.

What to Expect from Bitcoin in the Second Half of 2024?

What we can expect from Bitcoin in the second half of 2024 is of course difficult to say in advance. Fundamentally, things currently look mostly positive.

Bitcoin finally seems to be responding to the positive development of the macroeconomic picture and the potential election of Donald Trump also seems positive for the digital currency in theory. Donald Trump is known for his “Trumponomics”, which in short means low interest rates and paying little tax.

Across the board, central banks appear to be gearing up for a new cycle of rate cuts. The pace of this will depend on inflation, of course, but also on the health of the economy.

If the US economy cools down very quickly, then interest rates may have to come down a bit faster. That is a scenario that is still possible. The prospect of these interest rate cuts is driving up government bond prices.

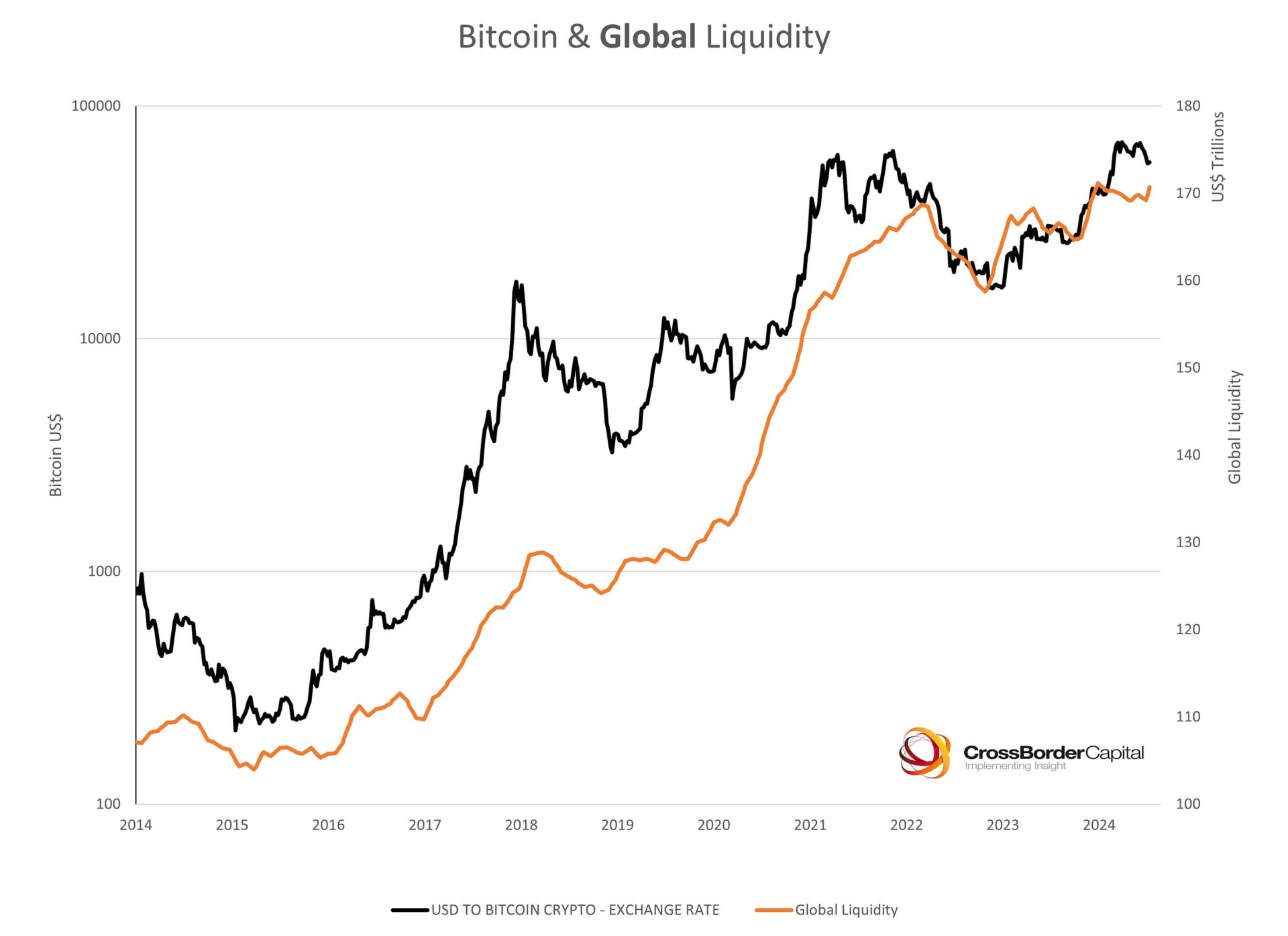

These government bonds often serve as collateral for loans (credit creation/money creation) and the increase in the value of these bonds is good for global liquidity – the amount of capital in the financial system available for investment.

If it continues to rise (orange line), this could lead to spectacular developments in the market during the second half of 2024. Basically, I am bullish on Bitcoin and stocks for H2 2024. That would change if the economy slides towards a recession.

Receive a Free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,500 people went before you!

Each Monday in Thursday receive everything you need to know about the financial markets directly in your mailbox.

Trade €10,000 for free and get €10 bonus

Want to enter the crypto world and perhaps buy Ethereum or another crypto? Then seize your chance now with this exclusive offer! Thanks to a special deal between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers get an exclusive offer.

Create an account at Bitvavo using the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you also pay no trading fees on your first 10,000 euros in transactions. Sign up now!

Source: https://newsbit.nl/bitcoin-koers-schiet-naar-66-000-blijven-we-nu-stijgen/