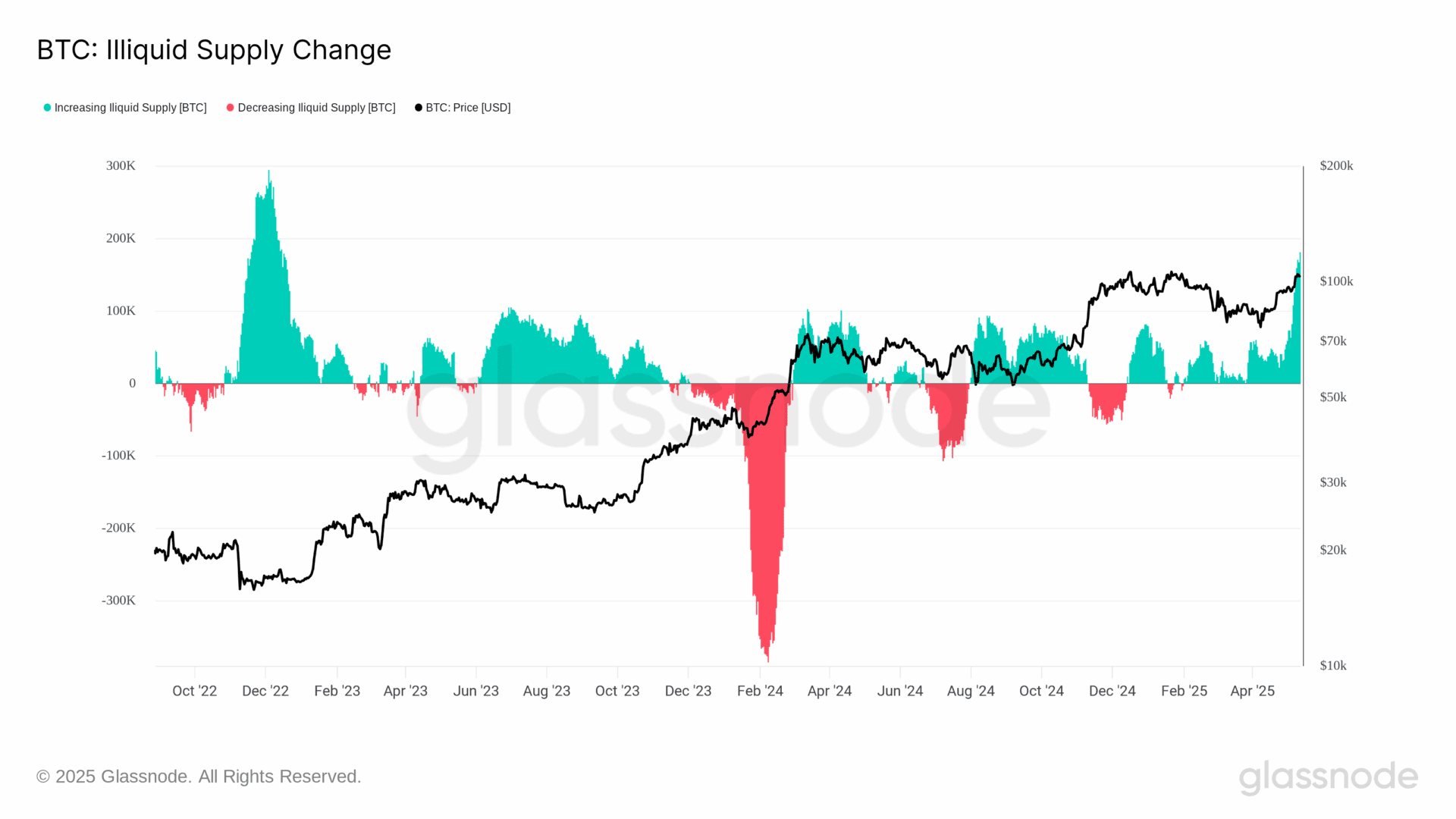

New data from Glassnode tells us that more and more Bitcoin qualify as “Not Liquid.” An entity is seen as an illiquid if the relationship between purchases and sales is below a certain value. So if an entity has made significantly less sales than purchases, which indicates that it is a long -term investor.

At the moment, the illiquid stock from Bitcoin has increased to 14 million pieces, which is an absolute record for this bull market.

An absolute record for Bitcoin

And that record is a good sign, because that means that more and more Bitcoin are finding their way to individuals or entities who are not planning to sell in the short term. Unless of course there is a good price, because in the end everyone has a price.

“Liquidity is therefore the extent to which an entity issues the Bitcoin received. Illiquid entities are those who accumulate coins, awaiting a long -term price increase of Bitcoin,” said Glassnode about this concept.

This week the Illiquide Supply from Bitcoin arrived at 14 million pieces, and the 30-day rolling average was at an increase of 180,000 BTC. That marks the biggest leap since December 2022.

At that time, a dark bear market came to an end, in which Bitcoin fell by 77% to find a bottom of just over 15,000 dollars.

The market cycle of rich investors

This market cycle is a special one, because we see for the first time in Bitcoin’s history that large investors dominate. Previously, Bitcoin was in particular an asset for private individuals, and that has been completely reversed lately.

Now it is the so -called “whales” that largely determine the rhythm of the market. Then you have to think, for example, of large companies that buy Bitcoin with millions of dollars at the same time. And the Bitcoin ETFS are also doing a big contribution.

The striking thing about the last month, for example, is that private individuals mainly dump their bitcoin, while Whales and Sharks, accounts with 10 to 10,000 bitcoin, were in the purchase mode.

Source: https://newsbit.nl/bullmarkt-record-14-miljoen-bitcoin-zijn-niet-meer-liquide/