The silver price is again going in all directions. After a rapid increase from 72 to over 116 dollars in a few weeks, the price has now fallen back to approximately 85 dollars.

Meanwhile, the crypto-based prediction market Polymarket is abuzz with speculation about where silver will end up at the end of February. The results cause a surprising amount of confusion.

Through Bitpanda, Dutch people can now respond to a possible silver increase by claiming 15 euros worth of silver for free when creating an account.

Confusion on Polymarket about silver prices

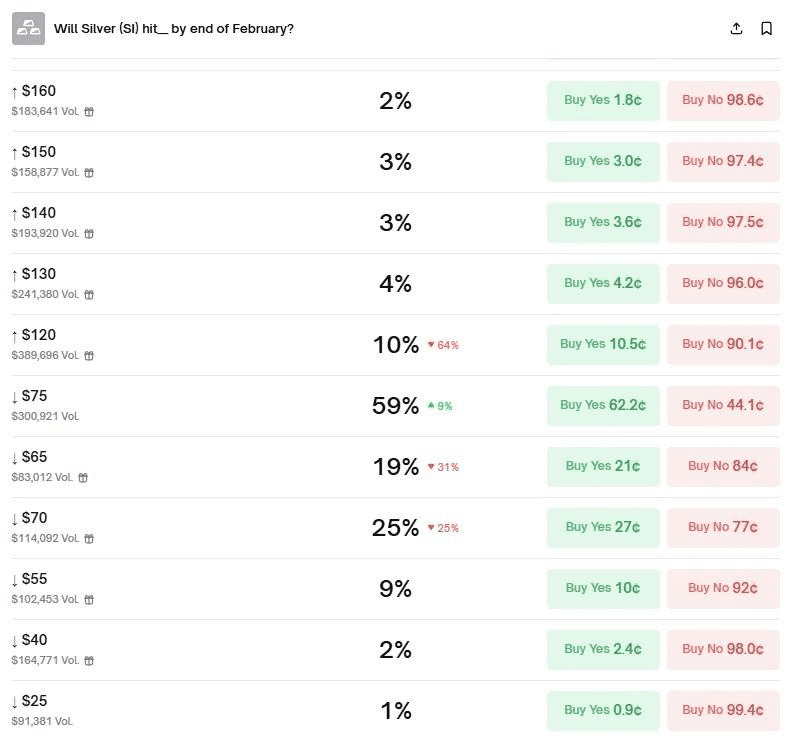

On Polymarket, users can bet on specific silver price levels at the end of this month. The chance that the price will end above $70 is currently estimated at 87 percent. For a slot above $75, the chance is 53 percent.

So far that seems logical. But if you look further at the data, you will see strange relationships. For example, the chance of a silver price above $110 is estimated at 36 percent, while the chance of a close above $100 is lower: 33 percent. The chance of a close above 70 dollars is also higher than that of a close above 40 dollars.

Such inconsistencies attract attention because higher price targets are normally always associated with lower probabilities. After all, if silver ends above 110 dollars, it is automatically also above 100, 80 and 70 dollars.

Bots and price links cause anomalies

The cause of these ‘deviations’ probably does not lie in massive errors of judgment by investors, but in the mechanism of Polymarket itself. The probability calculations there are not determined by a central model, but follow supply and demand in separate contracts.

Once certain price points become popular with bots or active traders, price relationships can become temporarily skewed. Automated arbitrage bots probably play a role in this: they try to profit from minute price differences between contracts, which leads to disruptions in the logic.

The result is that Polymarket functions more as a sentiment meter than as a purely statistical model.

Forecast for the rest of February

On Polymarket, traders can bet on the closing level of the silver price at the end of February. Recent data shows that most gamblers expect a price of 75 dollars. That outcome is currently assigned the highest probability: 59 percent.

Other scenarios, such as a price of $65, $70 or even $120, are considered a lot less likely. The chance of those levels is between 10 and 25 percent. The fact that more and more traders are clinging to $75 indicates that the market expects a quieter end to the month.

After weeks of wild results, sentiment seems to be cooling down. Yet silver, like other commodities, remains sensitive to unexpected shocks from the global economy. One unexpected news item can change the entire picture.

Source: https://newsbit.nl/polymarket-voorspelt-zilver-koers-voor-eind-februari-2026/