This week, US inflation came in lower than expected again. Initially, the market cheered, as evidenced by the Bitcoin price that shot up to $59,500. Not long after, Bitcoin dropped back to $57,000, while the chance of more rate cuts from the US central bank has increased.

How is it possible that Bitcoin is under pressure, while the macroeconomic climate seems to be improving? Could the rate cuts also be bearish for Bitcoin?

Receive a Free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,500 people went before you!

Each Monday in Thursday receive everything you need to know about the financial markets directly in your mailbox.

Are Rate Cuts Bearish for Bitcoin?

In theory, a rate cut is positive for Bitcoin, with the caveat that it would require a soft landing for the economy.

If the rate cuts come because the economy and inflation are cooling at far too fast a pace, that could also be a signal for investors to move into more defensive assets.

It’s not for nothing that we’ve seen gold and government bonds perform well in recent days. Markus Thielen of 10x Research confirms this: “If the rate cuts are only because inflation is falling, that’s bullish for Bitcoin in the short term. But if the rate cuts are because the Federal Reserve is worried about economic growth, that’s a different story.”

Historically, Bitcoin has performed best when the Federal Reserve paused its rate hike cycle. The arrival of the first rate cut has generally been less well-received. In 2019, for example, Bitcoin surged 19% after the first rate cut, only to give back all of those gains two weeks later.

Now, the interest rate cuts in 2019 did come because of concerns about the health of the economy. Hopefully, that won’t be the case in 2024. For now, the US economy seems strong enough.

Crucial weeks for Bitcoin

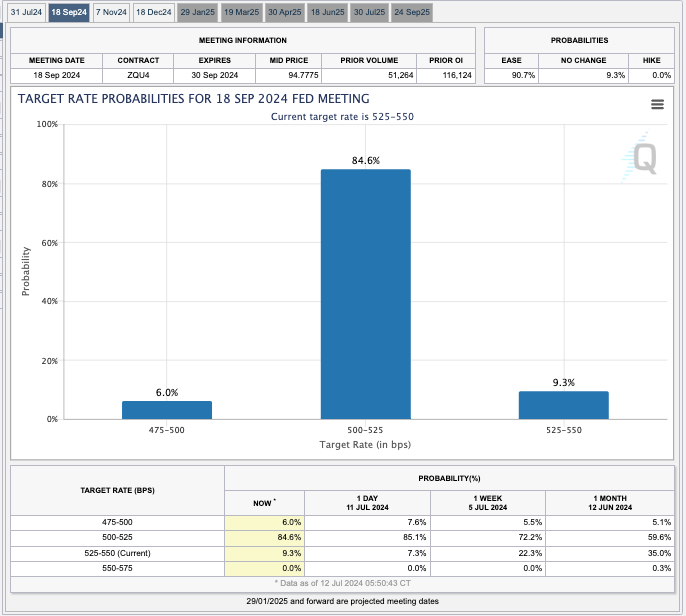

The coming weeks should show how good this “change of narrative” is for Bitcoin. We see the US economy, inflation and the labor market cooling down. As a result, a rate cut on September 18 is now 90.4% certain according to the futures market, which is bullish in theory.

Where we suddenly saw rising inflation in the United States in Q1 2024, causing the rate cuts we were hoping for to melt away like snow in the sun, they are now starting to return.

Unfortunately, we now see investors jumping to “safe assets” such as gold and government bonds. If interest rates come down aggressively, which investors now seem to be betting on, then the prices of those government bonds will rise sharply.

For that reason, Bitcoin and tech stocks may have a bit of a hard time in the coming weeks. In that respect, it is important to keep a close eye on these developments, which I do twice a week in my free newsletter called De Geldpers.

Receive a Free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,500 people went before you!

Each Monday in Thursday receive everything you need to know about the financial markets directly in your mailbox.

Trade €10,000 for free and get €10 bonus

Want to enter the crypto world and perhaps buy Bitcoin or another crypto? Then seize your chance now with this exclusive offer! Thanks to a special deal between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers get an exclusive offer.

Create an account at Bitvavo using the button below and receive a welcome gift of 10 euros completely free. And that’s not all – you also pay no trading fees on your first 10,000 euros in transactions. Sign up now!

Source: https://newsbit.nl/zijn-renteverlagingen-wel-bullish-voor-bitcoin/