If the SUS is already challenging, imagine a country without an accessible healthcare system while insurers increase costs and deny coverage

Health insurance costs are largely outpacing inflation, leaving more consumers burdened each year with thousands of dollars in out-of-pocket expenses. At the same time, some insurers are rejecting nearly 1 in 5 claims. This double whammy leaves Americans paying more for coverage but often feeling like they’re getting less in return, experts say.

Frustration over denials and high medical costs has fueled a wave of criticism against health insurance companies following the assassination of UnitedHealthcare CEO Brian Thompson. Also last week, a similar protest caused Anthem Blue Cross Blue Shield to reverse a decision to limit coverage of anesthesia during surgeries.

Anger may be rooted in fear that unexpected medical costs could be financially devastating, as well as concern that essential care could be denied by an insurer, putting the health and well-being of those who need it at risk.

In fact, most adults say they worry about their ability to pay for unexpected health care or medical bills, a sentiment shared by people regardless of whether they are financially comfortable or struggling, according to a KFF survey earlier this year. .

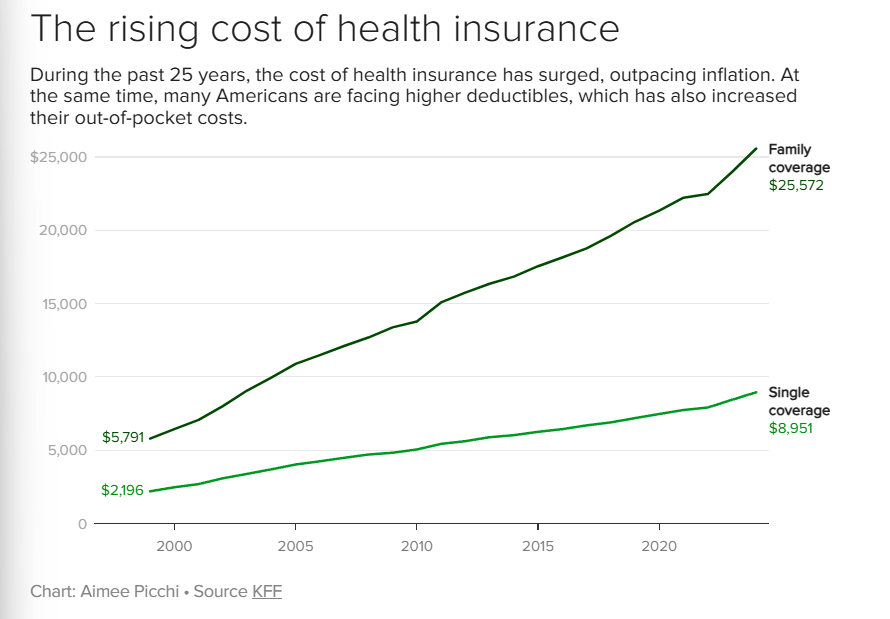

In 2024, the average health insurance premium for families was priced at $25,572 per year, while single workers paid an average of $8,951, representing a 6% and 7% increase over the previous year, KFF data shows . Since 2000, the rise in health insurance premiums has outpaced inflation for all but a handful of years, the health policy research firm found.

“Unhappiness with insurance companies comes from two things: ‘I’m sick and I’m being inconvenienced,’ and the second is much more costly — ‘I’m paying more than I used to, and I’m paying more than my salary has increased,’” he said. Rob Andrews, CEO of the Health Transformation Alliance, a cooperative representing large companies like American Express and Coca-Cola that works to improve health insurance for its employees. “A lot of people feel like they’re getting less” from their insurers, Andrews said.

And while Americans have unfortunately faced other types of inflation in recent years — sky-high food prices were responsible for helping President-elect Donald Trump to victory last month — health insurance can take on an even more personal character, Thomas highlighted.

“It’s not like, ‘How much do I have to pay for a lawn chair or a steak,’” Andrews noted. “People are sick or have some kind of health problem that they are worried about.”

Of course, people with employer-sponsored health insurance typically don’t pay the full premium, since their employers will foot much of the bill.

However, KFF data shows that employees’ share of premiums is also rising, with a worker with family coverage typically paying premiums of $5,700 per year in 2017, the most recent year for this data, up from about U.S. $1,600 in 2000, KFF data shows. The average family deductible — the amount paid out of pocket before insurance kicks in — increased from $2,500 in 2013 to $3,700 in 2023, according to KFF.

About 81% of Americans said last year they were dissatisfied with the cost of health care in the U.S., the highest level in 16 years, according to a Gallup poll.

“We have reached a point where health care is so inaccessible and unaffordable that people are justified in their frustrations,” said Dr. Céline Gounder, CBS News medical contributor and public health editor-in-chief of KFF Health News, told CBS Mornings on Friday.

Health Insurance Denials

In addition to rising health insurance costs, Americans are also expressing anger over coverage denials, which a KFF analysis of nonqualified group health plans in 2021 found impacted nearly 1 in 5 claims. However, their study found that denial rates varied considerably by insurer, with some as low as 2% while others were as high as 49%.

“When you pay for something and they don’t give you the money and keep raising the prices, of course you’re going to be frustrated,” noted Holden Karau, a software engineer who created a free service called Fight Health Insurance to help people appeal of their denials.

Karau says she created the app, which uses AI to draft appeal letters, after her and her dog’s experience with insurance. Her pet insurance company initially refused to pay for anesthesia for her dog’s root canal, while Karau, who is transgender, said she dealt with many appeals to have her own procedures and surgeries covered by her insurance.

More insurance companies are using AI to review claims and issue denials, which isn’t always obvious to consumers. The shift to AI-based reviews has sparked lawsuits against insurers, with UnitedHealthcare sued last year by the families of two now-deceased customers who alleged the insurer knowingly used a faulty algorithm to deny elderly patients coverage for long-term care deemed necessary by their doctors. .

“With AI tools on the insurance side, they have very few negative consequences for denying procedures,” Karau added. “We are seeing really high denial rates triggered by AI. And on the patient and provider side, they don’t have the tools to fight back.”

Most people may not be aware that they have the right to appeal a denial, Karau noted. Most people who get hit with a denial or billing error don’t dispute it, a study found earlier this year. For those who do, a first appeal will be handled by the insurance company, but if that internal appeal is also denied, you have the right to have an independent reviewer review your claim, according to the National Association of Insurance Commissioners.

“There are several levels of appeal, and in my experience, I would say it’s important to appeal until you at least get to an independent reviewer,” Karau said. “If you don’t appeal, you won’t get the care you need.”

By Aimee Picchi, associate managing editor at CBS MoneyWatch, where she covers business and personal finance. Previously, she worked at Bloomberg News and wrote for national news outlets including USA Today and Consumer Reports.

Source: https://www.ocafezinho.com/2024/12/10/americanos-enfrentam-custos-crescentes-e-negacoes-no-seguro-saude/