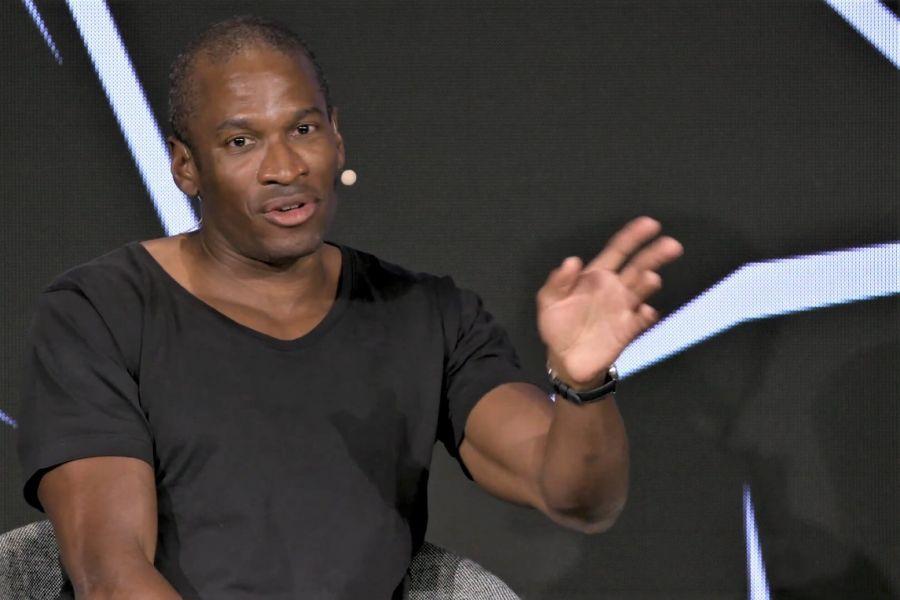

Arthur Hayes, co -founder of Bitmex, has made a daring prediction about the future of Bitcoin (BTC). According to him, BTC will first go through a considerable correction before it can realize an astronomical rise at the end of 2025. But how realistic is this scenario?

Short term: correction to $ 70k $ 75k

In a recent blog post, Hayes predicted that Bitcoin can undergo a 30% correction in the short term, which would reduce the price to $ 70,000- $ 75,000.

“I think it is more likely that Bitcoin will first fall to $ 70,000 $ 75,000 and then rises to $ 250,000 towards the end of the year than we continue to rise without a significant relapse.”

This price range marks the peak of 2024 and is a crucial level of support. In earlier cycles, Bitcoin often first tested the peak of the previous year in the post-necking year. Despite this expected dip, Hayes remains positive about the long term and he eventually sees BTC rising to $ 250,000 by the end of 2025.

But what would this downward movement cause?

Influence of inflation and rising bonds

Hayes points to rising inflation and a deteriorating macro-economic situation as the main causes for the expected correction:

“Inflation is still high and will probably continue to rise in the short term, since the world economy reveals itself. That is why I expect that the 10-year interest rate will rise. Shares will fall. “

The interest on US government bonds plays an important role in this. Because inflation remains stubborn, the Federal Reserve will be forced to uphold the interest. This would not only turn out to be negative for Bitcoin, but also for the stock market, with which BTC has shown a strong correlation in recent months.

The 30-day Pearson correlation between Bitcoin and US shares is currently 0.70, which means that a stock market crash will probably also cause a sharp fall in the BTC price.

Long -term vision: Bitcoin to $ 250,000?

Despite the imminent correction, Hayes sees enormous opportunities for Bitcoin in the long term. He predicts that a possible financial crisis could lead to a new round of quantitative relaxation (QE) in 2025, in which central banks again print money to support the economy.

According to Hayes, there is a 60% chance that the FED will switch to a relaxing policy in the first half of 2025. This could result in extra liquidity on the markets, which is historically bullish for Bitcoin. The Bullmarkt of 2021 coincided, for example, with a period of aggressive QE.

Another indicator that Hayes quotes is Bitcoin’s ‘Everything Indicator’, which measures factors such as miner profit, money supply and network growth. Based on this data, he states that Bitcoin is only halfway through the bull market. The current indicator value is above 50, while earlier cycle tops were only reached above 80.

According to him, if Hayes is right and central banks actually open the money tap, Bitcoin could break the $ 250,000 limit by the end of 2025.

Claim € 10 free today and do not pay trading costs over the first € 10,000!

Grab this unique opportunity with Newsbit and Bitvavo by creating an account now via the button below. Only deposit € 10 and receive € 10 free of charge. Moreover, you can act without costs for 7 days over your first € 10,000 in transactions. Start today and take advantage of the growing popularity of Crypto!

Make your account and claim € 10 for free.

Don’t miss this opportunity to take advantage of the growing popularity of Crypto!

Source: https://newsbit.nl/bitcoin-crash-op-komst-bitmex-oprichter-voorspelt-eerst-daling-naar-70k-daarna-explosie-naar-250k/