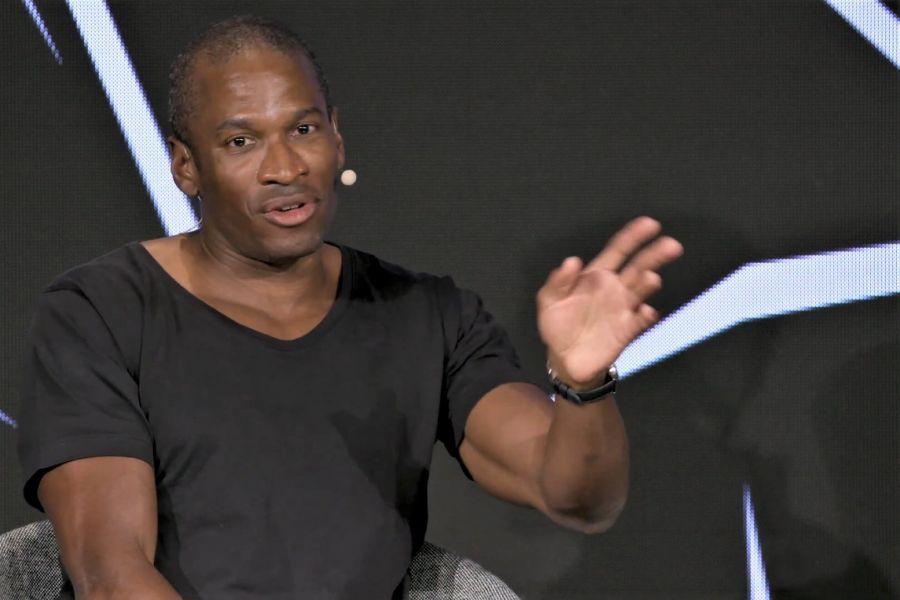

The crypto market is under pressure and striking on-chain transactions by BitMEX founder Arthur Hayes are causing additional unrest. Hayes sent almost 1,500 Ethereum and more than 2.4 million dollars worth of altcoins to trading platforms in a short time. Why he is doing this is still unclear, but the timing coincides exactly with increasing fear of a new downward phase in the market.

Arthur Hayes moves almost 1,500 ETH

According to data shared by Lookonchain on X, Arthur Hayes may have sold thousands of Ethereum (ETH) in a short period of time. This concerns a total of 780 ETH worth about $2.48 million that he sent to exchanges, followed by another 700 ETH ($2.22 million) to market maker B2C2 Group. Analysts suspect the transfer was intended to sell.

In addition, Hayes wallets dumped positions in multiple altcoins, including Ethena (ENA), Lido (LDO), Aave (AAVE), Uniswap (UNI) and EtherFi (ETHFI). In total, more than $2.4 million worth of tokens were sold.

Hayes does not seem convinced that the bull market will last and is taking his chances. There is also great uncertainty among experts. On the one hand, several indicators point to the end of the bull market, on the other hand, there are signals that point to possible upcoming fireworks.

Is the bull market over?

The first worrying sign that the bull market may be coming to an end is that Bitcoin (BTC) has fallen below the 50W SMA (50-week Simple Moving Average). This is the average price point of the past 50 weeks. Historically, this often marks the end of a cycle.

Bitcoin also historically moves in a four-year cycle, with the digital currency typically peaking 500 to 550 days after the halving. We are now more than 570 days further. Many analysts therefore think that the bull market is nearing an end.

Yet the situation is different than in previous cycles. Analysts such as Brendonicus point to the influence of the monetary cycle. Brendonicus shows how the Bitcoin price compares to periods of quantitative easing (QE) and quantitative tightening (QT). With QE, the central bank pumps extra money into the economy, while with QT money is removed from the system. It is striking that Bitcoin historically shows strong increases as soon as the policy turns to QE.

There are signs that the Federal Reserve (Fed) may end the current period of quantitative tightening. Fed Chairman Jerome Powell indicated that the central bank’s balance sheet reduction will end on December 1, 2025. That would leave the door open for new QE policies.

Source: https://newsbit.nl/arthur-hayes-dumpt-miljoenen-aan-ethereum-en-altcoins-nieuwe-klap-voor-wankele-markt/