Disclaimer: This article is a press release and Newsbit is not responsible for the content, accuracy or completeness of the information provided. This article does not constitute financial advice. Investing in cryptocurrencies or pre-sales involves significant risks, including the risk of losing your entire investment. Always do your own research before making any investment decisions.

Gold blinked first. On October 21, gold prices fell more than 5%—the biggest daily decline since 2013—after months of uninterrupted strength. Crypto investors around the world were getting ready to go long as gold always leads the way, with BTC following suit about ninety days later.

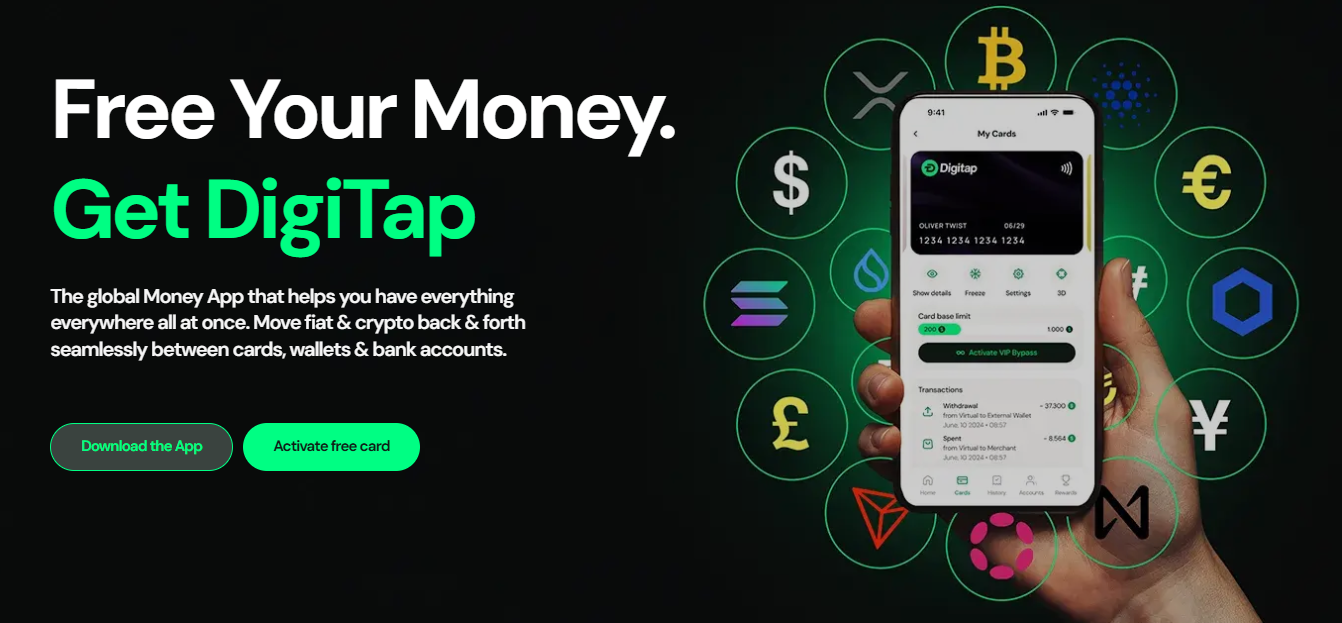

Gold leads during turmoil, then Bitcoin starts to sprint. XRP is back in the conversation, quietly approaching $2.50, but the strongest setup is surprisingly a presale. Digitap ($TAP) is breaking records daily as the stories surrounding stablecoins and banking innovation gain momentum. This could well be the consumer product that attracts billions in global flows.

Here’s what investors need to know.

Will gold pass the baton to Bitcoin?

Investors who have lived through multiple cycles know this scenario. Gold is on a long-term rally, followed by Bitcoin with a delay. The current price movements fit perfectly into this pattern. With gold retreating after reaching extremely overbought levels, history suggests it’s time for BTC to gain momentum.

One should not become too bearish on gold; it just experienced its biggest daily decline in more than a decade. But the most important thing to monitor now is how BTC behaves from here. It’s time for Bitcoin to overtake gold and equities on a risk-adjusted basis, and the case for going long BTC now is strong.

BTC/Gold: ready for a rebound?

The BTC/Gold chart is creating a lot of optimism as it appears to be forming a bottom at the same level as in April, just before Bitcoin exploded. While price targets range from cautious consolidation to ambitious multiples, almost no one denies that a position in BTC currently looks more attractive than in gold.

But the bigger question is: what comes next after BTC? If Bitcoin makes a new peak, it would fit perfectly within the four-year cycle and a blow-off top in Q4. And while many Ripple proponents are now shouting that XRP is the best bet, Digitap represents the same investment idea—but on a completely different level.

Stablecoin adoption reaches new heights

In the previous cycle, layer ones were the kings—tech innovations that powered the rest of the market. This cycle, stablecoins are at the helm. The Trump administration’s pro-innovation and accelerator stance aims to expand the reach of the dollar and modernize the settlement system, with stablecoins as its main weapon.

Smart investors can already see where this is going, which explains the huge influx into the Digitap presale. Platforms that can integrate fiat and stablecoin balances into one system will be the winners. Anything related to stablecoins will likely be among the best performing assets of the year. 2025 will be the year of the stablecoin. The total inventory is heading into the trillions, creating many side opportunities.

Digitap: an omni-bank for real financial applications

Digitap is built for a digitally oriented world. The platform works with a multi-rail settlement system that brings together fiat balances, stablecoins and crypto in one dashboard. Payments and transfers can be sent via public blockchain networks or banking corridors, whichever is faster or cheaper at the time.

Users can exchange crypto to fiat in real time, and use their on-chain balance to pay in real life with a Visa card. Conversions take place at the point of execution, with Digitap’s smart routing engine automatically finding the best price.

The interface is deliberately familiar—now available on desktop and iOS—and reminiscent of a neo-bank. Under the hood of Digitap’s omni-banking model is a clear ambition to offer customers something familiar and reliable, while at the same time enjoying the benefits of blockchain infrastructure.

In many ways, Digitap is a consumer gateway to stablecoins. And this type of application will likely lead the next wave of crypto adoption.

Why BTC and XRP are losing to the Digitap setup

Bitcoin is the ultimate store of value—but even if it rises to $250,000 this cycle, that’s only 2X and a bit. XRP’s value proposition is being undermined by stablecoins, which provide a better solution for cross-border payments. But Digitap, as an interoperability layer, can onboard any new stablecoin chain.

Digitap chooses to compete on user experience and tokenomics. The native $TAP token seems to be one of the best crypto coins to buy right now, given its current price of $0.0194 and the fact that 50% of platform profits are used to reduce the total supply via token burns. This means: more Digitap use leads to positive price evolution.

While everyone is cheering BTC from the sidelines, the difference in upside potential between digital gold and the omni-bank of the future is clear at this level.

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Disclaimer: This article is a press release and Newsbit is not responsible for the content, accuracy or completeness of the information provided. This article does not constitute financial advice. Investing in cryptocurrencies or pre-sales involves significant risks, including the risk of losing your entire investment. Always do your own research before making any investment decisions.

Source: https://newsbit.nl/bitcoin-moet-zich-bewijzen-nu-goud-terrein-verliest-xrp-stieren-terug-in-het-spel-waarom-beiden-verliezen-van-digitap-tap/