After months of sideways movement, the breakout is finally here, but it’s not the scenario bulls were hoping for. The Bitcoin price fell by more than six percent last night and briefly touched the level of $ 80,000. BTC is now trading around $82,000. What can we expect?

BTC Loses Support, Bearish Trend Coming

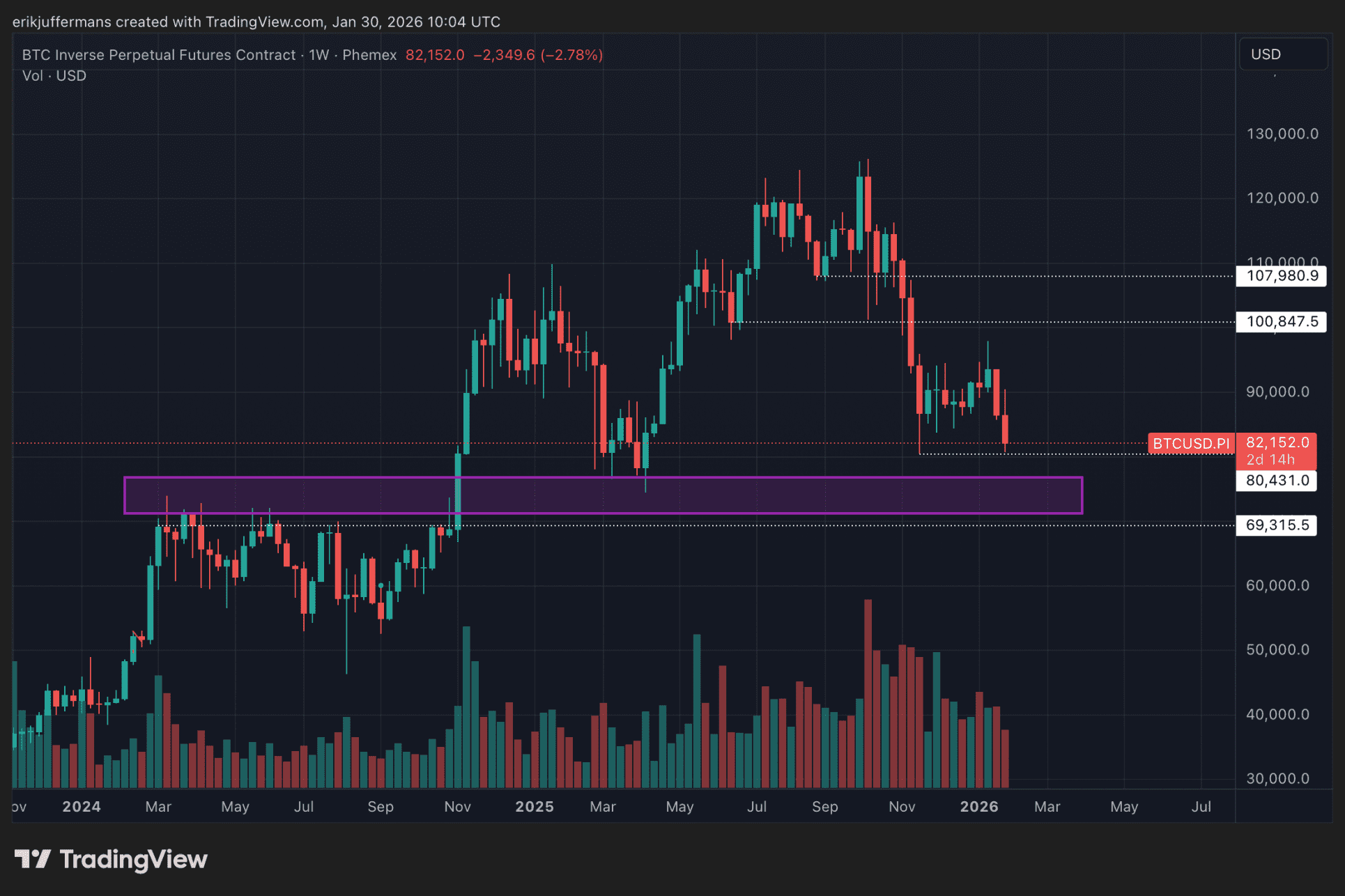

Since November, the Bitcoin price has largely moved within a clear price range. That consolidation phase ended abruptly with a so-called bull trap, followed by a sharp decline below the lower limit of the range. BTC quickly fell towards $80,000, a level last touched on November 21.

In previous analyzes this level was already mentioned as a possible first target when the range is lost. Although the price remained just above $80,000 last night, a retest could still follow in the coming days.

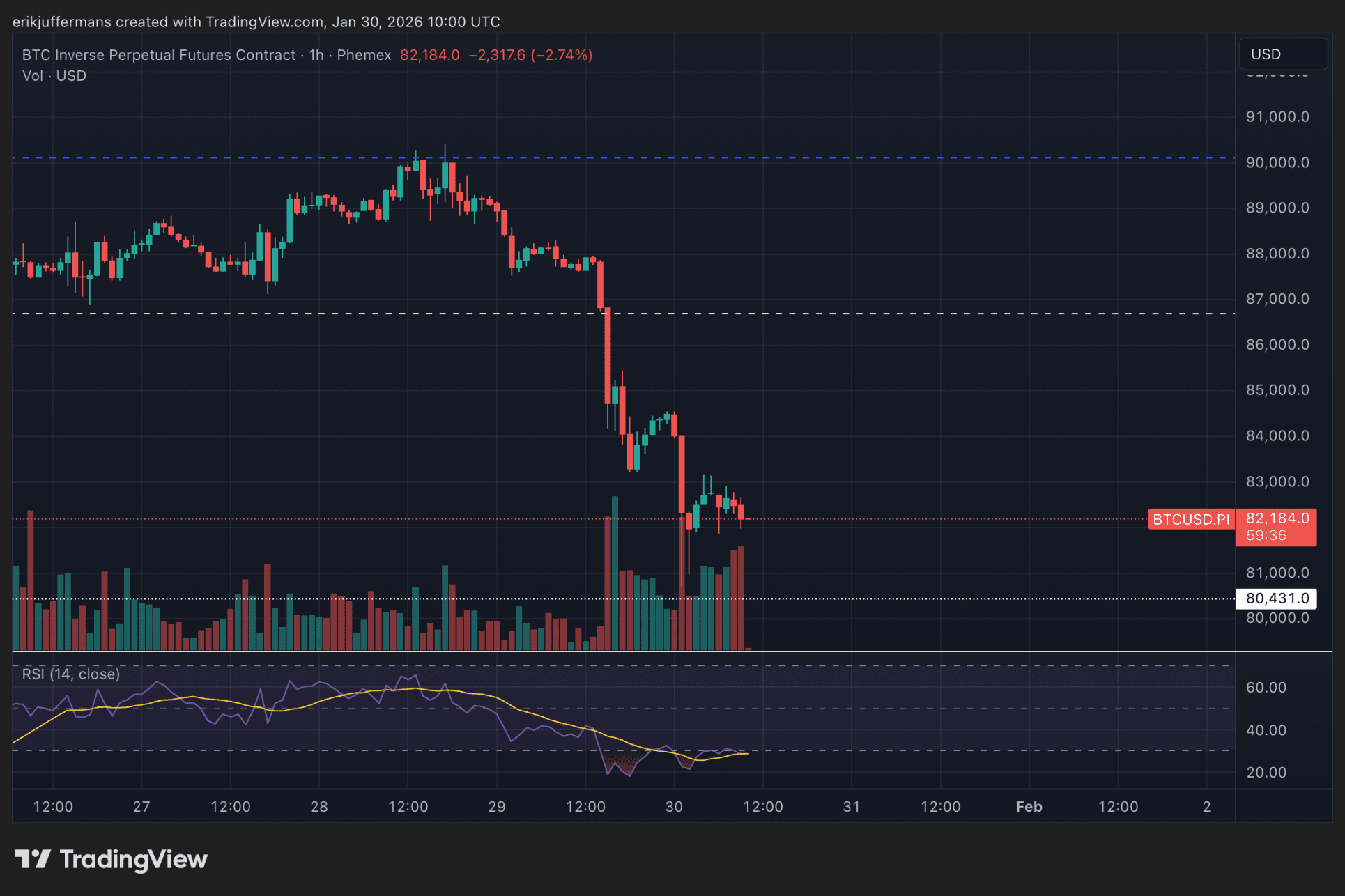

On the hourly chart, calm seems to be returning somewhat around $82,000. There is a modest bullish divergence in the RSI. However, that signal is still absent on the four-hour chart.

How far can the price fall?

For now, there seems little reason for optimism. There is a good chance that the weakness will continue and we will not see a strong rebound for a while. A short increase towards $86,500 cannot be ruled out. That was previously an important support level and may now act as resistance. It will remain to be seen whether sellers will regain the upper hand.

The real support area, according to analysts, is between $72,000 and $77,000. Here buyers will probably show interest again. For those aiming for bargains, the $69,000 level is an interesting benchmark. After all, this was the absolute peak of the 2021 bull market.

So the coming week promises volatile price action, with sentiment favoring the bears for now.

Source: https://newsbit.nl/newsbit-analist-zoekt-uit-hoe-diep-kan-de-bitcoin-koers-nog-zakken/