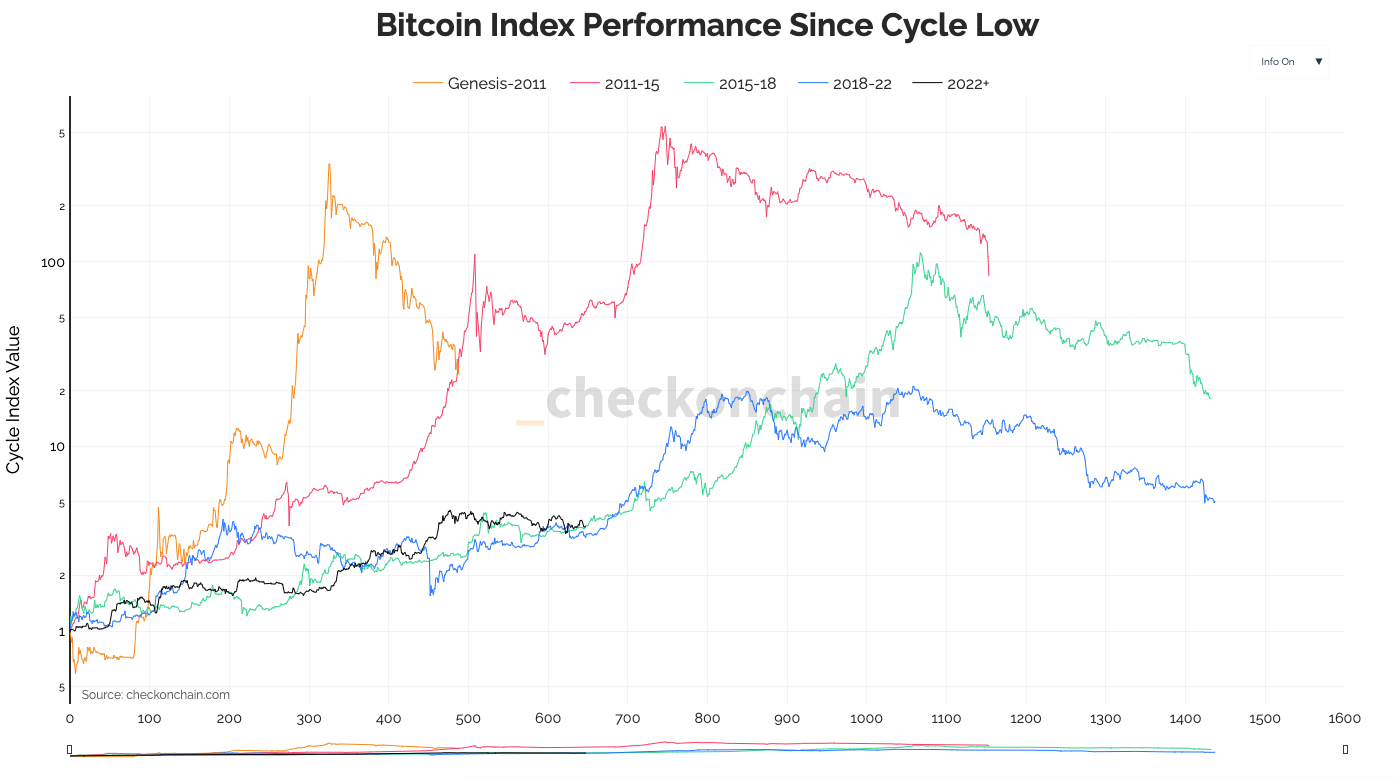

Since reaching its all-time high of $73,800 in March 2024, Bitcoin has been in a downward spiral. We are now at a point where many people are wondering if we are still in a bull market. The answer lies in the chart below from CheckOnChain.

Is the Bitcoin bull market over?

The year 2024 started strong. Of course, primarily driven by the launch of the Spot Bitcoin ETFs in the United States, combined with the fact that BlackRock associated its name with it. BlackRock, the largest asset manager in the world, almost became a standard-bearer for the Bitcoin ETFs in America.

This was partly due to BlackRock CEO Larry Fink, seen by many as the most powerful man in the financial world, suddenly becoming bullish on the digital currency. These two things together caused the narrative around Bitcoin to start changing.

Before the introduction of the Spot Bitcoin ETFs in America, many larger/serious investors still saw the digital currency as a nonsensical and purely speculative asset. Many have since changed their minds thanks to BlackRock’s advertising campaign.

Anyway, that’s why Bitcoin had an exceptionally successful first half of 2024, and we saw an all-time high earlier than ever during the cycle. We can see that in the chart below (black represents the current cycle).

Now the Bitcoin price has been dangling around 60,000 dollars for weeks and the sentiment is sometimes dramatic. But if you look at the two previous cycles, then there is not much going on. Bitcoin is “on track” if you compare the current price performance with that of the past.

Patiently waiting for the coming months

We are now entering a period where central banks around the world are going to cut interest rates. In theory, this is bullish for Bitcoin and other risk assets, because it encourages credit creation and makes it less attractive to invest in government bonds.

Unless there is a recession. That many people in the market are still afraid of that became clear on August 5. On that day, the market crashed after a weak jobs report from the United States.

For now, however, the economic data seems so strong that the chance of a recession is not very big. But then again, that is something we have seen before in the years before a recession.

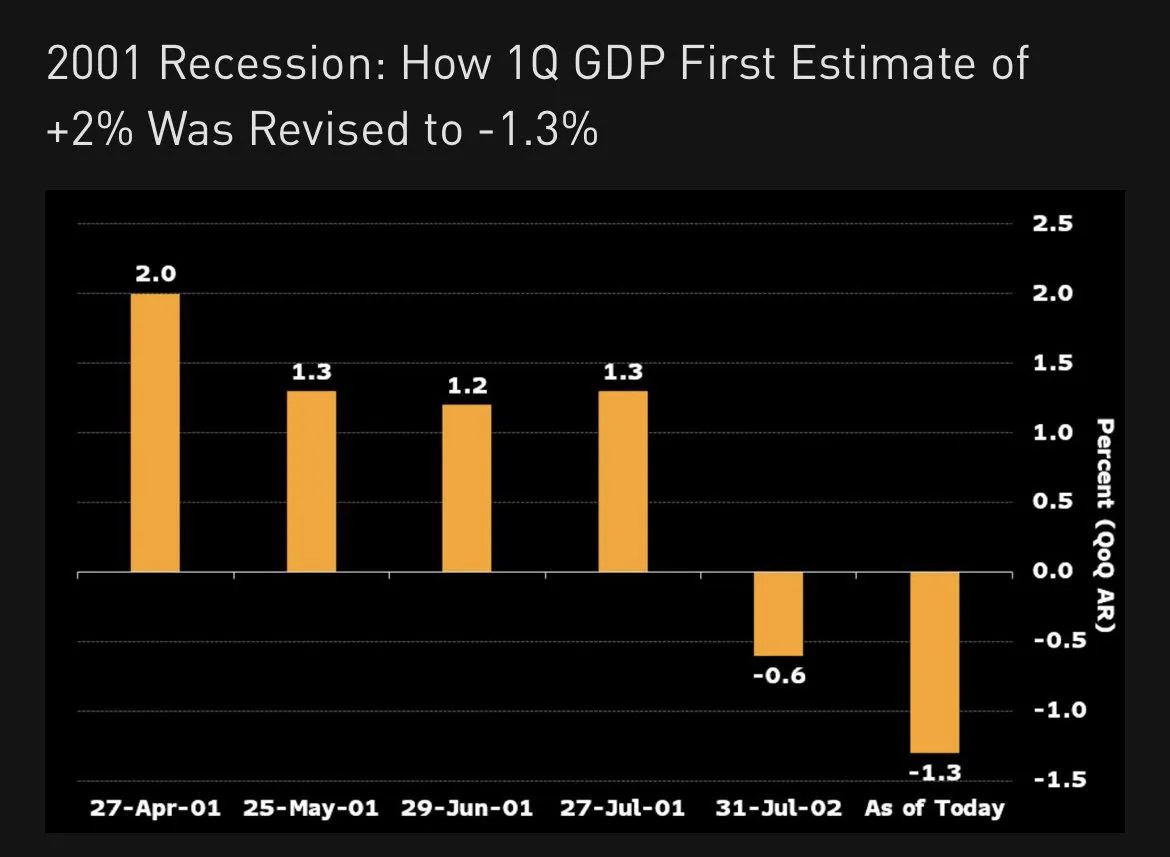

Often it seems like the economy is doing well, but there is something bubbling under the hood. The above graph of economic growth for Q1 2001 in the United States (dotcom bubble).

Initially, economic growth for Q1 2001 came in at +2.0%. However, that score was eventually revised to -1.3%. So a lot can change after a few months.

Trade €10,000 for free and get €10 bonus

Want to enter the crypto world and perhaps buy Bitcoin or another crypto? Now is your chance! Thanks to a special deal between Newsbit and Bitvavo, our readers get an exclusive offer.

Create an account at Bitvavo using the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you will also pay no trading fees on your first 10,000 euros in transactions for 7 days after registering your account.* Sign up now!

*Please note that terms and conditions apply to this promotion.

Source: https://newsbit.nl/bitcoin-in-moeilijkheden-maar-uitzoomen-belangrijk/