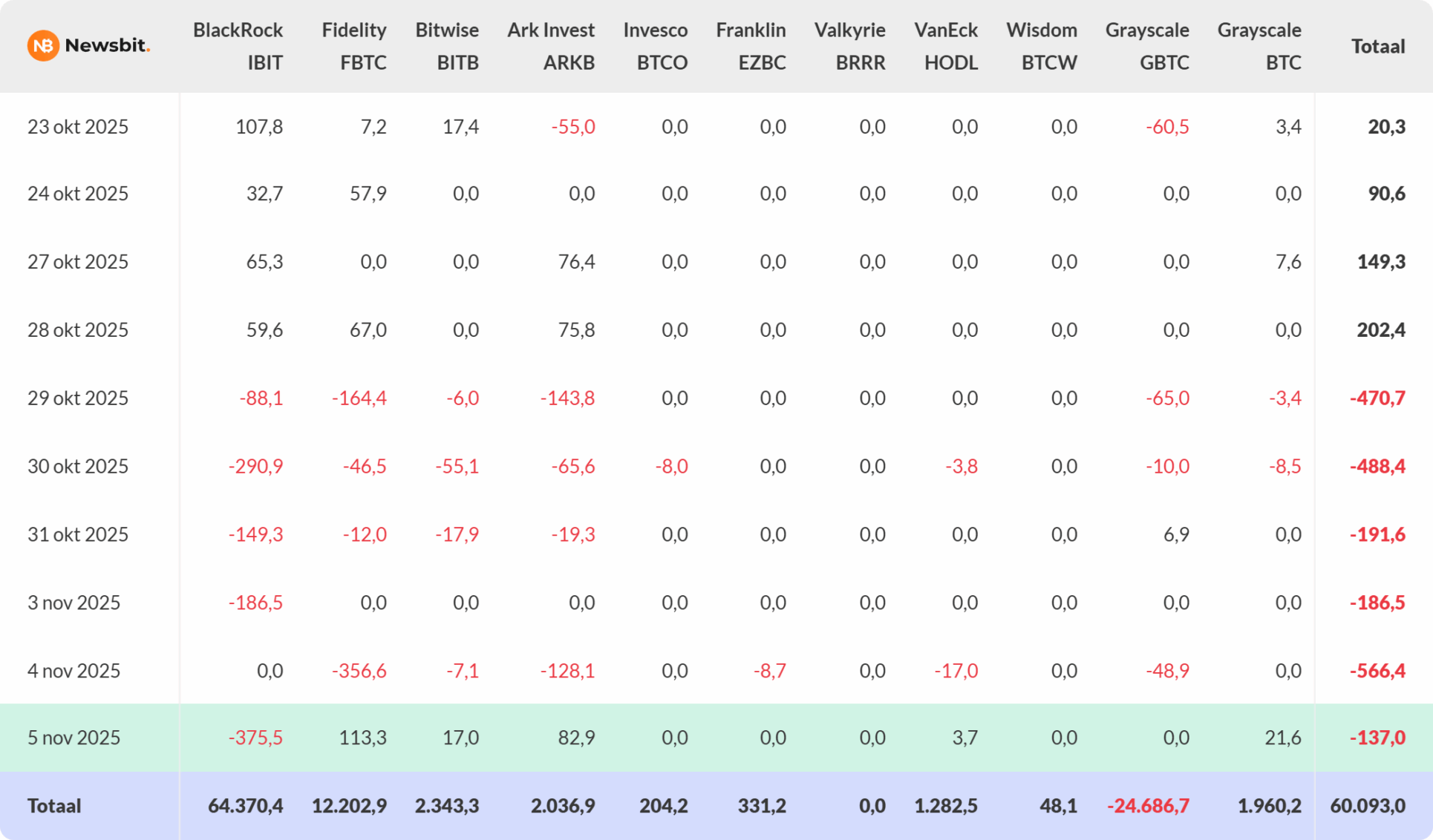

The American Bitcoin (BTC) ETFs had to say goodbye to $2 billion in capital last week. This was the second worst series in the history of ETFs. On Wednesday, another $137 million flowed out of Bitcoin ETFs.

Loss of $2 Billion for Bitcoin ETFs

The bleeding started on October 29 and resulted in a loss of $2.04 billion for the time being. The biggest day came on Tuesday, when investors pulled $566 million from the ETFs.

That amount followed previous loss-making sessions of $470 million, $488 million and $191 million. Only in February were the losses greater. Back then it was a $3.2 billion capital loss in one week.

Despite the losses, the bottom line still sees total inflows of more than $60 billion for Bitcoin ETFs since they came to market in January 2024. In that respect we can still speak of a successful expansion of the industry.

The Ethereum ETFs are also bleeding

It’s not just Bitcoin that has problems when it comes to ETFs. Ethereum is also doing less well in the United States. An outflow of $118.5 million was recorded there on Wednesday.

This brings Ethereum’s negative streak to six days, in which almost $1.2 billion in capital was withdrawn from the funds. Despite these outflows, cumulative inflows still stand at $13.9 billion for Ethereum funds.

It is striking that Solana’s ETFs are the only ones that still manage to record positive flows. Another $9.7 million flowed in on Wednesday. Since launch, these ETFs now have positive flows of $294 million.

Source: https://newsbit.nl/bitcoin-etfs-bloeden-en-verliezen-2-miljard-in-dramatische-reeks/